1. Introduction

Hello, dear journalists! It is a pleasure to welcome you to Latvijas Banka.

This is our concluding press conference for the year and this time we will sketch in our projections for 2015, but first we will evaluate the situation in the economy both in the entire euro area and in Latvia in particular.

For Latvia, this was a very important year: we successfully introduced the euro and have fully integrated with the Eurosystem. Over the course of the year, we have got a better understanding of challenges for successful functioning in the space of the single European currency and are anticipating 1 January when our neighbours, the Lithuanians, will also join the euro area.

There is no doubt that Lithuania’s membership will strengthen the euro area, which now finds itself in a crossroads, facing the need to adopt monetary and fiscal policy decisions important for Europe’s growth and competitiveness and institute essential structural reforms.

2. Situation in the euro area economy

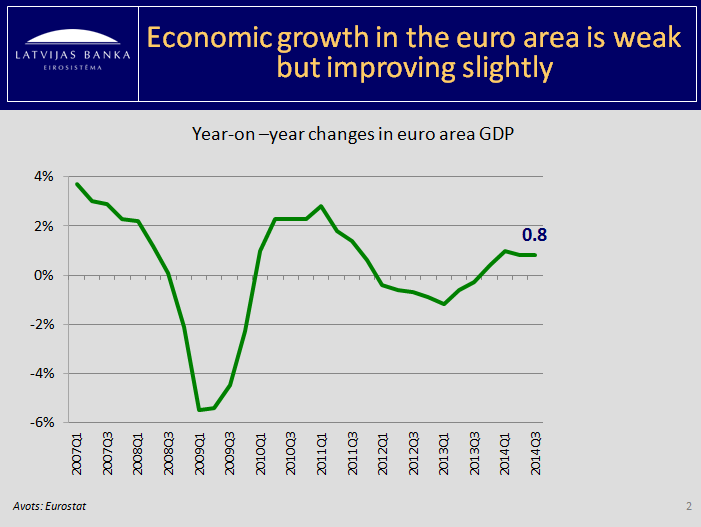

I will begin by evaluating the situation in the euro area. The economic growth of the euro area, albeit still weak, picked up speed slightly in the second half of the year.

This is borne out by Eurostat data. Gross domestic product (GDP) in the third quarter increased by 0.2% quarter-on-quarter: it is a faster increase than expected. In the third quarter, the euro area GDP grew 0.8% year-on-year.

The euro area growth was promoted by the growing domestic consumption as well as the increase in external trade, particularly in Germany and France. A negative impact on economic growth was exerted by the geopolitical situation, i.e. the events in Ukraine and Russia, as well as a number of internal problems, e.g., weak lending and the prolonged low investment activity.

As has been stated a number of times, in current circumstances, as the Eurosystem is carrying out an active and stimulating monetary policy, the implementation of the other two economic pillars, fiscal policy and structural reforms, is of ever greater significance. Sound budgetary policies and significant reforms in areas essential for the euro area competitiveness are the elements that should promote lending and future growth.

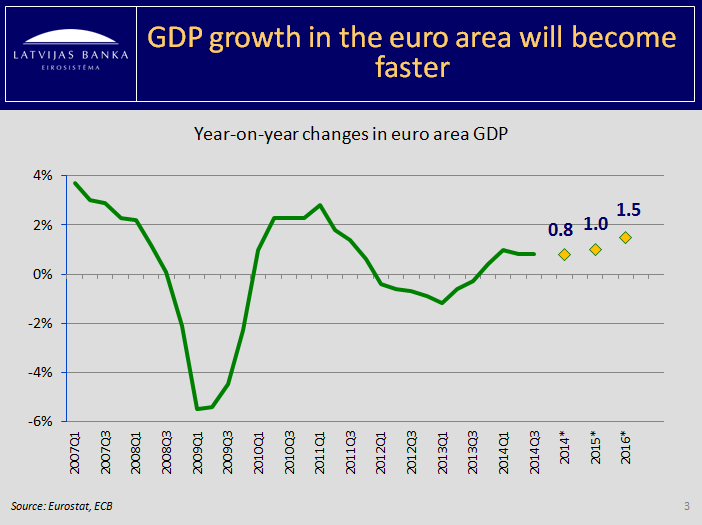

Yesterday, 4 December, the Eurosystem published the latest euro area economic projections. In the estimation of the European Central Bank (ECB) experts, the euro area GDP will increase by 0.8% in 2015. As a result of monetary policy measures carried out by the Eurosystem and recovery of the global economy, it is expected that GDP will rise by 1.0% and, in 2016, by 1.5%.

If the energy resource prices remain low, we can hope to expect recovery of private consumption. A gradual increase in external trade will promote the attraction of new investment. This will result in increased economic activity. Yet the high unemployment level is still worrisome and, in the countries most significantly affected by the crisis, it can be expected to drop very gradually. Growth will also be impeded by the inadequate structural reform progress in many euro area countries.

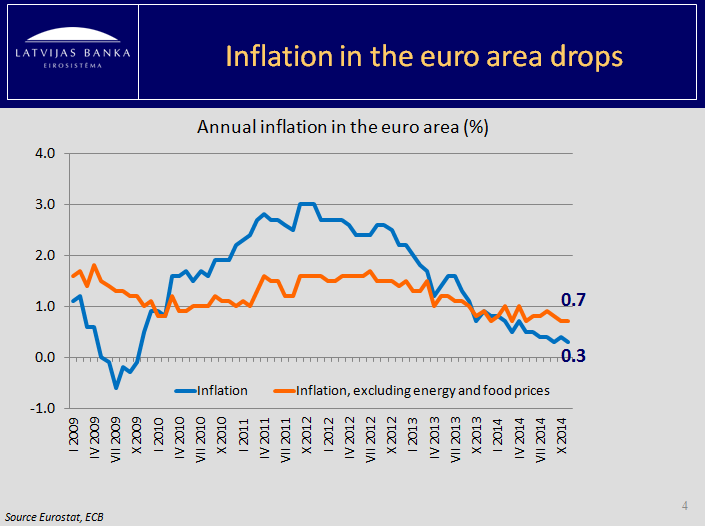

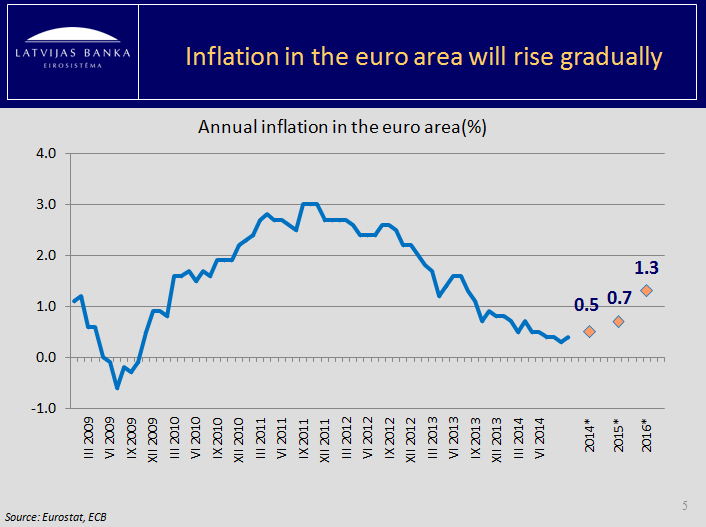

3. Inflation in the euro areaInflation in the euro area continued to drop, reaching 0.3% in November.

It is expected that the euro area inflation of 2014 will rise to 0.5%, reaching 0.7% and 1.3% in 2016.

It should be borne in mind that the projections have been made on the basis of assumptions available in mid-November, thus they do not take into account the drop in oil prices in the last few days. Any rise in inflation is expected to be curtailed both by the growth in economic activity, which is still weak, and by the low prices of energy resources in the world.

4. Measures taken by the Eurosystem

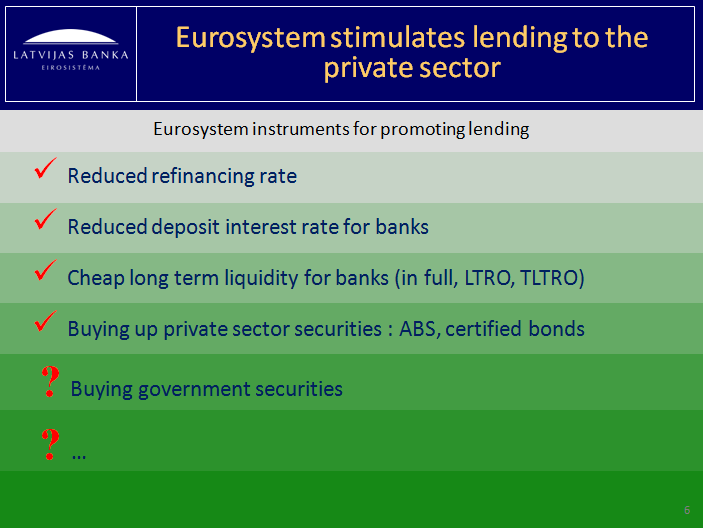

This year, the ECB Council made several decisions to stabilize the price level and approximate it to 2% in the medium term. One measure was to reduce interest rates to record low with the aim to reduce short-term borrowing rates in the interbank market of the euro area; additional measures were implemented to stimulate lending to the private sector.

Here we can mention both various programmes for buying up securities that have no direct impact on the Latvian economy and targeted long-term refinancing operations (TLTRO), with direct participation of Latvian credit institutions. The second round of refinancing operations will take place this month.

According to an initial assessment, the euro area commercial banks will have a greater interest in the second auction of the TLTRO programme whose value is 400 billion. I would like to remind you that euro area credit institutions have available, at very low interest rates (0.15% per year), up to 400 billion euro for four years this year and even more in the coming TLTRO auctions. That constitutes a very great support for the purpose of reviving lending in all of Europe, including the euro area.

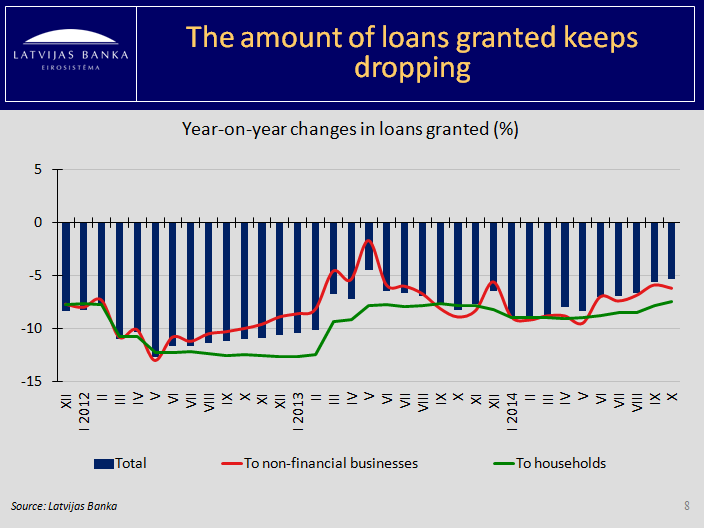

The Latvian credit institutions qualify for about 560 million euro, but it is clear already that not all of this sum will be claimed (FYI: only 5 of Latvia’s 27 credit institutions have shown interest in this instrument). That lends credence to our worry, that lending in Latvia is impeded not by a lack of money in the commercial banks but other, fundamental factors, including the pre-crisis “legacy”, uncertainty regarding future economic development in the region, caution of credit institutions and more stringent requirements for borrowers. Various legislative initiatives are also an important factor; they, like the notorious amendments to the Insolvency Law, have an impact on bank operations. As we already pointed out in September, here the factors of loan demand and supply interact with each other.

Getting back to TLTRO, the money will be allotted to commercial banks in 8 stages: in September and December of this year and then for six additional times, once every quarter. Moreover, even the credit institutions that previously did not participate, can do so in the subsequent auctions.

The Certified Bond Purchase Programme (CBPP3) was initiated in the second half of October and Asset Backed Securities Purchase Programme (ABS PP) was launched in the second half of November. Both will function for at least two years and securities will be purchased both in the primary and secondary markets. The minimum credit rating (BBB-/Baa3/BBBL) requirements will be applied to the securities to be purchased; these requirements have been set in accordance to the requirements for the ECB monetary operation collateral.

Yesterday, the ECB Council decided to leave the main refinancing operation interest rate and the overnight lending and deposit facilities interest rates unchanged.

At the same time it was decided that at the beginning of next year, the ECB Council will evaluate the performance of the existing monetary stimulation measures, increase in the ECB balance and inflation development, assessing also the impact of oil prices on the medium term inflation. If the existing monetary instruments are not enough to prevent the risks related to too long a period of low inflation in the euro area, the ECB Council will be ready to supplement the existing range of monetary policy instruments. All Eurosystem measures are aimed at stimulating a gradual approximation of the euro area to an indicator that is close to but not lower than 2%.

5. Situation in the Latvian economyI now turn to the situation in the Latvian economy.

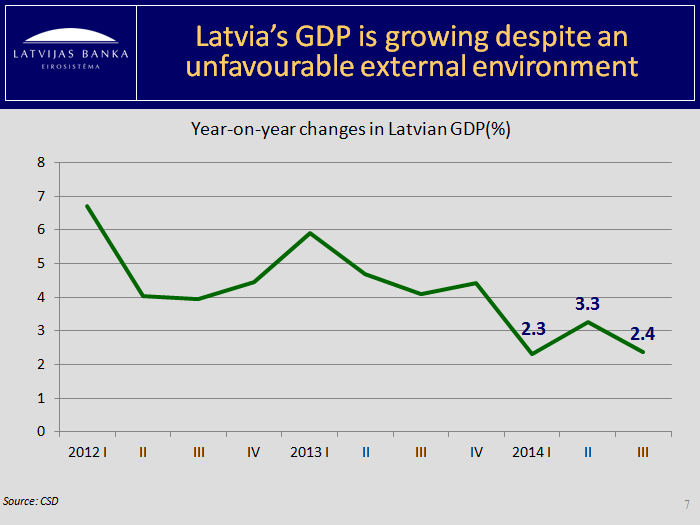

In the first three quarters of 2014, the Latvian economy posts growth that exceeds 2%. This has been achieved despite the unfavourable external environment that is affected both by the weak growth in the euro area and the drop in Russian demand as well as the economic sanctions directed at Russia and its reciprocal sanctions. In previous years, manufacturing, real estate and energy sectors dominated in ensuring GDP growth, but now their contribution is weaker, which determines the slowing down of GDP increase. Growth is sustained by the sectors oriented toward domestic demand: trade, construction and public services.

A cause for worry are the amendments to both the Immigration Law and Insolvency Law. Both could have a negative effect on Latvia’s economic growth. Therefore, the readiness of the Government and the parliament to amend the Insolvency Law to avoid creating additional obstacles to lending is to be commended.

The direct impact of sanctions announced with regard to the conflict between Russia and Ukraine has been slight so far, yet the indirect impact is also impeding. The effects related to the confidence (or rather, uncertainty) level of households and entrepreneurs can slow down the growth rate of the Latvian economy even more significantly than the direct influence of sanctions. If the uncertainty of the geopolitical situation persists, it may dampen the desire of entrepreneurs to take on risks and invest in expanding their operations and to prevent households from making larger purchases, thus increasing the accrual norm. We see it also in the macroeconomic data: this year, the rise in the salary fund exceeds the rise in household expenditure. That indicates the readiness of households to bide their time, deposit money with banks and wait for greater clarity to arrive regarding the future.

In the first nine months of this year, the exports of Latvian goods maintained a 2.0% increase year-on-year. The greatest positive contribution to goods exports was made by wood and wood products, chemical industry products and mechanisms, mechanical devices and electrical equipment. The year-on-year growth was under a negative impact from the drop in the exports on base metals and their products, textiles and mineral products.

The average wage is continuing to grow this year, thus promoting the growth of private consumption as well. It was primarily private consumption that ensured GDP growth in the third quarter, increasing by 2.1% and contributing 1.4 percentage points to GDP growth. The October retail trade indicators were also positive, which indicates that in the fourth quarter as well private consumption will continue to support GDP growth.

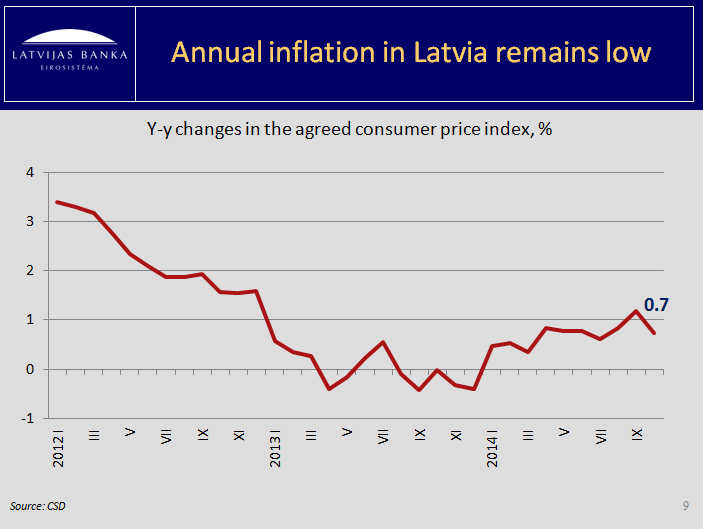

6. Inflation development in LatviaThe annual inflation level in Latvia remains low both from the long-term perspective and from the point of view of a growing economy.

A low inflation level in Latvia this year was determined both by the world price trends that affected the inflation level in the euro area as well and by postponing the liberalization of the power market to 2015. Reacting to the Russian food import ban, inflation expectations diminished in August and September. Under the impact of increased supply of dairy products and vegetables, their prices were expected to drop. Yet the data for August and September indicated that the expectations did not fully come to pass and the inflation level continued to stabilize gradually, uncharacteristically for the season and economic conditions in some consumption groups. Yet already in October, many of these prices were adjusted, showing that demand may have possibly been exaggerated.

7. The latest Latvian GDP and inflation projections

At present, at the end of 2014, it is clear that the negative development scenario we emphasized before has come to pass. The geopolitical situation has had a substantial effect on growth both in Latvia and the region at large.

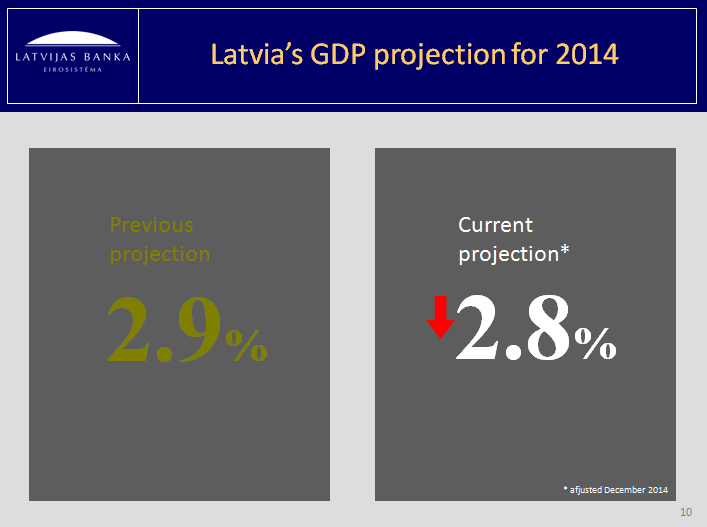

The previous Latvijas Banka projections were published at the press conference of 26 September (we predicted a 2.9% growth).

The September projections is being technically adjusted in December to take fully into account the latest GDP data and the CSC historical time series adjustments. Latvijas Banka thus projects real GDP growth in 2014 by 2.8%, whereas for 2015, we retain the projections for growth at 2.7% .

The inflation projections for 2014 is currently at 0.7%, which corresponds to the September projections.

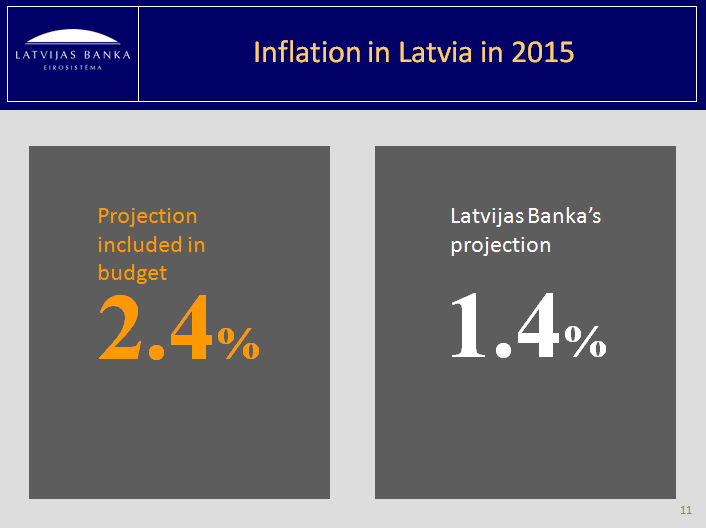

The largest contributor to the 2015 inflation will be the rise in power prices because of market liberalization, but the total impact of energy prices on inflation could be limited by the rather low oil price level. Total inflation in 2015 could reach 1.4%.

8. The significance of sound budgetary policiesIn the conditions that slower economic growth is observed and uncertainty is on the rise, even more responsible budget policies must be the case. Therefore the Cabinet of Ministers should be commended for implementing responsible budgetary policies. That finds reflections in the control numbers for the 2015 budget and the final draft that is to be sent to the parliament for review next week. Even though a small deficit is to be retained in next year’s budget, it will still be low enough to prevent any doubt regarding Latvia’s resolve to continue implementing sustainable budgetary policies. Yet at the same time, a certain worry is caused by some assumptions, which in some cases could be characterized as too optimistic, used in drafting the budget.

For instance, the expected 2.4% inflation level included in next year’s budget was planned on the basis of data available in August. It is too high, particularly if we take account recent developments in the global goods markets and the lower than previously projected inflation level in the rest of Europe. As I mentioned earlier, the aggregate of these factors has make us lower our inflation projections for next year.

Currently we see some risks, albeit not very great, in drafting next year’s budget.

- First, retaining such inflation projections, another 30 million euro are calculated in the budget, but this revenue is doubtful. Given that this projected additional revenue is already matched by drafted real expenditure, planning for a higher inflation may give rise to a larger than expected budget deficit.

- Second, budget execution by local governments in Latvia has been traditionally worse than planned, thus worsening the actual total government budget balance.

- Finally, the government resolve to battle the gray economy more actively is commendable, yet relying on a rather substantial inflow of additional tax revenue as an actual fact seems premature.

- Increasing state expenditure and the budget deficit and thus giving rise to doubts about following fiscal discipline, may mean increased debt servicing costs. Latvia is a country that still has great enough possibilities to borrow in the external markets. Our worry is that if the foreign lenders feel that Latvia has changed course and is increasing the deficit during a period of growth, the costs of servicing its public debt could increase and the relative “gain” from increasing budget expenditure could be lost.

Given these risks, the uncertainty that rules in financial markets regarding further development in the global economy, including that of Europe, which, in the context of the geopolitical risks facing the region, will undoubtedly impact Latvia’s economic development as well, I would like to emphasize that increasing expenditure any further is not acceptable. We have reached the limit and the expenditure part of the draft budget sent to the parliament by the Government must not be allowed to be raised.

Before the crisis, growth was ensured by cheap lending and fast rising salaries, but after the crisis we have learned much. Now we face the challenge of achieving growth both by improving productivity and resuming lending. Therefore in Latvia, just as in Europe the importance of structural reforms is growing.

We often hear the question: what are structural reforms? Who will carry them out and why hasn’t it been done? I hope that next year, a deeper discussion will arise regarding what we can do in terms of structural reforms and that the new government will implement many of these reforms thus finding additional financing in the budget instead of looking for new sources.

In terms of structural reforms, it is not enough to reduce expenditure: productivity and innovation must be promoted. In other words, they call for acting wisely and linear “cutting” does not constitute structural reforms.

The importance of structural reforms is on the rise and they will be decisive for the growth of our economy and ensuring the prosperity of the population of Latvia.

And now I will be happy to answer your questions!