Payment service providers that already participate or intend to become participants of EPC SEPA Credit Transfer (SCT) scheme and EPC SEPA Instant Credit Transfer (SCT Inst) scheme and having interest in the IVS are invited to reach out to Latvijas Banka via e-mail verifythepayee@bank.lv.

More about IVS:

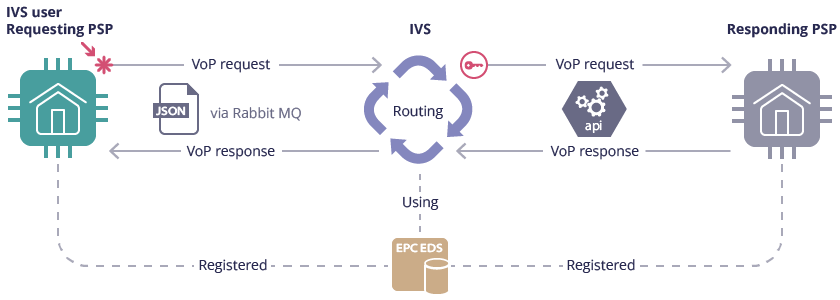

- Developed in compliance with the requirements of the European Parliament and Council Regulation (EU) 2024/886 and EPC VoP Scheme

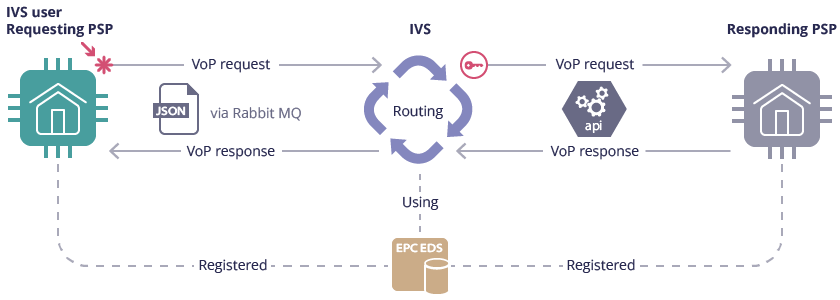

- Ensures exchange of information in JSON format via Rabbit message queues

- Provides routing services for EPC VoP requests and related responses based on the EPC Directory Service data

- Maintains QWAC PSD2 certificates and uses them for authentication of external EPC VoP requests

Provides three solutions for IVS Service users on the responding side

Provides three solutions for IVS Service users on the responding side

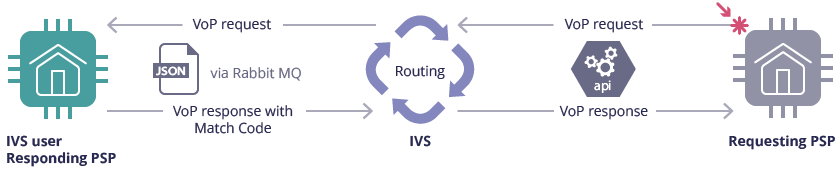

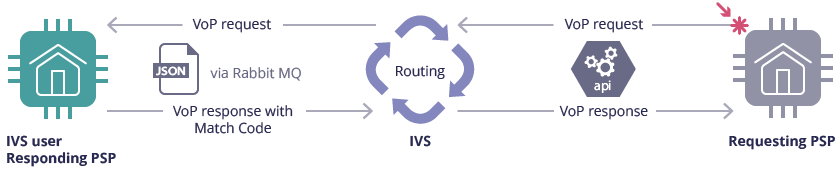

Option 1: Routing only

- Forwarding VoP requests received from the Requesting PSP to the appropriate IVS user

- Routing the corresponging VOP response generated by the IVS user back to the Requesting PSP

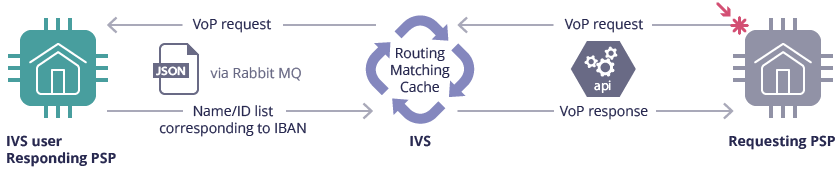

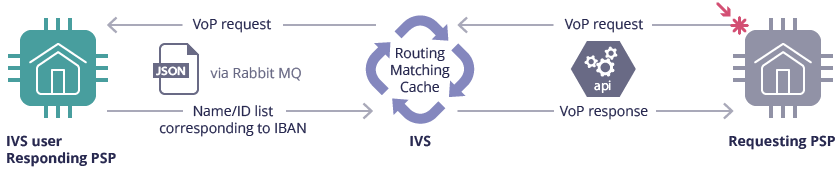

Option 2: Routing and Matching based on the immediate response from the user

- Forwarding VoP requests received from the Requesting PSP to the appropriate IVS user

- Matching based on the list of names or IDs provided by the IVS user for each individual VoP request

- Caching name information to respond to subsequent requests throughout the calendar day without forwarding them to the IVS user

- Generating and routing the VoP response

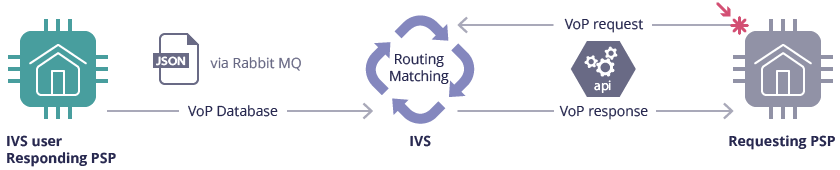

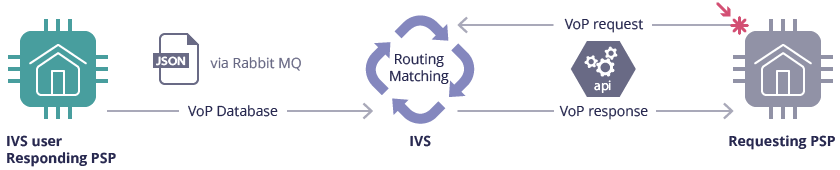

Option 3: Routing and Matching based on IBAN/name(ID) database

- Receiving VoP requests from the Requesting PSP

- Matching based on the IVS database provided and regularly updated by the IVS user

- Generating and routing the VoP response

IVS Pricing

|

EUR 200

|

Monthly fee for Option 1 and Option 2

|

|

EUR 350

|

Monthly fee for Option 3

|

|

EUR 0.0001

|

Per each request/response sent by the user above 500,000 in a month

|

Provides three solutions for IVS Service users on the responding side

Provides three solutions for IVS Service users on the responding side