Latvia's economic growth remains uncertain, mostly on account of the developments in the external markets. Growth is projected to remain moderate, and there is hardly any hope for a more accelerated pick-up seen in the previous years. Economic developments, the latest euro area and Latvia's economic growth forecasts, as well as reasons for the weak lending growth: these were the issues discussed by Ilmārs Rimšēvičs, Governor of Latvijas Banka, at the press conference.

Welcome to our press conference where I will speak about the following topics:

- developments in the euro area economy and the monetary policy decisions taken by the Governing Council of the ECB;

- economic growth in Latvia, inter alia the revised forecasts by Latvijas Banka;

- lending trends in Latvia.

Last week the ECB's Governing Council held its meeting where:

- it was decided to keep the key interest rates at a record low level, and

- a commitment on the use of non-standard monetary policy instruments was reiterated.

Looking at the economic developments in the euro area:

- In the third quarter of 2019, the euro area real GDP growth was 0.2% quarter-on-quarter.

- The weak dynamics of international trade and an environment of persistently high global uncertainty continue to weigh on the euro area economy.

- Nevertheless, the growth slowdown in the euro area has stabilised somewhat, supported by the robust strength of the domestic demand. The performance of the services and construction sectors continues to support growth.

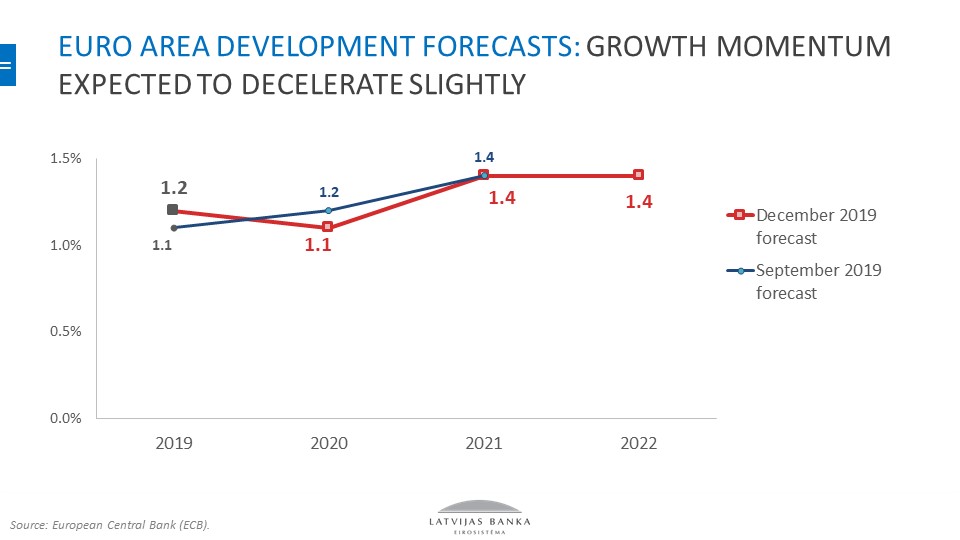

Consequently, the December 2019 ECB and Eurosystem staff macroeconomic projections for the euro area forecast the following annual growth rates of the real GDP:

- 1.2% in 2019,

- 1.1% in 2020,

- 1.4% in 2021 and 2022.

Compared with the September 2019 ECB staff macroeconomic projections, the outlook for real GDP growth for 2020 has been slightly revised downwards and, unfortunately, downside risks persist.

At the same time, there is hope that the domestic consumption and stimulating fiscal policy are likely to serve as stabilising growth elements in the next projection periods.

Now let's have a look at the euro area annual inflation:

- In November, it increased to 1.0%, up from 0.7% observed in October, mostly on account of a more rapid rise in service and food prices.

- Measures of underlying inflation still remain weak overall.

- Despite the intensification of the labour cost pressure in the context of the constantly tightening labour market, the moderating growth rate is mitigating the pressure on inflation.

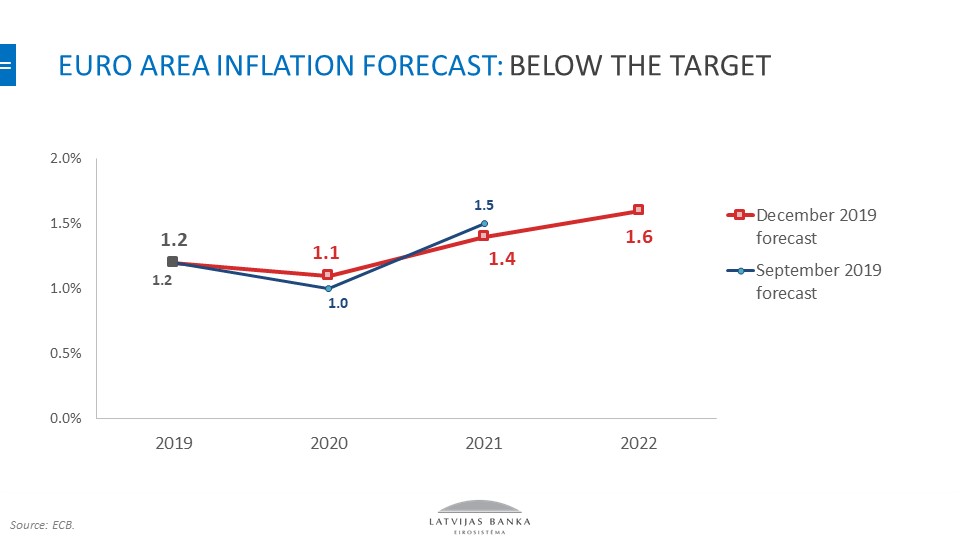

This assessment is also reflected in the latest euro area projections suggesting that the annual inflation rates will be as follows:

- 1.2% in 2019,

- 1.1% in 2020,

- 1.4% in 2021,

- 1.6% in 2022,

and even in 2022 inflation will be neither close to 2% nor 2%. At this stage, inflation expectations remain low.

It was the first monetary policy meeting of the ECB's Governing Council chaired by Christine Lagarde, President of the ECB. She pointed out that the key ECB interest rates would remain unchanged until the inflation converges to a level sufficiently close to, but below, 2%, and such convergence has been reflected in the underlying inflation dynamics.

We will continue purchases of securities at a monthly pace of 20 billion euro for as long as necessary and end them shortly before raising of interest rates starts. We will continue reinvesting the principal payments from maturing securities.

We will also continue to provide further guidance. (The ECB's policy remained unchanged after the package of monetary policy measures adopted in September.)

As to the economic development in Latvia, we can see no essential changes since September 2019, with external factors, i.e. uncertainty, still having the main impact.

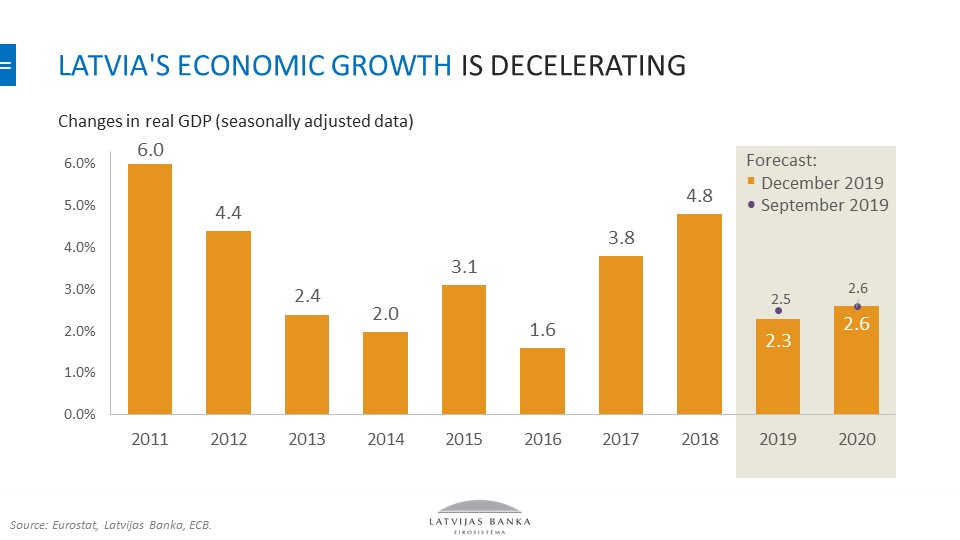

With the global and euro area economies slowing down, Latvia's growth is also gradually decelerating. On account of weaker demand in Latvia's major trade partners, we see the pace of increase in both exports and investment decelerate, with the domestic consumption playing the major role in maintaining GDP growth.

Although some short-term factors also had a notable effect on the GDP dynamics in 2019, making the economic growth slow down at the beginning of the year, but supporting it in the third quarter, the high degree of external uncertainty gradually makes households and businesses more cautious in Latvia as well. In view of the previous forecasts, this will result in slower economic growth in the future.

The latest available statistics also confirm the above. In the third quarter of 2019, GDP grew by a mere 1.9% and 0.7% year-on-year and quarter-on-quarter respectively (seasonally and calendar adjusted data).

Next year, the external demand growth is also projected to be relatively sluggish, with a further negative impact on export performance, business investment and household spending persisting.

Sectoral trends are in line with the changes in the external and domestic demand:

- The results of the exporting sectors are weaker, particularly in the transport and financial sectors (mostly in the non-resident segment) where the value added has even decreased.

- Manufacturing growth is also experiencing a slowdown, mostly on account of the decline in the wood industry.

- Although selected services sectors have posted a more accelerated rate of increase this year, the domestic-market-oriented sectors are showing signs of deceleration as well, e.g. the rather moderate growth in the trade sector.

The impact of the weather conditions on the GDP dynamics has varied during the year: at the beginning of the year they accounted for a decline in energy growth, while later they were favourable for agriculture granting a good grain harvest.

Speaking about the economic outlook, uncertainty will persist, mostly associated with developments in the external markets. Growth is projected to remain moderate and there is hardly any hope for a swift rebound to the high rates seen in the previous years.

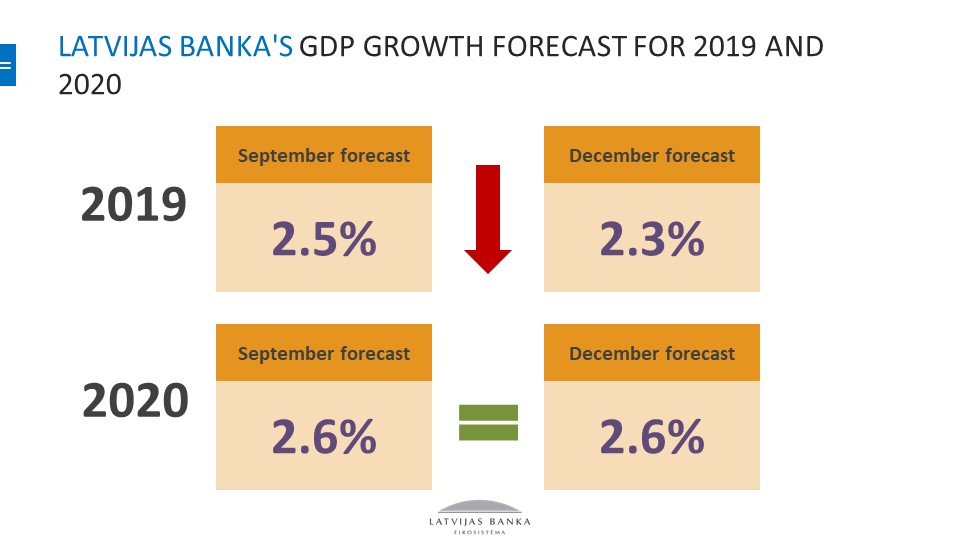

We should keep in mind that actually this is the third consecutive downward revision of the forecasts.

In December we revised the GDP forecast for 2019 to 2.3%, down from 2.5%,

while keeping the one for 2020 unchanged at 2.6%.

Although such a growth rate exceeds the average of the euro area, it is insufficient for ensuring improvement of living standards: currently the income level in Latvia is below 70% of the EU average and considerably lagging behind that of Lithuania and Estonia.

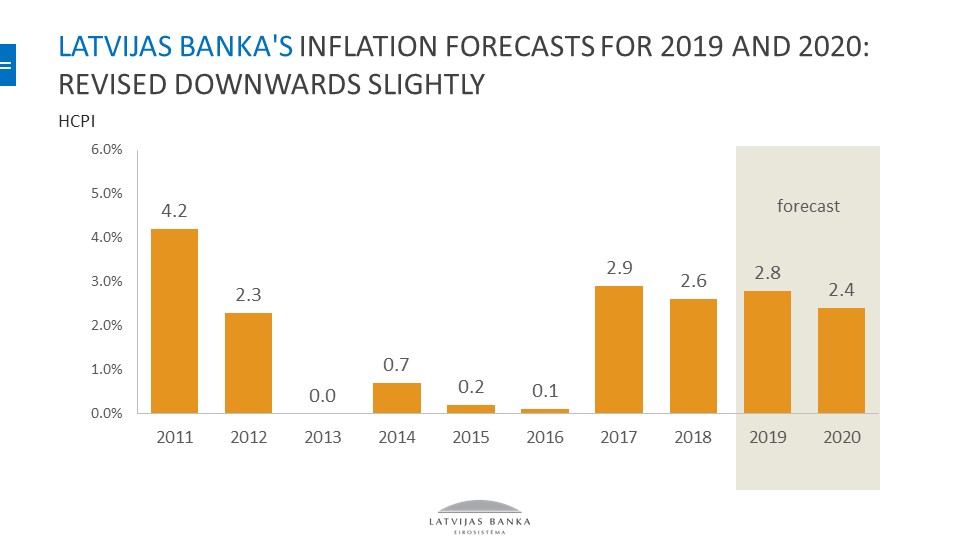

Now let us turn to inflation forecasts:

- The most pronounced and rapid impact of economic activity changes is reflected in services prices, and we see the price rise slowing down.

- In response to the downward trend in oil prices, fuel prices dropped somewhat in the last few months. The OPEC decision on further oil production cuts, taken in early December, notwithstanding, market participants are expecting a gradual oil price decrease. According to Latvijas Banka's current forecast, the average Brent crude oil price in 2020 will be 60 US dollars per barrel (the June forecast was 66 US dollars per barrel).

- The global food prices did not follow a uniform trend. Meat prices remained high as the widespread outbreak of swine fever in Asia negatively affected the global pork supply. Meanwhile, the global grain harvest has been record high, pushing wheat prices down.

In view of this set of factors, Latvijas Banka's inflation forecasts for this and next year have been revised downwards by 0.1 percentage point. The price rise is projected to be:

- 2.8% in 2019,

- 2.4% in 2020.

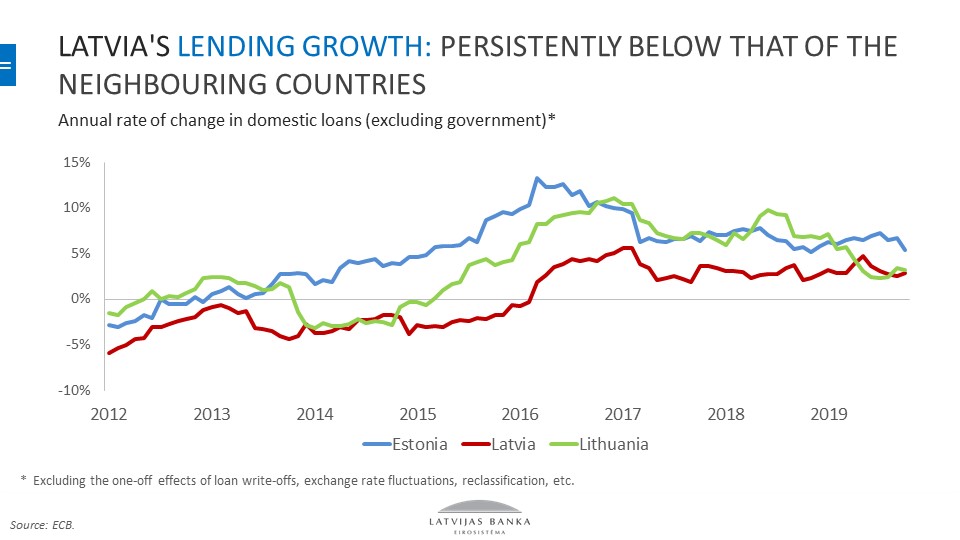

Of late, there have been a lot of discussions as to why Latvia's economic growth is slowing down, and the sluggish lending to the Latvian economy has been pointed out as one of the reasons. I will try to briefly highlight the related issues. Lending growth in Latvia has been persistently lower than in the neighbouring countries, despite the fact that borrowers' creditworthiness has been improving over the recent years. Borrowers' wages and salaries are on the rise, while their liabilities are contracting; banks are also reporting an increasingly stronger demand for housing loans. However, despite the persisting economic growth, lending remains subdued in Latvia. Let me remind you that the first 6-7 post-crisis years saw growth without lending, the so called "creditless recovery": something foreign analysts and rating agency experts thought was impossible.

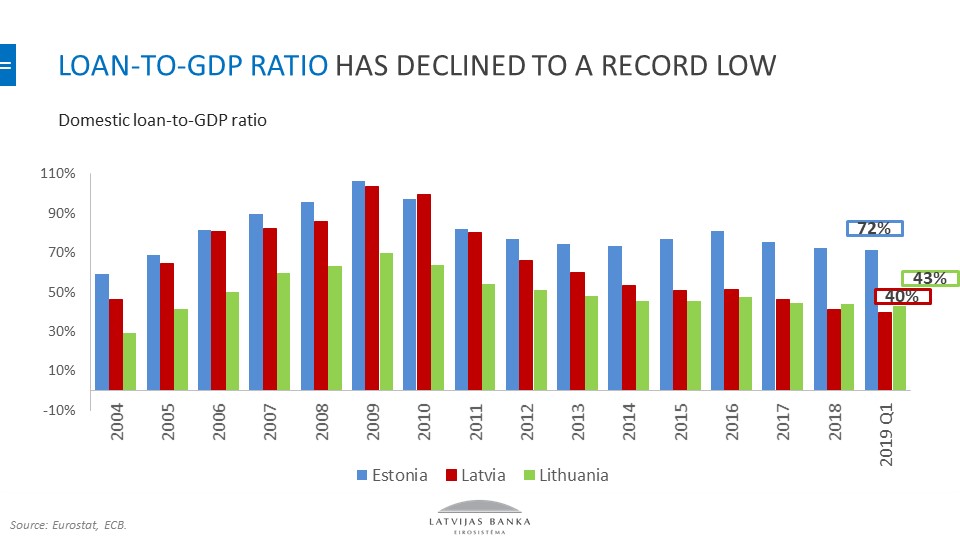

The domestic loan-to-GDP ratio has fallen to 40% in Latvia, a record low of the last 15 years. The low level of liabilities points to unused lending potential. It is considerably below the level registered in Estonia and closer to that of Lithuania where the pre-crisis lending growth was not so fast as in Latvia.

The rate of increase in lending to non-financial corporations has moderated in 2019, with the annual growth of their loan portfolio standing at 3.5% in October 2019. This dynamics is mostly a result of long-term loans for large investment projects.

- In the segment of small and medium-sized non-financial corporations, however, banks remain cautious and the potential risks are priced in higher interest rates on loans.

- Meanwhile, the household loan portfolio increased by 0.8% in October 2019, largely on account of a 1.8% rise in loans for house purchase.

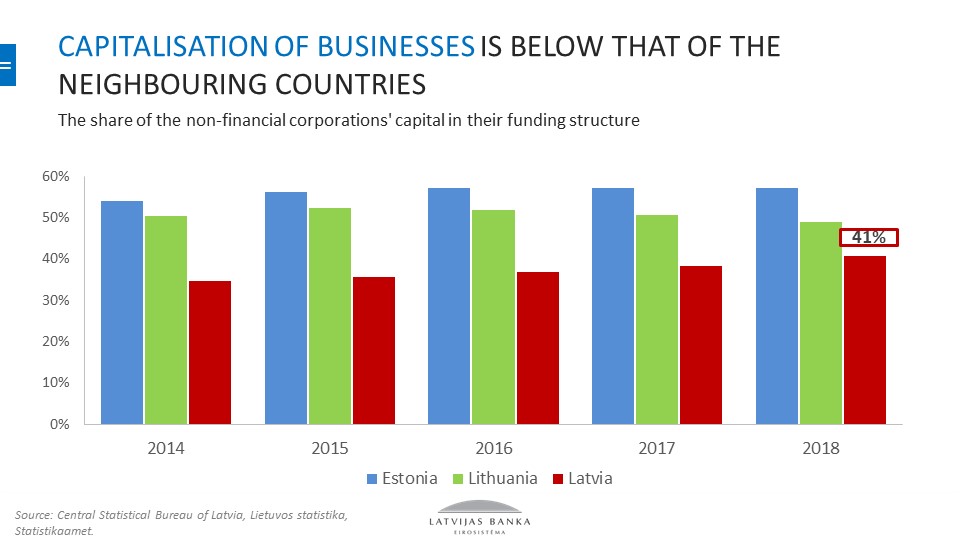

Some of the reasons why our neighbouring countries outpace Latvia in lending:

- low capitalisation of businesses. Despite its average increase of 1.5 percentage points since 2015, it is still considerably lower than in our neighbouring countries;

- The corporate income tax reform has provided an additional stimulus to strengthening the capital of businesses by not imposing income tax on the reinvested earnings, but this impact is yet to be seen in the longer term.

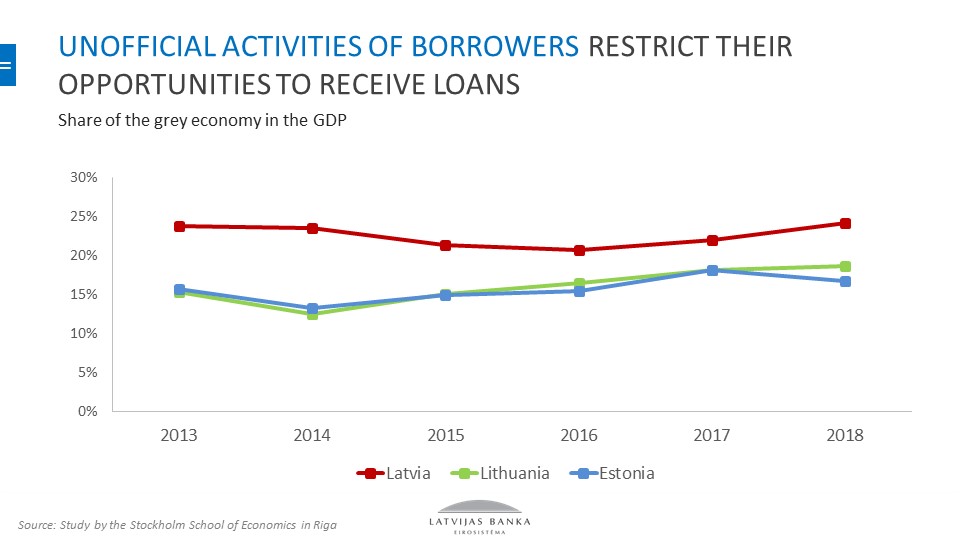

According to research by the Stockholm School of Economics in Riga, the share of the grey economy in Latvia's GDP has been expanding since 2016, reaching 24% in 2018; it is considerably higher than in the neighbouring countries.

From the lenders' point of view, one of the major obstacles to lending is the high share of grey economy which is directly accountable for the security of financial services.

The bank survey conducted by Latvijas Banka in 2019 points out the major obstacles to receiving loans both by businesses and households:

- lack of transparency in the potential borrower's business, and

- inability to show an official source of income.

- Only then follows the next factor restricting lending, i.e. insufficient level of cash flow for non-financial corporations and that of income for households.

It is obvious that the commenced effort of implementing comprehensive measures for reducing the grey economy has to continue and new initiatives and solutions have to be sought. Only then we could hope for more active lending growth.

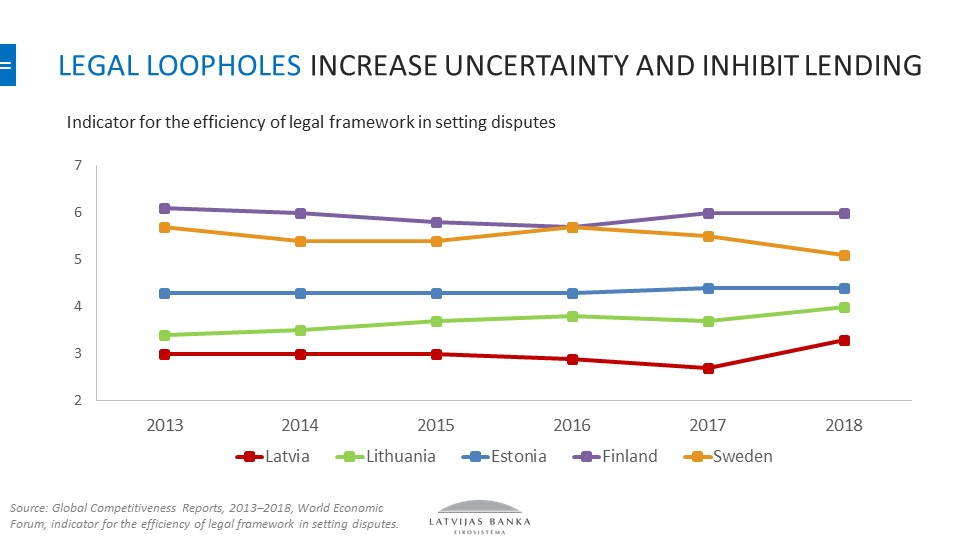

Another important obstacle to the legal certainty of financial services and, consequently, to lending growth still results from loopholes in the legal environment.

- Notwithstanding the recent notable improvements, e.g. Latvia's insolvency regulatory framework ranks No. 26 in the latest Global Competitiveness Report of the World Economic Forum, there is always room for further improvement.

- The assessment of the efficiency of Latvia's legal framework in settling disputes has improved, ranking Latvia No. 93 (up from No. 120); still, it is considerably lower than in the neighbouring countries.

Strengthening the legal environment efficiency is a priority in protecting investor and lender rights; it is an essential precondition for robust lending growth.

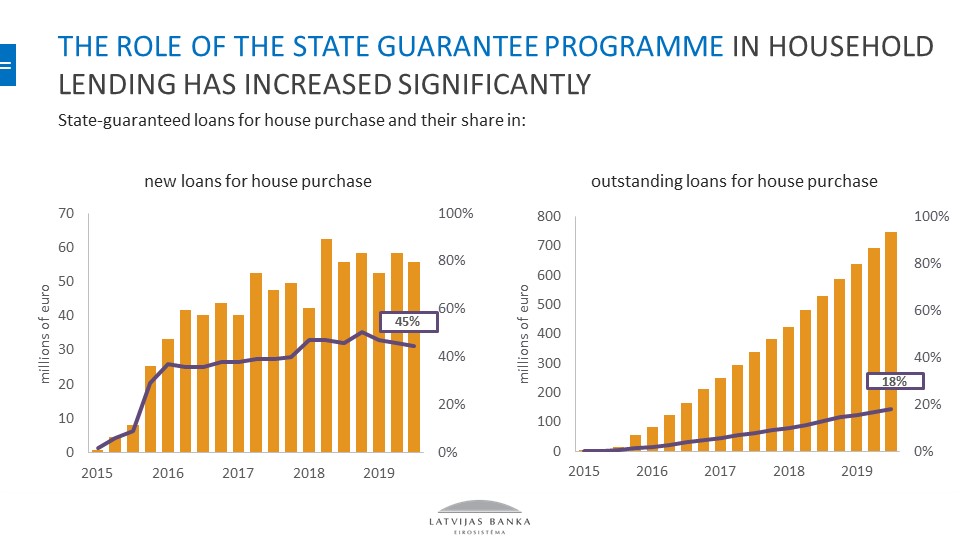

A significant role in household lending has been played by the state guarantee programme: over the last two years, approximately half of the new loans for house purchase were guaranteed by the state; as a result, such loans already account for 18% of the total loans for house purchase. This makes one think about the initial purpose/aim of the programme and its current use.

- The considerable discount on the stamp duty for property registration with the Land Register, provided for by the programme, is an essential stimulus to use the above programme also for such borrowers who in fact do not need any state guarantees and who could afford to make the initial down payment themselves.

Obviously a number of issues have to be addressed to revive healthy lending growth in the economy. However, apart from the grey economy and insolvency issues, more attention should also be paid to competition aspects in the banking sector in the future.

If we recall the drastic bank competition for market shares in the pre-crisis period promoting the expansion of the real estate bubble and overheating of the economy, today we see a cardinally different picture, with banks remaining inactive with respect to lending and standing ready to grant loans only to the most creditworthy customers.

Tighter competition would definitely facilitate recovery of healthy risk appetite in the banking sector, with eventual reflection in higher lending growth as well. On the monetary policy side, we have ultra favourable conditions for bank lending: failure to make use of them would not be in the interest of the state.

This is my last press conference in the position of Governor of Latvijas Banka. I would like to take a brief look at what was accomplished by Latvijas Banka during my term of office.

Several important facts testify to the accomplishments of Latvijas Banka.

- The lats was introduced in 1993, the euro was introduced in 2014.

- In 2008 and 2009, Latvijas Banka safeguarded the lats stability and household purchasing power without devaluing the lats.

- Latvijas Banka actively cooperated with the Latvian government in overcoming the financial crises of 1998 and 2008.

- Latvijas Banka has evolved into the main think-tank on economic development issues.

- In recent years, Latvijas Banka provided recommendations for addressing several issues topical for the Latvian economy, e.g. healthcare, education and tax reform.

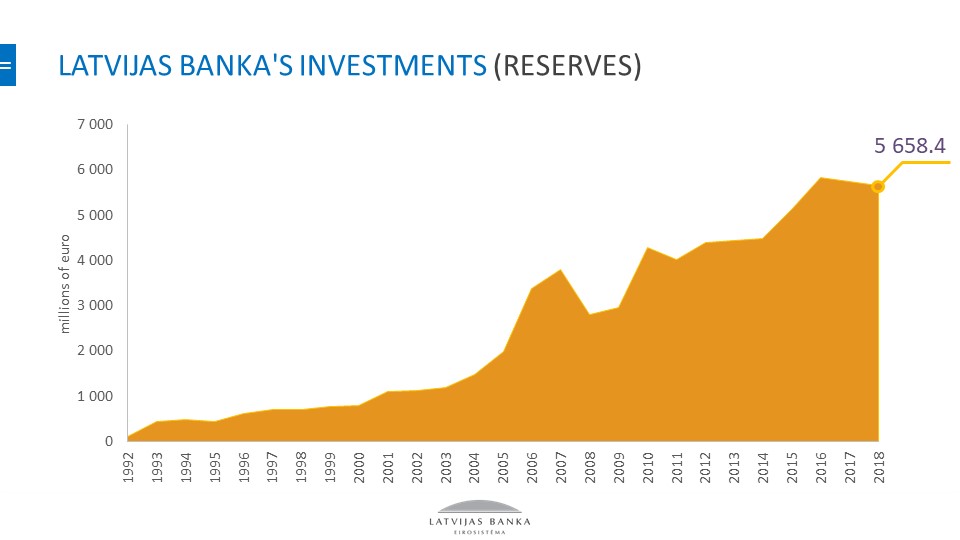

- Latvijas Banka's gold and foreign currency reserves have grown from 100 million US dollars in 1992 to 5.4 billion US dollars at the end of 2019.

- In 2000, Latvijas Banka built a modern cash vault. As a result, today Latvijas Banka functions as the Baltic regional cash logistics centre and provides services related to cash logistics to the central banks of Estonia and Lithuania. In 2018, approximately 144 million banknotes were processed by the central bank, replacing 17 million banknotes with new ones.

- In 2017, Latvijas Banka was the first in the euro area to introduce instant payments, i.e. interbank payments executed within a matter of seconds 24/7/365. At this stage, already over 90% of the customers of Latvian commercial banks have access to instant payments. In 2018, 2.4 million instant payments amounting to 494 million euro were made in Latvia. In the first half of 2019, 2.6 million instant payments amounting to 477.2 million euro were processed via the instant payment infrastructure, developed and maintained by Latvijas Banka.

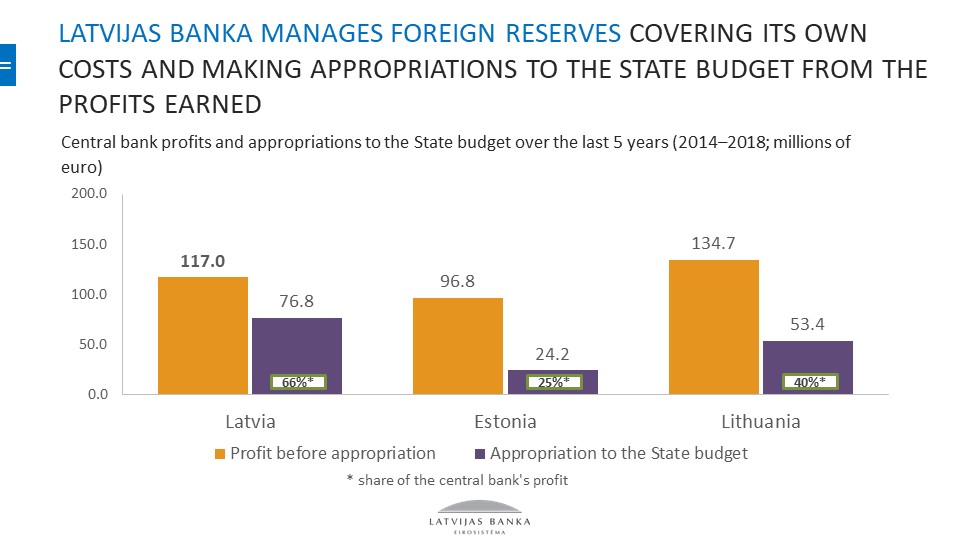

Please note that Latvijas Banka does not receive a single cent from the central government budget. On the contrary, it transfers the largest share of its profit to the state budget. Moreover, in the last five years, the total amount of Latvijas Banka's contributions to the central government budget has equalled the total sum contributed by both our neighbours - central banks of Lithuania and Estonia - together.

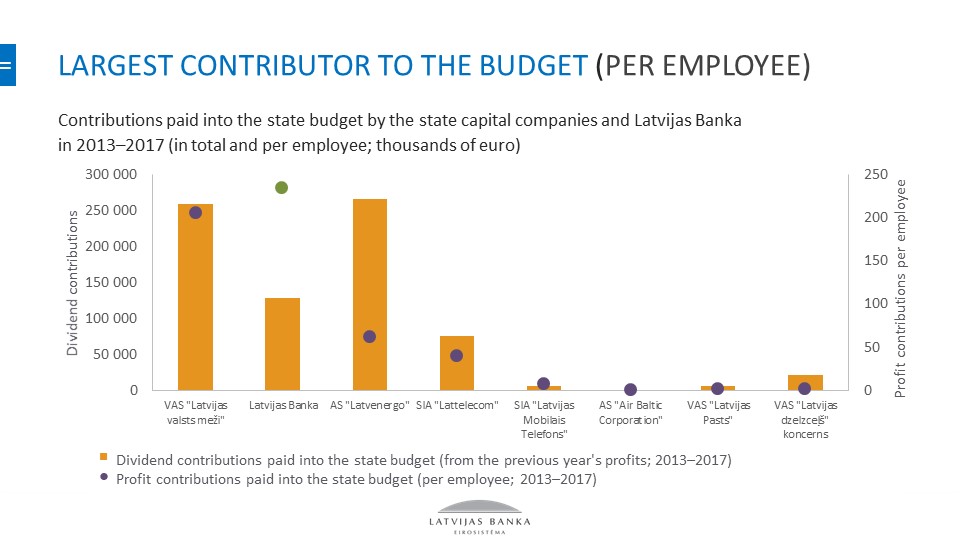

Furthermore, Latvijas Banka is the largest contributor to the central government budget per employee. True, total contributions by Latvenergo and Latvijas Valsts meži are larger; however, the number of their employees is much larger as well; consequently, looking at return per employee, Latvijas Banka is in the leading position.

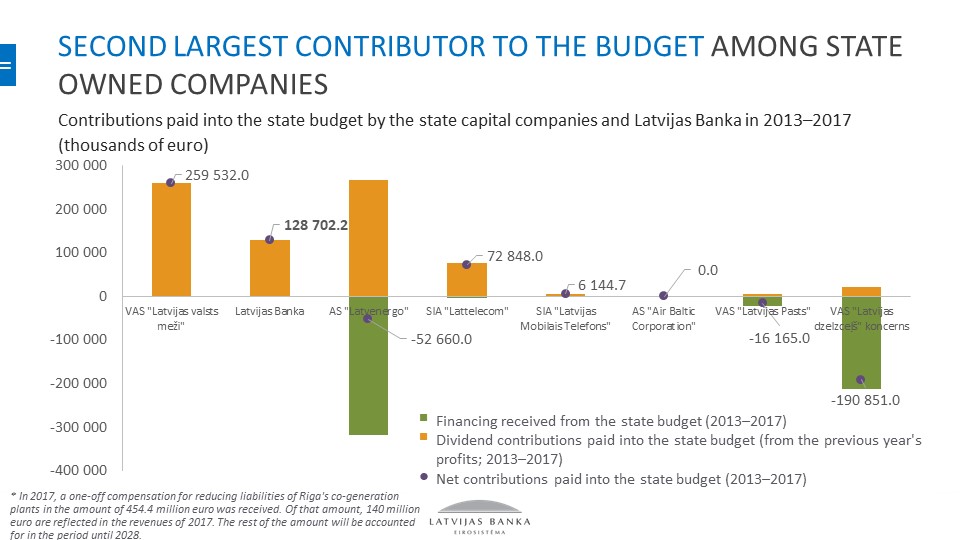

As to the state owned companies not receiving government grants, Latvijas Banka is the second largest net contributor among them.

The success of Latvijas Banka's operation lies in the skilful and efficient management of its foreign currency and gold investments. We can see that since the restoration of operation of the central bank of Latvia, investment has increased more than 55 times.

Taking the chance, I would like to thank all my colleagues at Latvijas Banka who have worked together with me all these 27 years. A fantastic team, fantastic persons! A huge "Thank you" to everybody who had been together with me for the last two years, to everybody who supported me. I would like to thank the organisers of the press conferences, the persons who took care of the technologies so that you could hear and see everything.