Situation in the economy of the euro area

I will begin with evaluating the situation in the euro area. We can say that, generally speaking, the monetary measures initiated by the Governing Council of the European Central Bank, i.e., the Eurosystem last year, have represented a stimulus to a rise in the economic activity and faster growth of the euro area.

In the first quarter of this year, the economic growth of the euro area accelerated to 0.4% quarter-on-quarter. That is the fastest rate of growth in the course of two years. Data indicate that economic activity is stabilizing in the industrial production sector, the confidence indicators are imploring and there is a positive impact from the lower oil prices. Successful indicators in all four largest euro area members – Germany, France, Italy, and Spain – point to stable growth. We see that the dynamic of the euro area inflation has changed.

According to provisional calculations, this indicator in May was 0.3%, compared to the April inflation, which was a round zero. Judging by the prices of oil futures traded in the stock exchange and other factors, inflation in the euro area could continue to be very low in the coming months. Yet, with the positive effects of the monetary policy of the Eurosystem holding and taking into account the base effect of oil prices and the increase in economic activity, inflation could continue to rise in autumn. Overall, inflation in the euro area can be predicted around 0.3%, but in 2016, it will rise to 1.5%.

We see that in recent months the conditions of the financial market have become more favourable, the conditions of lending have improved substantially, the demand for loans in the euro area has grown, and the costs of private sector financing have dropped.

This, to a great extent, has been due to the monetary policy implemented by the Eurosystem. Latvia is actively involved in two ot the Eurosystem programmes. One is the programme of longer term refinancing targeted operations, which I have analyzed in greater detail in previous press conferences. In the first three auctions of this programme, Latvian credit institutions used the opportunity to borrow 161 million euro from the financing offered by the Eurosystem for lending to the productive sector of the economy on very favourable terms. The other programme involves the purchasing of the assets of the state sector and its impact on Latvia will be indirect, through a positive impact on the euro area. The latest data indicate that within three months, Latvijas Banka has purchased the securities of the state of Latvia and euro area international organizations in the amount of 531.8 million euro. The Latvian government securities have been purchased in the amount of 458 million euro; these securities have been mostly purchased both by Latvijas Banka and the European Central Bank.

Situation in the Latvian economy

Now to the economy of Latvia.

In 2014, GDP grew by 2.5% – this is the weakest outcome in the postcrisis period, which nevertheless should receive a positive evaluation, given the conditions in the external environment. A faster growth of the Latvian economy in 2014 was prevented by the still weak growth in the euro area, which did not allow Latvian exporters to raise their sales volumes more rapidly. In addition, as the external demand from Russia weakened and the value of the rouble dropped, the economic conditions deteriorated in the nearby region as well. Even though the direct impact of the introduced economic sanctions on the Latvian economy has been relatively small, their impact was great on the overall economic situation: the confidence level of the participants in the economy dropped and their actions, when making decisions about larger purchases or investments, became more conservative. In 2014, economic growth was ensured primarily by those sectors that were oriented toward domestic consumption – trade, construction, and public services. A similar trend will likely continue in 2015 as well.

In the first months of 2015, the lending dynamic in Latvia maintained the trends of previous periods. The repayment of loans granted previously still exceeded the inflow of new loans into the economy. Yet positive trends are also observed – the drop rate of domestic loan volume began to decrease. If, in December 2014, we lagged behind the level of the previous year by 7.1%, at the end of April that same percentage was only 4.4%.

Bank lending surveys indicate that the perception of high risk and lack of clarity about the development of the economy in the future and external factors act to maintain the caution of both banks and borrowers, yet banks are becoming more optimistic regarding demand developments in the near future. Banks are ready to loan to quality enterprise projects and the resources for lending are becoming ever cheaper and more accessible, which trend has been promoted by the monetary measures taken by the Eurosystem. The current situation with the low level of interest rates is an excellent opportunity for launching competitive projects.

The latest GDP and inflation predictions

The previous predictions by Latvijas Banka were published on 13 January 2015. Given the development of the geopolitical situation, problems in the Russian economy and weakness of growth in the euro area, the projections for 2015 were adjusted downward from 2.7% to 2.0%. The data of the first quarter and operational statistics of the second quarter indicate that our vision of the economic development for this year has been correct. Therefore, the Latvijas Banka growth prediction for 2015 remains unchanged at 2.0%.

With the situation in the external environment gradually improving in 2016, GDP could grow slightly faster than this year, i.e. around 3%, but the growth-related risks, primarily the negative ones but also the positive ones remain high.

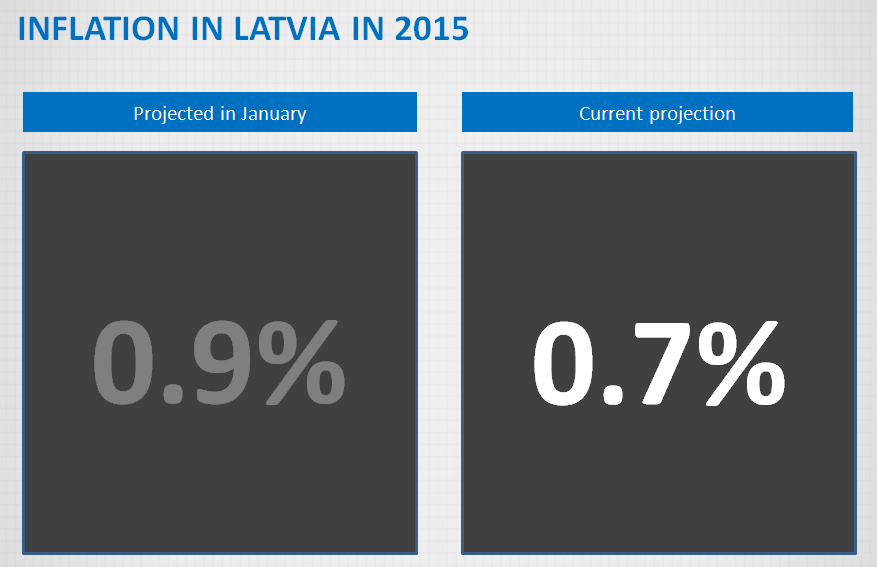

The inflation predictions for 2015 were reduced from 0.9% to 0.7%. This reduction was due to the lower prices of oil and natural gas with the respective impact on heating energy tariffs and the lower world food prices. The 2015 inflation will primarily be supported by the demand side, which will be fostered by rises in compensation. An additional contribution will be made by the consequences of some decisions – the rise in tariffs caused by the liberalization of the electric power energy market and the tariffs raised by "Rīgas satiksme". In 2016, as the oil and global food prices rise and a faster growth of both the euro area and Latvian economy, inflation will be closer to 2%.

On the budget!

This month, the government will begin discussions on the first political initiatives for the budget of 2016. An important question, in terms of Latvia's development, is whether the state will be able to retain the reasonable budget policy that helped us overcome the crisis. Will we prove capable of not returning to the policies, which led Latvia to the crisis?

We know full well that the work at next year's budget is only at the beginning and much can be changed and improved. That is why it is important to diagnose the possible risks early enough and take the appropriate steps to avoid them. Right now, observing the latest tendencies and public pronouncements, the situation is rather worrisome. What is worrisome is the many initiatives that require additional financing from the budget, knowing full well that Latvia has no money to finance these promises. It is behaviour that gives rise to a dangerous trend and can, in a short time, destroy all efforts that have been put into stabilizing the macroeconomic situation and ensuring fiscal sustainability.

The publicly announced consolidation sum for the budget of 2016 is, in our opinion, a very conservative estimate of the actual situation in the budget and ignores several matters. It is perfectly clear right now that there is no money in the budget to fulfil and finance new initiatives.

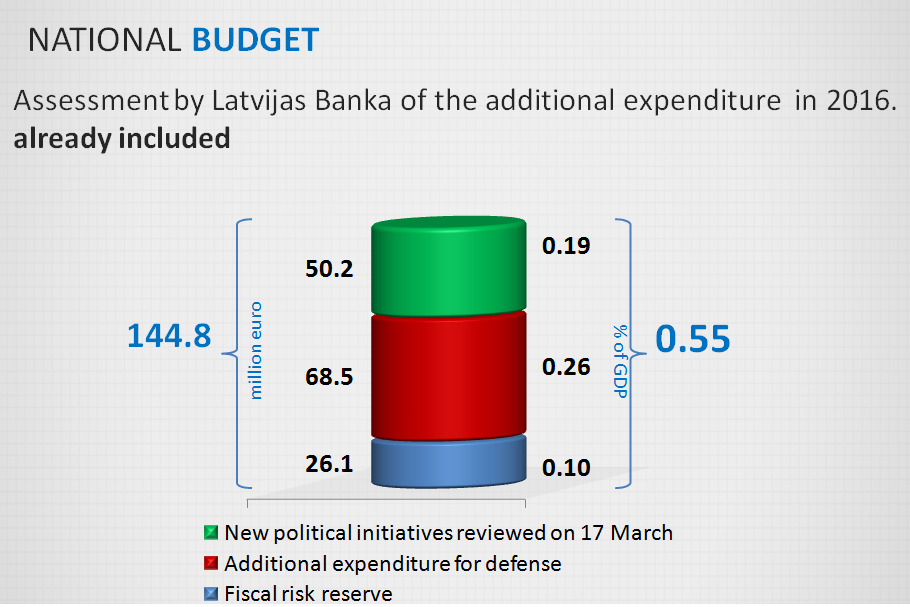

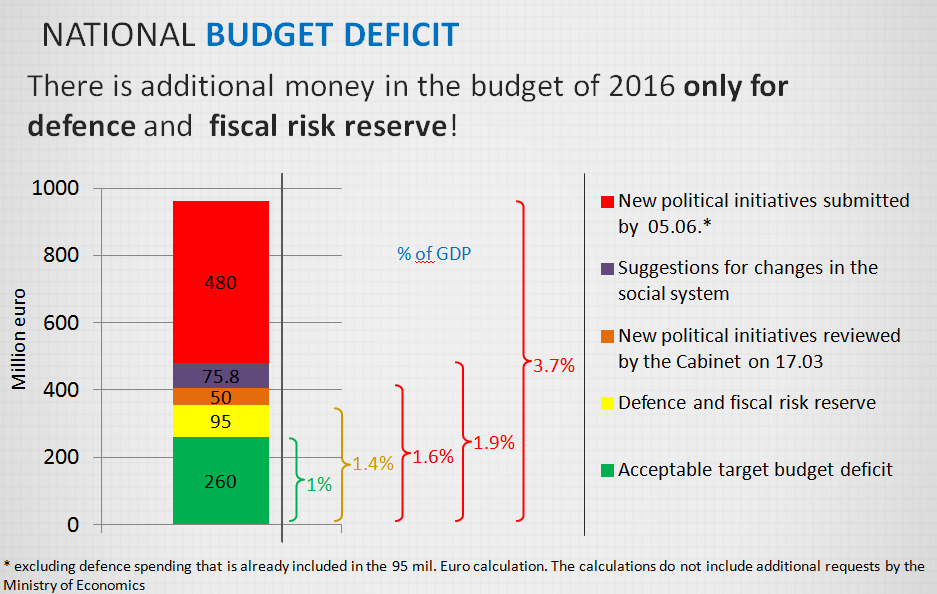

Even right now, the acceptable level of GDP is 1% of GDP or a deficit in the amount of 260 million euro, even though during growth as we are currently experiencing in Latvia, the budget should be balanced, i.e. without a deficit. The abovementioned 1% is not all: the money already worked into the laws and government decisions, which has been allotted to various needs in 2016, i.e. 145 million euro must be added to it.

Of this sum 68.5 million euro or 0.26% of GDP is accounted for by an additional demand for defence and 26 million or 0.1% of GDP – by the fiscal risk reserve, and together they would increase the budget deficit to about 1.4%.

To the 95 million euro we must add 50.2 million euro or 0.19% of GDP, which is accounted for by the new policy initiatives reviewed in the Cabinet of Ministers in March. Should they be carried out, the budget deficit would rise to 1.6%.

There is no money, no income to fulfil these new policy initiatives – the so-called fiscal space has been exhausted. We are already exceeding our target budget with a deficit at 1%.

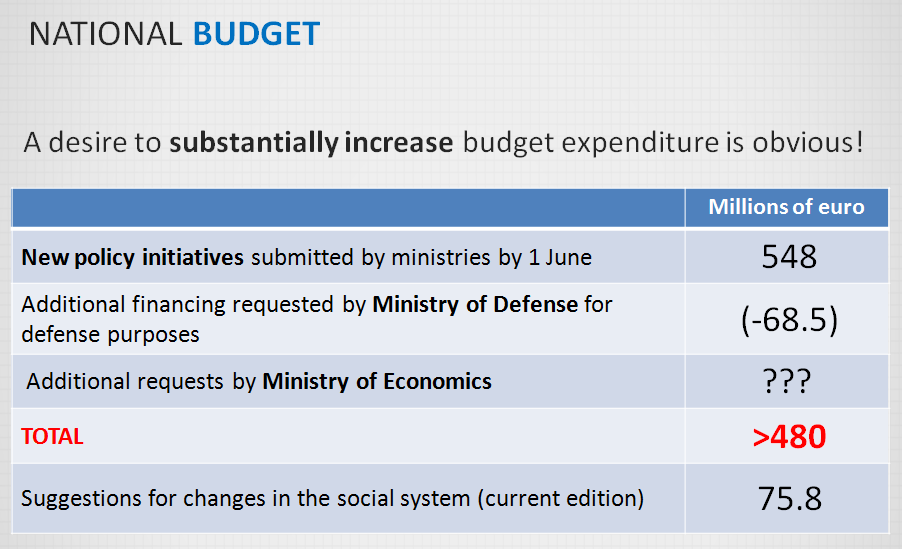

Yet we see that many additional initiatives have been submitted.

In autumn, discussions can be expected on straightening out the social welfare system, which needs almost 76 million euro or 0.3% of GDP. In the new policy initiatives submitted in June around 550 million euro has been demanded; if we subtract the previously accepted defense priorities, it amounts to an additional demand for money in the amount of 480 million euro. Should such demands be satisfied, the level of the budget deficit would reach 3.7% of GDP.

This is a clear indication that we are planning to borrow and increase the burden of the public debt and thus pay an additional several million euro from the state budget to pay for servicing the debt.

The framework for developing fiscal policy stipulates drafting the budget according to the countercyclical principle. In ordinary language it means that in periods of growth that are more moderate than projected, a short-time downward deviation in the budget deficit from the previously set target is acceptable. Under conditions where the economy is growing faster than what was predicted during the budget drafting period, the budget deficit must also be smaller than planned before and the money collected in additional tax revenue should be directed toward forming future accruals or cutting the public debt. A higher Latvian GDP prediction also does not mean additional money for distribution, and I would urge a stop to the competition of positive growth scenarios as if thereby the current budget problems could be solved.

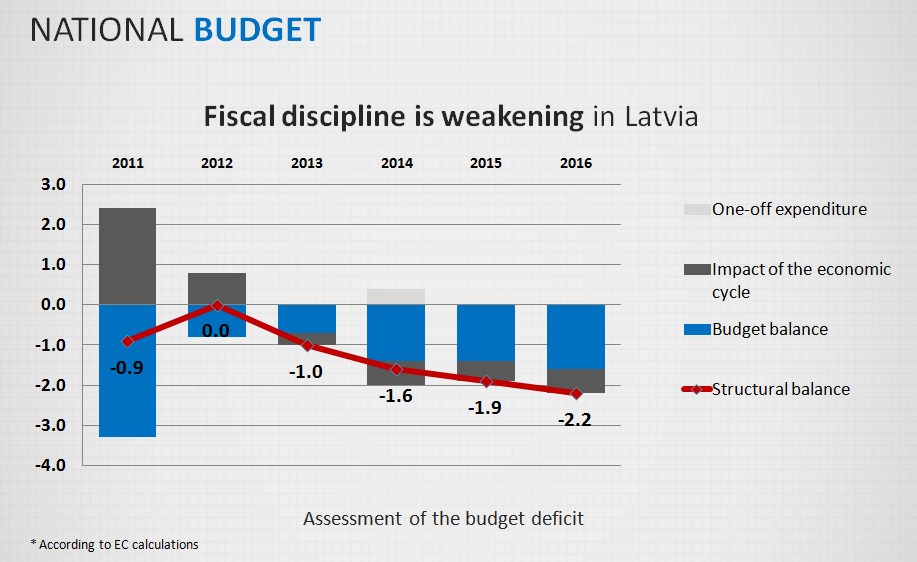

This is best seen in the dynamic of the so-called structural balance of the budget, which indicates the direction of the national budget, excluding the impact of the economic cycle and various one-off factors. Here it can clearly be seen that, as of 2012, the fiscal discipline in Latvia has been gradually weakening.

Despite the fact that the Latvian economy has grown, we have spent more every year, worsening the condition of the structural balance. If we continue on this trend, next year we can achieve the same 1.9% level. The same situation is being repeated that formed in Latvia in the years 2004-2005-2006. In the illustration, we see income ensured by short-term fluctuations in the economy. This money should not be spent, yet we are doing just that right now and it is not a prudent or sustainable practice.

Therefore we completely support the warning issued in May by the Fiscal Discipline Council and the Ministry of Finance and the discussion initiated by them regarding the necessity for fiscal consolidation in the budget of 2016.

The state finances are becoming less balanced and more vulnerable and it is necessary to implement the measures aimed at ensuring budget sustainability and fiscal discipline principles set down in law. Luckily, it is not yet too late and this is the right moment to make relatively painless adjustments to the budget policy.

Please don't get me wrong, I am not saying that we have to freeze all the budget programmes or cut expenditure. Not at all! Additional money for the needs of the society must be sought and found, but not by increasing the budget deficit and burden of the public debt, but by conducting structural reforms. Right now, the situation is very favourable for conducting the necessary structural reforms. The Stability and growth pact allows for deviations from the budget deficit target in the amount required in the short term by structural reforms. On the other hand, the programme for buying up the euro area government securities has allowed us to reduce the costs of servicing the public debt and created unplanned savings. Governments can and should use this money for conducting structural reforms instead of using it for financing additional day-to-day expenses.

Parallel to structural reforms, it is worth considering the expenditure of the public sector. It is my opinion that much of it, when viewed ten years later, has lost its urgency. We believe that this would be the right course of action, for the third alternative for improving the budget situation, raising taxes, would be a blow to entrepreneurship and would undermine confidence in the Latvian economy. The idea of raising the VAT should be abandoned right off. Unfortunately, it has already been voiced. I would characterize it as an issue of national security: under the conditions of economic growth, raising the VAT should by no means be done. This is a tax, an instrument, which allows us to overcome deep and unexpected crises like the one in 2008, when there was the chance to raise it by 3 percentage points and use it as the last straw in the complicated financial situation. The only country that is currently discussing raising its VAT is… You must know which one it is. You don't? It is Greece, a country that is facing serious financial trouble. I do not believe that Latvia is currently undergoing any financial trouble. Therefore, all talk about raising the VAT and thus raising inflation, is unacceptable.

I will repeat what I have said in all of my recent press conferences: the tax policies must be planned in the context of several years; it must be stable and predictable. Therefore, it would be best not to "jerk" the tax rates and the system at large, which would mean a better and more predictable business environment and a greater confidence of entrepreneurs in future growth. The stability of the tax system would foster the confidence of entrepreneurs in future development and would encourage them to consider more projects and investments in Latvia.

Furthermore, both our own experience and that of other countries indicates that consolidation on the account of cutting expenditure is always more lasting and provides a greater and better effect than consolidation performed through raising taxes.

This is our prescription and I hope that the government and the parliament will take this opinion that we share with the experts of the Fiscal Discipline Council and the Ministry of Finance.

Thank you and now I welcome your questions!