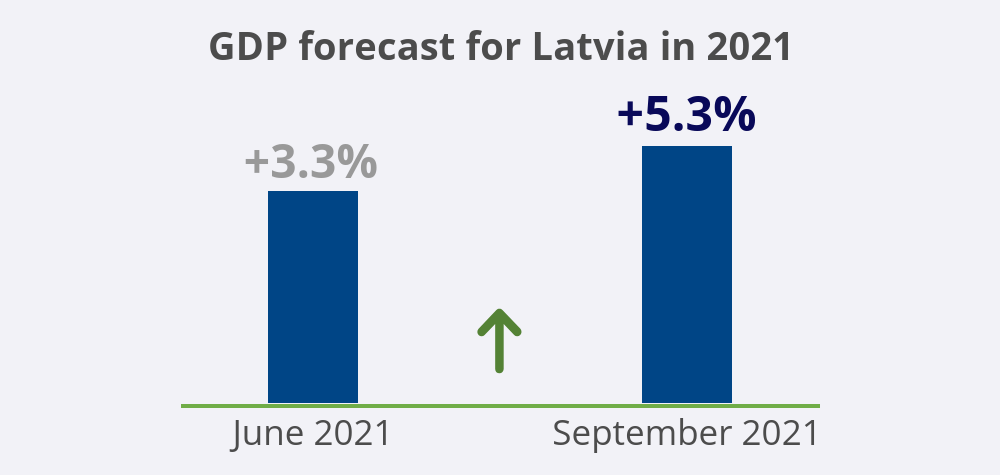

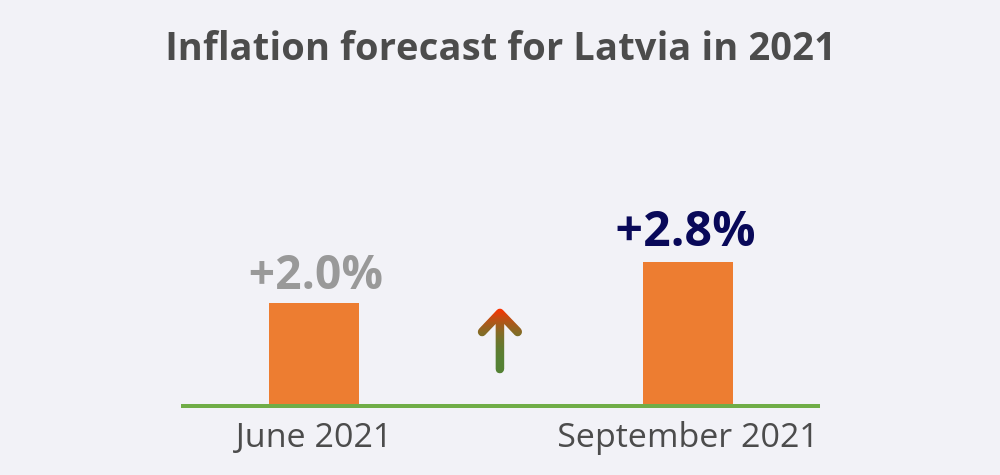

Latvijas Banka has published its latest September 2021 macroeconomic forecasts, including the gross domestic product (GDP) and inflation forecasts, for Latvia. Latvia's GDP growth forecast for 2021 has been revised upwards to 5.3%, whereas that for 2022 has been revised downwards to 5.1% from 3.3% and 6.5% in Latvijas Banka's June forecast respectively. Meanwhile, Latvia's inflation forecast has been revised upwards to 2.8% in 2021 and to 4.0% in 2022 from 2.0% and 2.9% in the June forecast respectively.

The recovery of the global economy is supported by the roll-out of the Covid-19 vaccines and the progress made with vaccinations. The euro area economy is also recovering swiftly and approaching the pre-pandemic levels. Central banks view the rise in inflation caused by the growing demand and supply bottlenecks as transitory.

Over the most recent months, major central banks, including the European Central Bank, have continued with highly accommodative monetary policies, maintaining very favourable financing conditions for businesses, households and the public sector. As regards the fiscal policy, effective investment of the funding provided by the European Union (EU) recovery instrument NextGeneration EU is required to strengthen the post-crisis recovery and the long-term economic growth.

The Latvian economy has recovered faster than expected, with its GDP growth reaching the pre-crisis level already in the second quarter of 2021. Nevertheless, the activity in the hardest-hit sectors that were most directly affected by the restrictions, like accommodation and food service activities, arts and entertainment as well as transport remains considerably below the pre-crisis levels.

Given the rapid growth so far, Latvijas Banka has revised the 2021 GDP growth forecast upwards to 5.3%.

Towards the end of 2021 and at the beginning of 2022, however, the economic growth could temporarily decelerate due to an upsurge in new infections and slower than hoped progress with vaccinations. Given that, the economy can be expected to grow at a similar rate this year and next year, and Latvijas Banka has revised the GDP growth forecast for 2022 downwards to 5.1%. Private consumption will be supported by releasing the savings accumulated during the pandemic in 2022, whereas exports will benefit from the rising external demand. Estimates concerning the government investment suggest a strong rebound in construction due to a significant increase in projects commissioned by the public sector, thereby enhancing the overheating risks of the sector. The main challenges faced by the sector are the capacity shortages and the rising costs in the construction industry.

Meanwhile, the GDP growth forecast for 2023 at 3.8% reflects a return to a sustainable pace of long-term growth. At the same time, one of the biggest challenges to sustain investment and innovations-based economic growth would be the revival of the currently sluggish lending by eliminating both the demand and supply side constraints, including a reduction of the relatively high lending rates. Moreover, the government should strengthen its support to reduce labour market tensions and develop the human capital in Latvia.

The global economic recovery and the rebound in demand as well as the supply side constraints associated with the pandemic are reflected in a temporary rise in consumer price inflation following a brief period of deflation. Inflation is expected to peak around the turn of the year, when the annual consumer price increase could shortly rise above 5%.

The upward inflationary pressures are largely stemming from the rising energy prices on global stock exchanges and their direct effect on the prices of fuel, heating, gas and electricity, all raised over the second half of 2021 as announced in summer. Despite the rapidly growing commodity prices, consumer price inflation is rising at a much slower rate. Commodities are just one of the cost components of finished goods and there is a several months lag in the path-through of their prices to inflation, which is also not necessarily always full.

Labour market is recovering strongly, as unemployment is declining even after the expiry of the furlough benefits provided by the government and the wage growth remains steady. The price developments in services are overall moderate, yet further acceleration is likely on account of both the pent-up demand and cost factors. The global shortage of shipping containers and hence also the transportation costs have an upward effect in the prices of industrial goods. Inflation expectations have grown substantially since the beginning of the year. Producer and consumer inflation expectations have reached the highest levels of several years, albeit remaining below the levels observed prior to the global financial crisis.

In light of the above, the inflation forecast for 2021 and 2022 has been revised upwards to 2.8% and 4.0% respectively. Solid economic growth and a sustainable wage increase will result in a gradual pick-up of the underlying inflation over the projection horizon, yet, with the global commodity price pressures easing, inflation is expected to retreat below 3% in 2023.

On account of a more positive economic outlook, the general government deficit (6.7% of GDP in 2021) is estimated to be lower than previously projected. The government spending is expected to grow over the coming years on account of both using the available fiscal space (for instance, for the purpose of raising wages for individual professions in the public sector, as currently discussed) and rescheduling some investment and health care related spending to 2022 and 2023. This increases the projected government deficit in the near term in comparison with the June forecast, while the medium-term budget balance is still showing an improvement. Government investment is expected to grow considerably, but mostly on account of EU projects, with the negative effect of the national co-financing on budget balance offset by the positive effect of investment on economic growth.

According to Latvijas Banka estimates, the government debt will remain below 50% of GDP in the medium-term. Provided that the economic growth remains solid and in the absence of any new Covid-19 related restrictions, additional government measures to stimulate the domestic demand are unnecessary. Available funding should be invested in strengthening labour productivity and future growth, and any revenue windfalls should be used to address structural issues.

Latvijas Banka's projections of main macroeconomic indicators

|

2021 |

2022 |

2023 |

||

|

Economic activity (annual percentage changes; at constant prices; seasonally adjusted data) |

||||

|

GDP |

5.3 |

5.1 |

3.8 |

|

|

Private consumption |

5.9 |

8.9 |

4.8 |

|

|

Government consumption |

5.8 |

3.7 |

1.5 |

|

|

Investment |

3.9 |

6.9 |

3.3 |

|

|

Exports |

5.7 |

5.8 |

3.8 |

|

|

Imports |

11.7 |

2.6 |

3.4 |

|

|

HICP inflation (annual percentage changes) |

||||

|

Inflation |

2.8 |

4.0 |

2.7 |

|

|

Underlying inflation (excluding food and energy) |

1.8 |

2.2 |

3.1 |

|

|

Labour market |

||||

|

Unemployment (% of the economically active population; seasonally adjusted data) |

7.5 |

6.8 |

6.5 |

|

|

Nominal gross wage (annual percentage changes) |

8.9 |

7.5 |

5.5 |

|

|

External sector |

||||

|

Current account balance (% of GDP) |

–2.1 |

–0.5 |

–0.8 |

|

|

Government finances (% of GDP) |

||||

|

General government debt |

45.9 |

47.2 |

45.8 |

|

|

Budget surplus/deficit |

–6.7 |

–4.0 |

–2.2 |

|

The cut-off date for the information used in the forecast is 17 September 2021.