Popular involvement: an appeal from the finance minister

In order to attract local capital for the establishment of the bank, an appeal of the Minister of Finance Ringolds Kalnings, addressed to the citizens and supporters of the Latvian state, was printed and distributed widely. In the appeal signed on April 28, 1921, he outlined the idea of how to source funds for the Bank of Latvia. Confidence of potential depositors would be gained by involving an institution of fiduciaries or trustees ("uzticības vīri"). Minister listed 25 well-known personalities whose promises the people might trust, that the deposited money will be safe. In the capital Riga 16 fiduciaries were named and three in each constituent region of Latvia – the culturally and historically distinct Vidzeme, Kurzeme and Latgale (German exonyms – Livland, Courland, Lettgallen) respectivelly.[1] The appeal was a clear evidence of the government's realisation that wartime decisions on forced requisitions and new taxes had significantly undermined confidence of many people in the authorities' promises.

"The Ministry of Finance has up to 15 million Gold Francs at its disposal, but that is insufficient. It is necessary to gather as large a sum as possible in Latvian gold or stable foreign currencies, such as pounds, kroons, etc. One should then attempt to raise foreign capital matching that amount, so that "The Bank of Latvia" can not only establish itself immediately, but also start operating on a secure foundation as the Bank of Issue and Reserve, thus providing all Latvia's citizens with a yardstick for calculating their private payments and payments of their enterprises.

We have three months to accomplish this. Preparations are already complete and a plan has been drafted. Therefore, with the consent and assistance of the Cabinet of Ministers and many public figures, the Ministry of Finance organizes [the process of] private subscription at the premises of the fiduciaries. There may be such trustees in every city or county, and any citizen known for uprightness may serve as one . These trustees are organizing a private subscription, the information about it is aggregated by the Riga Committee, the composition of which is as follows: (..)

Committee members are working without remuneration, for the cause. The Finance Minister will get in touch with this committee, which in turn will report privately, what sums are expected, without divulging to the minister - where and how much will be given and by whom. The names of the subscribers do not have to be known to the minister.

The Bank of Issue is conceived of as a high-ranking autonomous establishment which elects most of its officials and is working in a close liaison with both the Ministry of Finance and government, irrespective of their party affiliation and political views. [Building] trust [in this institution] is of utmost importance to us at the moment.

After a significant sum of money is drawn up in such a manner, the Finance Minister will be able with good prospects of success to get in touch with foreigners, even travel abroad in person. The Finance Minister hopes that on behalf of this bank he would not only meet with trust and acceptance there, but also attract gold and foreign currency double the sum total of funds made available [to the bank] by the Latvian government and its citizens. In this manner it is intended to create a stable benchmark, based on which we would be able to rebuild our lives successfully and it would be our labour, incessant labour that would secure the flourishing of this country.

At the same time a currency reform has to be carried out and the state revenue and expenditure recalculated in gold.

[..] Finance Minister would like to appeal to all of you to talk this issue over, reflect on it and to facilitate it with means within your capabilities, then report on the results in a private manner to anyone of the above mentioned committee members."[2]

However, the government had not thought of the need for a more extended communication with the public. A month after the publication of the appeal, for example, the Kuldiga branch of the State Treasury had not yet received more detailed information and thus was unable to explain elementary questions to those "interested in participating in the establishment of the bank of issue with their funds", like, would foreign bank notes and mortgageable real estate be accepted alongside gold. The promise that the fiduciary committees would be contacted by the Minister of Finance was not kept. The chairman of the Daugavpils district board, Jezups Zarāns, found out that he had been appointed to the committee from newspapers. On May 20, he wrote to the Ministry of Finance asking for more detailed information: "In appeal leaflets to be distributed in agriculture shows and rural municipalities, I have noticed my name listed among the fiduciaries. My knowledge of the establishment of this bank does not stretch much further than the newspaper articles I have come across from time to time, therefore, without immediately rejecting the tasks put upon me, I would like to request as complete set of materials as possible to familiarise myself with the case."[3]

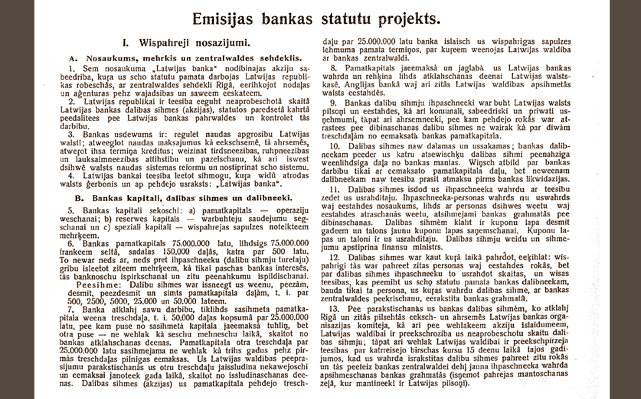

The initial publication of the draft Statute of the Bank of Latvia

In the summer of 1921, the draft Statute of the Bank of Latvia" was made available to the general public as widely as possible for the first time, as it was published in Latvian in June and in July in English.[4] It envisaged that one third of the planned 75 mln. Gold Francs worth of capital of the Bank of Latvia would be provided by the Latvian government and the people and two thirds would be invested by three of the Allied powers, the United Kingdom (20%), the United States (20%) and France (10%). The board of directors of the bank would be comprised to two thirds of Latvian citizens and one third of foreigners. Foreign directors should reside in Riga.

Draft Statute of the Bank of Issue. Ekonomists (magazine The Economist). 1921, Nr. 12 (15.06.1921.), 481.–485. lpp.

From September onwards, the project became the subject of another debate in the Finance Council, and in parallel, work was under way to attract foreign investors.

Trade and Banking Division of the Finance Ministry's Credit Department informed the Latvian legation,a diplomatic representation in Paris via Political and Economic Department of the Ministry of Foreign Affairs: "The Ministry of Finance has managed a while ago to get off the ground the question of establishing a Bank of Issue involving foreign capital. Now the bank's founding draft Statute has been drawn up, the government has received offers of capital, and the project is expected to be implemented in the near future. Please, spread this information as widely as possible in the world of Belgian financiers, merchants and also the government circles about the Bank of Issue project, noting that the Latvian government would be glad to see capital attracted from the respective country".[5]

The Diplomatic Effort

In September 1921, some Latvian envoys received a paper from the Ministry of Finance informing about the establishing of a bank of issue.[6] At least six Latvian envoys were involved in the process (in the three great Allied or Entante Powers, as well as in Germany, Italy and Sweden): Latvian envoy to the United States Pēteris Sēja, Latvian envoy to France Oļģerts Grosvalds, Latvian envoy to the United Kingdom Georgs Bisenieks, Latvian Consul General in Germany Edgars Švēde, Latvian Envoy to Sweden Frīdrihs Grosvalds and Latvian Envoy to Italy Miķelis Valters.

E. Švēde, the former head of Banking Division of the Finance Ministry's Credit Department, who chaired meetings of the Finance Council on occasion during 1920, was actively involved not only in the formation of a currency issuing bank, but also in formulating and resolving the country's currency reform, foreign exchange problem and – financial policy in general. After becoming the Consul General of Latvia in Berlin in October 1920, he tried to attract foreign entrepreneurs who would be interested in investing capital in the Latvian currency-issuing bank. On May 13, 1921, he wrote to the Latvian Ambassador to the United States, P. Seja, that "negotiations with representatives of some American banking groups [National City Bank of New York] have commenced here in Germany about financial operations in Latvia, and in particular – about participating in Latvia's bank of issue, which is currently being founded, and about a loan against the Latvian railways as collateral. Attitude of these representatives was very obliging, as I gathered and I have received assurances that there is the necessary interest in America for such financial operations and that consent in principle has been granted by the interested circles. Now the question is whether the American government will not put obstacles in the way for political reasons and whether American capitalists will not become reserved at the last minute, given their government's negative treatment of the new states on former Russian territory, thus threatening the results of these negotiations. My worries are confirmed additionally by a conversation I had with a local German, which had recently returned from America, and who maintained that American citizens would not be available to make any investments in Latvia before the political relations are clarified."[7] As the Latvian Consul General was expecting the Minister of Finance R. Kalnings to arrive on a visit to Germany at the end of May, he asked the Latvian Ambassador to the United States for information on whether there were any changes in the American government's views on the new countries, that would allow to understand whether hopes for an American financial assistance were realistic. Latvian ambassador to the United States replied that Latvia's possibilities to obtain a loan from the American government would be clear only after the United States recognized the Republic of Latvia de jure.[8] (The USA recognized the government of the Republic of Latvia – but not the country, de iure on July 28, 1922.)

However, E. Švēde had hoped in vain as it turned out - The National City Bank of New York informed the Minister of Finance R. Kalnings on November 14, 1921, in a response to his letter of October 13, that it was not interested in participating in the founding of banks abroad.[9]

On November 17, 1921, Frīdrihs Grosvalds, Head of the Latvian Embassy in Stockholm, informed the Trade and Banking Division of the Credit Department that he had personally tried to interest directors of two Sweden's largest banks, Stockholms Enskilda Bank and Skandinaviska Kredit Aktiebolag. He summed up: "We cannot hope that the Swedish banking community would participate in the Note issuing bank as Swedes themselves are faced with a serious crisis and a shortage of free capital, so that all banks there are very cautious about new enterprises".[10]

Minister of Finance R. Kalnings was actively involved and encouraged the activities of diplomats. On August 8, 1921, he informed Olģerts Grosvalds, the Latvian ambassador to France, that he planned to be in Paris on September 23 and 24. "You may already be able to contact all those who would like to meet me in Paris, perhaps, so as not to waste time and draw up a general plan for negotiations with the French Government representatives, where you deem it advisable on the proposed issues. For me, the main item on the agenda now is founding the bank of issue, for which you will receive a separate letter, and for what purpose preparations are being made here. With the consent of the Prime Minister, I would request that a copy of all the reports you send to the Ministry of Foreign Affairs on economic matters is placed in a separate envelope for me through the Ministry of Foreign Affairs, so as not to waste time on copying. f transcription. See you in Paris, R.Kalnings."[11]

On the morning of September 26, when the Minister was already in Paris, O. Grosvalds arrived and tried twice unsuccessfully to meet R. Kalnings at his hotel, he wrote. "After that, I was at the bank Banque de Paris & Pays-Bas and arranged an appointment with two of their directors on Wednesday, September 28, at 10 am. If this day and hour were not convenient for you, I could arrange other times. Would you kindly telephone me to set an appointment when you could meet me at the hotel. I'll stay home this afternoon and wait for your message."[12]

The Latvian Ambassador to Italy, M.Valters informed Foreign Minister Z. A. Meierovics on December 21, 1921, that news of possible participation of Italian banks in the Latvian currency-issuing bank had appeared in the Italian press, so he would need to receive instructions on how to facilitate that. On December 27, he informed the Ministry of Foreign Affairs that the Paris representative of the Banco di Roma had informed the bank's head office in Rome about his conversation with the Minister of Finance of Latvia R. Kalnings.

"In that letter, the Paris representative stated that, having heard of Mr Kalnins' talks in Paris, he went to meet him to gather more information about the establishment of a Latvian bank of issue and possible participation of the Italian capital. Finance Minister Kalnings informed representatives of Banco di Roma that there were no intentions to attract Italian capital, but solely that of England, France and America. If the bank was interested in Latvia, it could get in touch with some private bank, for example, Riga Commercial Bank. In reading the letter, chief executive of the management, director La Roche picked out parts, which expressed rejection from Finance Minister Kalnings and made it clear that this attitude was very surprising, adding that Banco di Roma had found out its options and that it had no intention of participating in a Latvian bank of issue."[13] M. Valters suggested that the Minister of Finance had been misunderstood and that he would like to report this to the bank's central management in Rome. R. Kalnings' reply confirmed the envoy's assumption that "we have no reason to oppose participation of Italian capital in the founding of the bank of issue; on the contrary, it would be highly desirable".[14] Moreover, the Minister was ready to go to Rome immediately to deal with the matter.[15] Alongside with that, he was trying to get the opinions of foreign professionals on the draft Statute of the Bank of Latvia, which was thus being constantly improved.

Criticism of the Statute of the Bank of Latvia: involvement of foreign experts

On October 13, 1921, Sir Ernest Harvey criticized the draft Statute of the Bank of Latvia in a letter to the Minister of Finance of Latvia, R. Kalnings. [16] R. Kalnings' letter of March 7, 1922 to the Latvian ambassador in London shows that he has continued to correspond with E. Harvey on various issues.[17]

"Dear Mr. Kalning, following the conversation which I enjoyed with you yesterday, I would begin my comments on your Bank Scheme with a most serious warning. The Bank of Latvia must exercise the greatest circumspection in the matter of advances to customers, Bankers and to the Government, because every advance renders the Latvia Bank liable to increase its Note issue, and this liability may be an insupportable strain unless the advances are restricted by the most intelligent management which is far better protection than statutes," wrote E. Harvey.[18] He pointed out that criticism of all the Statutes, article by article, would be time-consuming, so he would use one article as an example, which envisages that the share capital of the Bank of Latvia is 75 million gold francs and cannot be used but for the exchange of banknotes and other obligations.

"In the first place a capital of Frs. 75 000 000 gold equal to nearly £ 4 000 000 is a large capital for the chief Bank of a country with 1 750 000 population, and the restrictions on the employment of the capital mean no restrictions at all. As an instance of the dangers to which the Latvia Bank would be exposed, read Statute 22: "The Latvia Bank withdraws Treasury Certificates by order of the Minister of Finance based on law "__". As a result of this Statute the Finance Minister might acquire such enormous Ways and Means Advances from the Latvia Bank that the Latvian Government would, in effect, have recovered a free hand with the printing press. Many other of the Statutes are to my mind wrongly conceived, especially where reference is made to the Latvian Government or to Latvian Government Ministers. The ideal Note issuing Bank would have the strictest rules as to conditions under which notes may be issued, and as little association with the Government as possible. For instance, if the Latvian Government, as is probable, would have to find the capital for the Bank it would be best to have the Bank as an appanage of the Latvian Government and not a Government department. Two out of five or six directors might be Government nominees, but with no more authority than the other directors.

In fact if the Latvia Bank were registered as an English Company with nominal Head Office in London, it would probably add to its usefulness and credit. If the association of desirable English directors and management could be secured, the advantage to Latvia would be most quickly apparent.

It must, however, be remembered that no first class man would associate himself with the Bank until he were satisfied that the Latvian Government can balance its books.

The idea of depositing gold in vaults in London is an unnecessary luxury for Latvia, and just as much credit would be restored to Latvian currency if it were redeemable by cheque drawn on a balance kept with an English Clearing Bank, as if it were redeemable in gold." [19]

E. Harvey rejected the idea that beside Latvians in the Bank of Latvia's Board of Directors, three other nationalities should be represented, stating that this would be an unnecessary restriction on the composition of the bank's management.

In October 1921, when R. Kalnings and the Latvian Ambassador to London G. Bisenieks visited J. D. Gregory, the Head of the Northern Department of the British Foreign Office, the question of Latvian currency-issuing bank was also touched upon. On November 3, G. Bisenieks submitted an application initiated by R. Kalnings to the British Foreign Office, enclosing a copy of journal "The Latvian Economist" – the seventh issue of 1921.[20]

R. Kalnings was looking for contacts in the League of Nations as well. He had discussed the scheme for establishing the Bank of Latvia by telephone with Henry Strakosh of the Finance Committee of the League of Nations, and outlined it in a letter on October 19, 1921. In a reply letter dated 21 October, H. Strakosh wrote that he needed to discuss the matter with some colleagues in the Finance Division of the League of Nations and that he could then return to the matter directly or via the International Credit Organisation of the League of Nations.[21]However, he advised R.Kalnings to pursue the matter with Lt.-Col. G. Schuster from the International Credit Organization, because he himself was planning to be away on a trip.

In a letter to the British Foreign Office, the Latvian Ambassador G. Bisenieks expounded the principles for the establishment of the Bank of Latvia, indicating that the recommendations made by H. Strakosh had also been taken into account.[22] He outlined the vision of the Bank of Latvia as potentially extremely important for the North-Eastern region of Europe (Latvia, Estonia, Lithuania), noting that an agreement between the three countries could be reached if the Bank of Latvia enjoyed the support of the League of Nations. A representative of the Finance Committee of the League of Nations would be appointed to the Board of the Bank of Latvia.

[1] In Rīga: Ernests Birkāns, university lecturer, director of the Latvian Trade and Industry Bank; Jānis Bisenieks, agronomist, director of the Latvian Farmers' Economic Society; Dr. Roberts Erhards, former finance minister; A. J. Gusevs, factory owner; Jēkabs Landaus, member of the Constitutional Assembly; Vilhelms Kerkoviuss, Bourse committy chairman; Fricis Lasmanis, merchant; Mārtiņš Miljons, merchant, Director of the Latvian Mutual Credit Union; Vladimirs Presņakovs, member of the Constitutional Assembly; Jegors Raudzeps, merchant ship captain, head of Rīga port authority; S. Zakss (Sachs), director of the Nordic Mutual Credit Union; Johans Zēbergs, merchant, former minister of trade and industry; Pēteris Siecenieks, director of "Konzums", the central union of consumer co-operative associations; Eižens Švarcs, director of the Bourse Bank; Jānis Grišāns, member of the Constitutional Assembly; Ādams Turkupols, member of the Constitutional Assembly. In Vidzeme: Arvīds Bremers, farmstead "Glāznieki" in Ļaudona, Pēteris Pelcs, farmstead "Kažauči" in Smiltene, Jānis Grīnbergs, farmstead "Roķēni" in Sigulda. In Kurzeme: agronomist Žanis Blumbergs in farmstead "Garauši" in Praviņi via Tukums, A. Sausups , farmstead "Bulduri" in Džūkste, Jānis Jaunzems, farmstead "Škutāni" in Sērenes via Daudzeva. In Latgale: Jezups Zarāns in Daugavpils, Pēteris Zadvinskis in Rēzekne, Pēteris Soikins in Ludza.

[2] LNA LVVA, 4620. f., 2. apr., 602. l., 138. lp.

[3] Ibid, 139. lp.

[4] Emisijas bankas statūtu projekts. Ekonomists. 1921, Nr. 12 (15.06.1921.), 481.–485. lpp. English translation of the Statute was published in july: Proposed Statutes of "The Latvia Bank". The Latvian Economist. 1921, No. 7 (July), pp. 161–165.

[5] LNA LVVA, 2575. f., 7. apr. 111. l., 128. lp. un 128. lp. o. p.

[6] Ibid, 4620. f., 2. apr., 602. l., 53. lp.

[7] LNA LVVA, 293. f., 1. apr., 678. l., 1. lp.–1. lp. o. p.

[8] Ibid, 4. lp. o. p.

[9] Ibid, 4620. f., 2. apr., 602. l., 39. lp.

[10] Ibid, 53. lp.

[11] Ibid, 2575. f., 7. apr., 111. l., 129 lp.

[12] Ibid, 139. lp.

[13] LNA LVVA, 6824. f., 3. apr., 184. l., 8. lp.

[14] Ibid, 6. lp.

[15] Ibid, 10. lp.

[16] Ibid, 4620. f., 2. apr., 602. l., 70.–75. lp.; 76.–77. lp. o. p.

[17] Ibid, 27. lp.

[18] Ibid, 76. lp.

[19] LNA LVVA, 4620. f., 2. apr., 602. l., 76.–76. lp. o. p.

[20] Ibid, 6824. f., 3. apr., 184. l., 11., 18. lp.

[21] Ibid, 4620. f., 2. apr., 602. l., 49. lp.

[22] Ibid, 6824. f., 3. apr., 184. l., 19.–21. lp.