Latvijas Banka has published its latest March 2022 macroeconomic forecasts for Latvia. Their key points are as follows:

- the latest forecasts should be mainly perceived as a reflection of macroeconomic trends, since they have been prepared amid increased uncertainty;

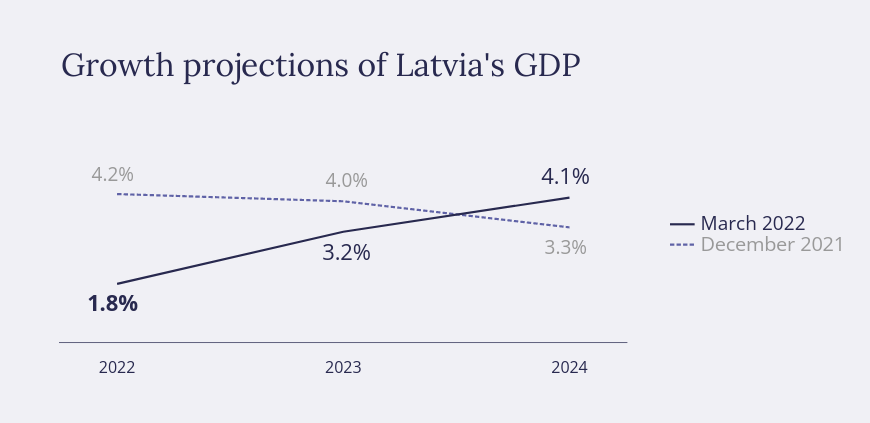

- owing to Russia's invasion of Ukraine, growth projections of Latvia's gross domestic product (GDP) for 2022 and 2023 have been revised downwards to 1.8% and 3.2% respectively (from 4.2% in 2022 and 4.0% in 2023 in the December growth forecast);

- with confidence improving, 2024 is expected to see revival of faster economic growth, and Latvia's GDP could increase by 4.1%;

- however, the decline in economic activity caused by the war is likely to be more pronounced this year if the warfare continues or escalates and sanctions are expanded. The effects of cessation of trade with the aggressor countries can be estimated relatively precisely. However, the impact of the possible commodity shortage and deteriorating confidence is far less clear cut, and in the event of adverse developments it can reduce production, consumption and investment. This may result in a more pronounced decline in economic activity this year and a delay in acceleration of growth. Further escalation of the war would also sustain higher resource prices and inflation;

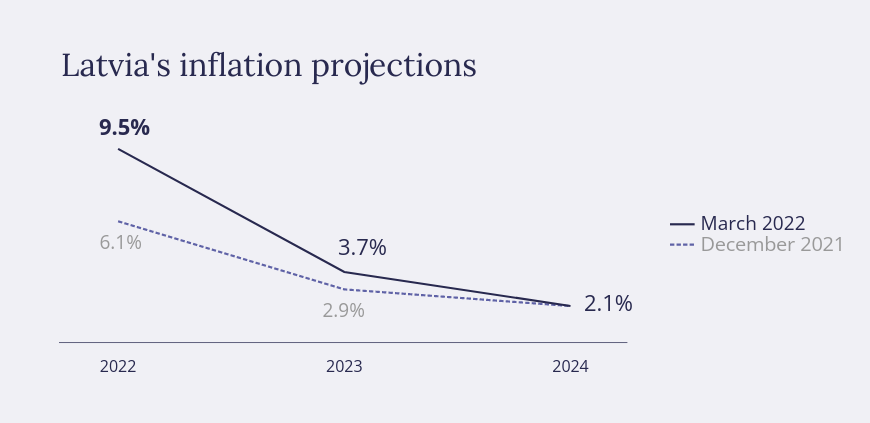

- Latvia's inflation projections for 2022 and 2023 have been revised upwards to 9.5% and 3.7% respectively (from 6.1% in 2022 and 2.9% in 2023 in the December inflation forecast) on account of the rising global energy and food prices, which have increased further since the outbreak of the war in Ukraine;

- the inflation forecast for 2024 (2.1%) reflects a drop in energy prices, but nevertheless they remain considerably higher than in the previous years.

The Russian-Ukrainian war is slowing down global and European growth

Russia's aggression in Ukraine will reduce global economic growth, and the uncertainty surrounding oil and gas supplies as well as the availability of alternative sources translates into high volatility of energy and other commodity prices and their elevated levels.

With inflation hitting its historical highs, the major central banks have taken steps towards monetary policy normalisation. The challenge of monetary policy decision makers is shaping the monetary policy that reduces inflation but does not dent growth.

The Governing Council of the European Central Bank (ECB) has taken a decision on adjusting its monetary policy instruments, accelerating decrease in net asset purchases while continuing to reinvest the principal payments from maturing securities. The Governing Council of the ECB takes the high inflation rate seriously, but at the same time the Russian-Ukrainian war adds to uncertainty which prompts the Governing Council of the ECB to remain cautious and move gradually towards monetary policy normalisation, emphasising the readiness to adjust its policy in compliance with economic developments.

The energy and refugee crises should be tackled through the implementation of targeted fiscal policy support measures.

Russia's invasion of Ukraine has a strong and immediate effect on Latvia's economic growth

The downward effects of the war on economic growth will materialise mainly through the following channels:

- falling exports to the aggressor countries due to shifting away from economic cooperation with Russia and Belarus on account of the sanctions and payment problems as well as firms' own initiative;

- replacement of imports of raw materials and components received from the countries engaged in the war. Finding alternative suppliers takes time, limits production and boosts prices;

- further increase in the already mounting prices for global energy and other commodities and materials;

- deterioration of confidence and further increase in uncertainty in the region.

The war in Ukraine has reinforced the price rise and has had an adverse effect on the purchasing power of Latvia's population:

- higher inflation for almost all products, particularly fuel, gas, heat, electricity and food implies that one can buy less for the same amount of money;

- government support makes it easier to withstand price hikes. With the price rise persisting, a targeted government support to the most vulnerable population groups will continue to be relevant.

At the same time, the crisis induced by the war (like the effects of the Covid-19 pandemic) will have uneven effects across businesses and households:

- the firms that were dependent on the Russian market and are unable to switch to other markets will have to scale back or even cease their activity. Employees will lose their jobs and slide into unemployment, and their income will decline;

- the businesses exporting to Western markets can grow considerably. The demand for the replacement of the undelivered goods from the countries under sanctions and from Ukraine is expected to be high. These firms will be able to generate profits and also increase wages of their staff;

- unemployment will pick up in Latvia; however, an increased availability of employees will not substantially dampen wage growth, which is expected to remain fast. The current unemployed will be unable to satisfy the demand for qualified staff in the growing sectors.

The war in Ukraine will dampen investment activity:

- amid the shortage of materials and commodities, production costs will follow an upward path, reducing firms' ability and willingness to invest;

- the sanctions restrict the availability of construction materials and boost prices, leading to postponement or termination of investment projects;

- deteriorating confidence may have an adverse effect on financing conditions;

- however, the investment inflows will be supported by the availability of European funds, and projects replacing Russian energy are ongoing.

The government support provided during the energy price and refugee crises, security strengthening expenditure and investment enabling progress towards achieving the climate objectives are the most pronounced matters of urgency that increase the government deficit. At the same time, they also support economic activity.

|

Macroeconomic indicators: Latvijas Banka's projections |

||||

|

2022 |

2023 |

2024 |

||

|

Economic activity (annual changes; %; at constant prices; seasonally adjusted data) |

||||

|

GDP |

1.8 |

3.2 |

4.1 |

|

|

Private consumption |

5.4 |

4.7 |

4.4 |

|

|

Government consumption |

2.7 |

0.4 |

0.6 |

|

|

Investment |

–0.3 |

4.0 |

5.7 |

|

|

Exports |

–0.5 |

2.4 |

3.2 |

|

|

Imports |

–4.7 |

2.7 |

4.1 |

|

|

HICP inflation (annual changes; %) |

||||

|

Inflation |

9.5 |

3.7 |

2.1 |

|

|

Underlying inflation (excluding food and energy) |

4.1 |

3.5 |

3.7 |

|

|

Labour market |

||||

|

Unemployment (% of the economically active population; seasonally adjusted data) |

8.1 |

7.1 |

6.0 |

|

|

Nominal gross wage (annual changes; %) |

9.7 |

6.4 |

5.7 |

|

|

External sector |

||||

|

Current account balance (% of GDP) |

0.4 |

–0.3 |

–1.0 |

|

|

Government finances (% of GDP) |

||||

|

General government debt |

48.3 |

45.8 |

43.1 |

|

|

Budget surplus/deficit |

–5.9 |

–1.8 |

–1.1 |

|

The cut-off date for the information used in the forecast is 15 March 2022, and 11 March for the information used in some technical assumptions.