The Council of Latvijas Banka has approved the Annual Report of Latvijas Banka for 2019. In addition to the financial statements and a favourable independent auditors' opinion, it provides an overview of the economic environment and economic developments in Latvia and the euro area as well as information on the operation of the national central bank and the accomplishments in the areas of its responsibility.

2019 brought changes for both Latvijas Banka and Latvia's financial sector. The beginning of a new era in the central bank was symbolically marked by the change of its Governor in December 2019.

"My priority in the office of the Governor of Latvijas Banka is to strengthen Latvijas Banka's position as best performing, most ambitious and most effective central bank in Northern Europe. Finding solutions to many complex problems in the next couple of years will be imperative for successful functioning of Latvijas Banka and strengthening of Latvia's financial sector", says Mārtiņš Kazāks, Governor of Latvijas Banka, in the Foreword of the Report.

He mentions that the most important near-term tasks in context of the central bank functions include modernising the law on Latvijas Banka, changing Latvijas Banka management model and evaluating the potential benefits and drawbacks of the FCMC and Latvijas Banka merger, providing a full analysis to the decision-makers at the Parliament.

The main priority at the euro area level is the mitigation of the consequences of the coronavirus (COVID-19) crisis, including the provision of liquidity and credit and maintaining the financial stability.

"The events unfolding in spring 2020 in connection with the coronavirus (COVID-19) outbreak and its economic implications have proven that the euro area central banks together with the ECB are ready to act swiftly, effectively and in a coordinated manner in order to provide the necessary monetary policy support to the governments in their attempts to soften the crisis impact on households, businesses and the euro area in general", stresses Mārtiņš Kazāks.

Important euro area level tasks comprise monetary policy strategy review, support to the introduction of state-of-the-art technologies in the financial system and implementation of measures to limit climate change. This will have an effect also on the economic policies and application of policy tools at the disposal of central banks.

Significant progress was made in 2019. At the beginning of 2020 international experts concluded that Latvia has shown positive results with regard to implementing an up-to-date regulatory framework for prevention of money laundering in compliance with international standards. Transparent, sustainable and sound operation of the financial sector should become the new reality.

Clean-up of the financial sector will also have a positive effect on Latvia's economic sustainability and resilience to shocks. Moreover, this is a pan-European priority requiring an adequately powerful institutional framework and economic policy instruments.

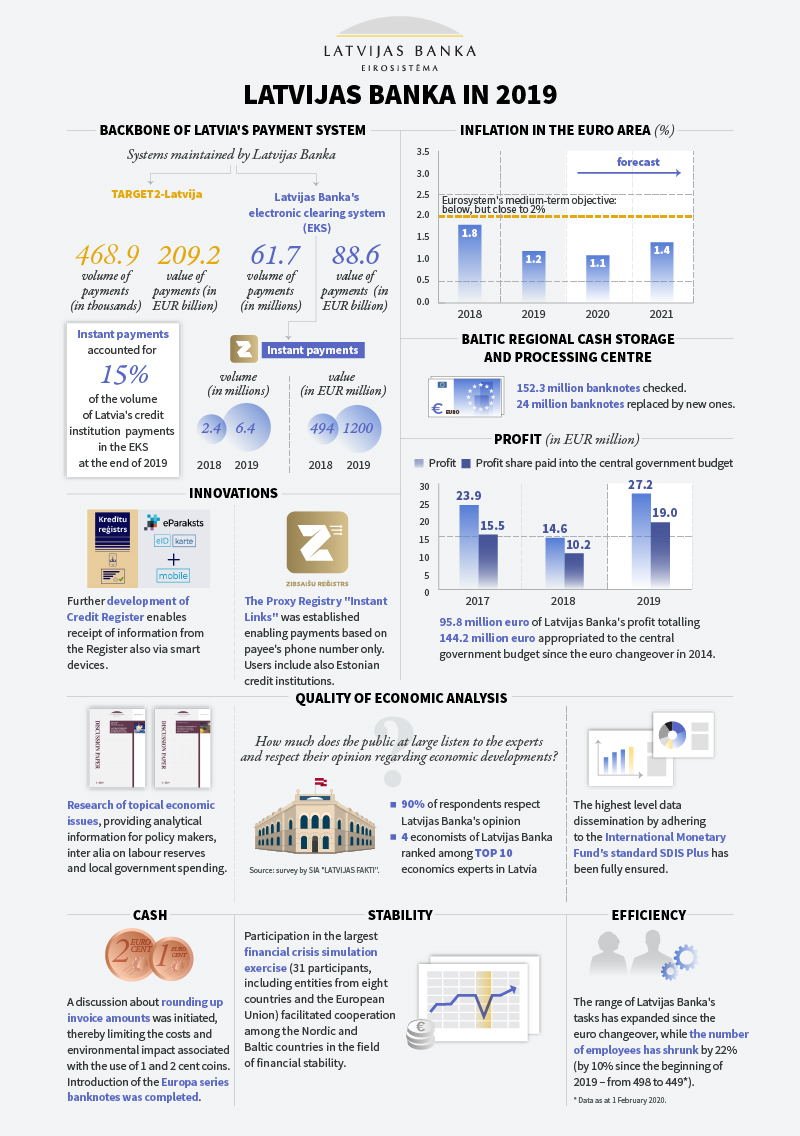

In 2019, Latvijas Banka's profit totalled 27.2 million euro, representing an 86% year-on-year increase. Pursuant to the Law on Latvijas Banka, 70% or 19 million euro of Latvijas Banka's profit for 2019 will be appropriated to the central government budget. The rest of the profit will be transferred to the reserve capital of Latvijas Banka.

The aggregate profit of Latvijas Banka since the euro changeover in 2014 totals 144.2 million euro, of which 95.8 million euro have been appropriated to the central government budget.

The Annual Report of Latvijas Banka for 2019 is available at www.bank.lv. Financial statements of Latvijas Banka for 2019 are also published separately on the website of Latvijas Banka together with an independent auditors' report.