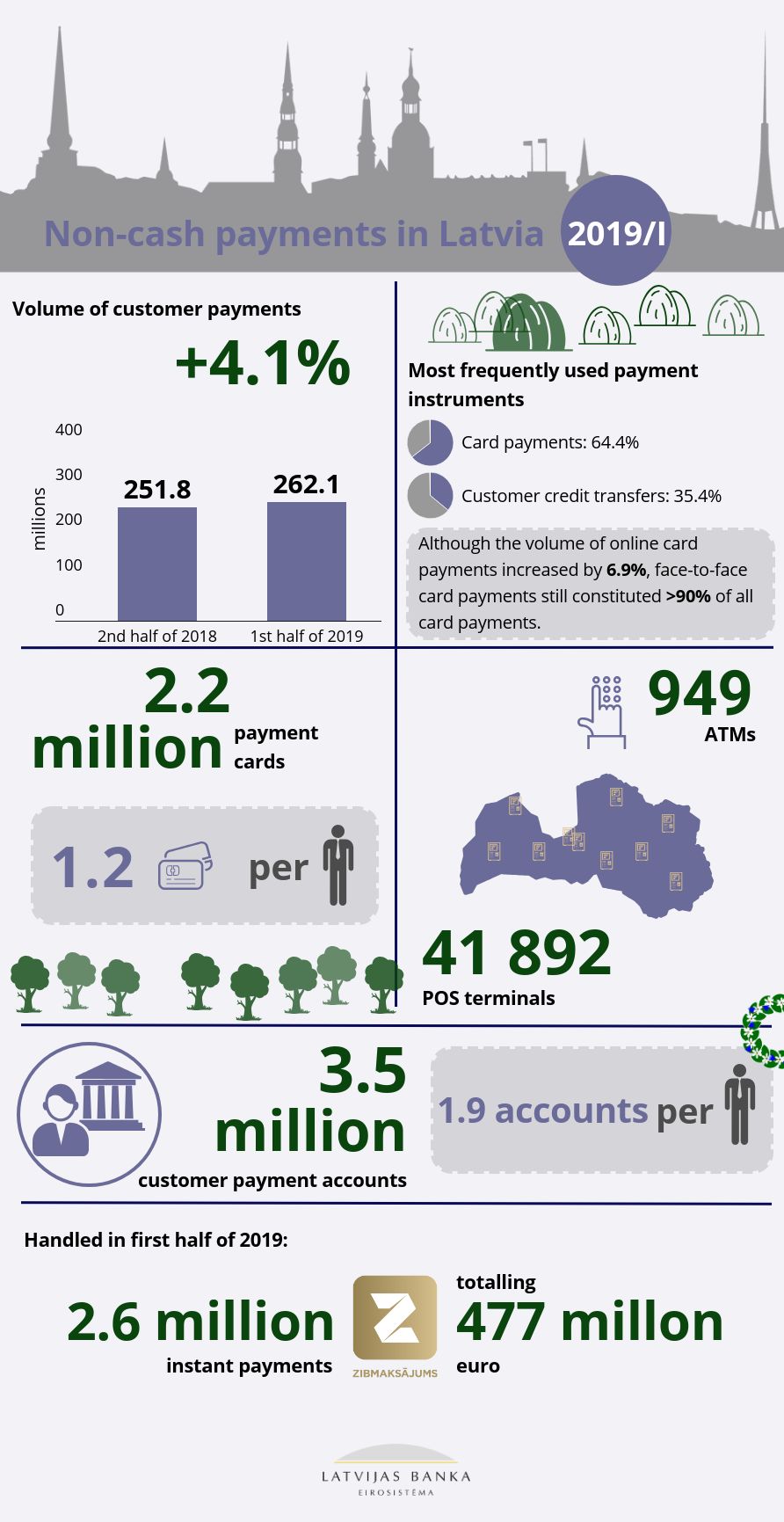

262.1 million non-cash payments made by customers and totalling 92.8 billion euro were executed by the Latvian payment service providers (credit institutions, electronic money institutions, payment institutions, Latvijas Banka, VAS Latvijas Pasts and the Treasury) in the first half of 2019. This averages 1.4 million payments worth 512.6 million euro a day.

The total volume of non-cash payments made by customers increased by 4.1%, but the total value of the payments decreased by 5.6% in comparison with the second half of 2018.

The most popular customer non-cash payments were card payments and customer credit transfers, constituting 64.4% and 35.4% of the total volume of non-cash payments respectively.

To ensure card payments, 2.2 million payment cards were issued by the Latvian payment service providers as at the end of the first half of 2019 (1.2 cards per capita on average), and most of them were cards with a debit function.

41.9 thousand points of sale (POSs) and 949 ATMs were available to the public. At the end of the first half of 2019, the number of customer payment accounts opened by the Latvian payment service providers totalled 3.5 million or 1.9 payment accounts per capita on average.

It is noteworthy that, in the first half of 2019, 2.6 million instant payments amounting to 477.2 million euro were processed via the instant payment infrastructure, developed and maintained by Latvijas Banka.

A detailed report on the operation of interbank payment systems, development of payment instruments and other areas vital for non-cash payments is available on Latvijas Banka's website: (https://www.bank.lv/en/statistics/stat-data/payment-systems-statistics).