1. First, a little about the economy of the euro area and the implementation of the Eurosystem monetary policy decisions.

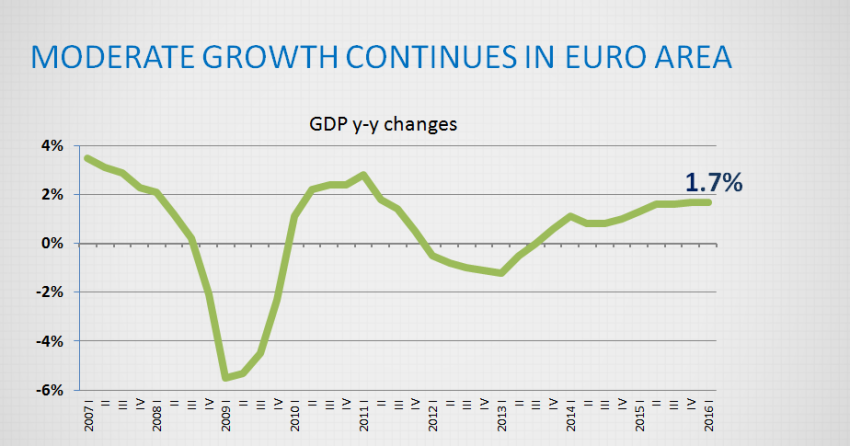

The euro area real GDP in the first quarter increased by 0.6% quarter-on-quarter, which is a much better result than predicted. As a result, in the first quarter of this year, GDP was 1.7% higher than a year ago and has finally exceeded the pre-crisis level.

Growth continued to be fostered by increased private underpinned by the stimulating monetary policy of the Eurosystem, improved labour market indicators, as well as the continued relatively low oil prices. Growth was reduced by the weakened external demand or our export capacity, which, to a certain degree, was also determined by the geopolitical situation.

Even though the Eurosystem implements an active and stimulating monetary policy, implementation of a reasonable fiscal policy and carrying out of structural reforms continue to be important factors in developing sustainable growth.

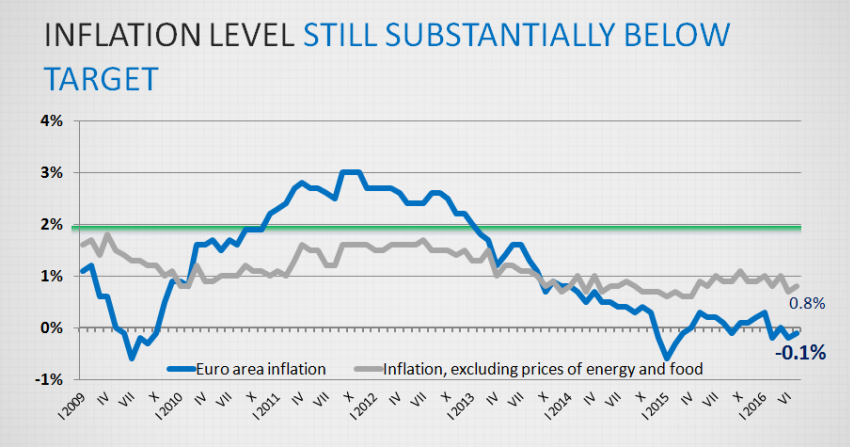

As predicted previously, inflation in the euro area turned negative again in April and May -0.2% and -0.1%, respectively. It is expected, however, that in the near future, inflation will return to positive territory. The world energy price dynamic still had the most important impact on the drop in prices. Yet oil prices have gone up recently and their impact on inflation is thus gradually diminishing. The rise in prices was also impeded by the rather weak pressure from demand.

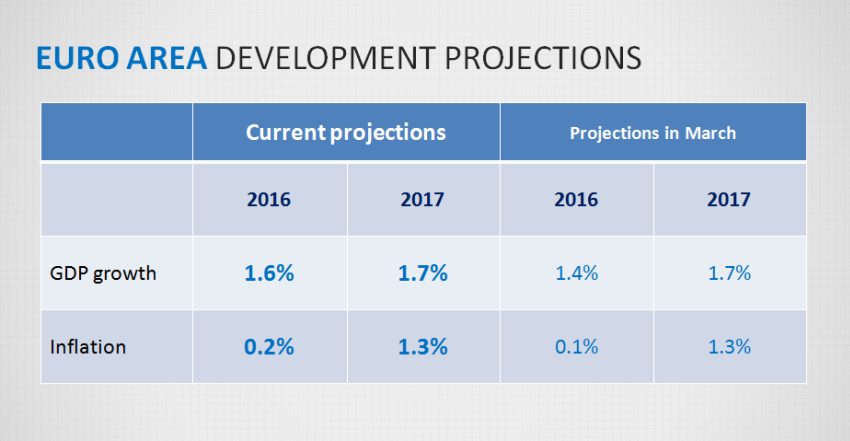

A weak ago, on 2 June, the Eurosystem went public with the latest euro area economic development projections. ECB experts estimate that this year the euro area GDP will grow by 1.6%. In 2017 then, as a result of the monetary policy measures taken by the Eurosystem and recovery of the global economy, GDP could increase by 1.7%, and the same rate of growth is predictable for 2018.

The rise of growth in the euro area will of course be fostered by Eurosystem's stimulating monetary policy, which will effect increasingly favourable financing conditions, the comparatively low oil prices and rising employment. As a result of the decreasing global economic development, the rise in exports, as I already mentioned, was relatively slow, yet it can be expected that in the near future world's economic growth will pick up speed and export growth could recover.

According to June forecasts, the average inflation this year will be 0.2%; in 2017 it could thus be 1.3% and, in 2018, reach 1.6%. It can be expected that inflation growth will be curtailed both by the relatively low rise in economic activity and moderate rise in the prices of energy resources.

Turning to the monetary policy measures implemented by the Eurosystem, let us remember that the ECB Council has adopted decisions in several stages to stimulate economic growth and achieve inflation that would be close to yet under 2% in the medium term. The latest of these decisions were adopted in March of this year. With the goal of reducing short-term borrowing rates in the euro area interbank market, interest rates have been reduced to record low and additional measures have been taken to stimulate lending to the private sector.

Even though lending conditions in the euro area have improved substantially under the impact of monetary policy decisions, growth rate is still low and the Eurosystem is therefore continuing with vigorous actions.

Among the new, non-standard instruments is the Expanded Asset Purchase Programme with a new sub-programme – the Corporate Sector Purchase Programme (CSPP), under which, the bonds of nonbank corporations will be purchased. The total amount of bonds purchases was also increased – from 60 to 80 billion euro a month. As part of this programme, government securities in the amount of 933 million euro have been purchased in Latvia, and the purchases by Latvijas Banka of Latvian government securities and securities of other Eurosystem institutions are approaching a total of 3 billion euro.

Additional new targeted longer-term refinancing operations (TLTRO II) have been announced, and they will be available also for Latvian credit institutions. Compared to the previous round of TLTRO, the conditions for credit institutions involve even more favourable interest rates. Unbelievable! These are interest rates that are no longer at zero or slightly above, but have reached a point where the euro area central banks will in fact pay banks that will borrow this money. Namely, if banks use this opportunity, the interest rate will be on par with the overnight interest rate, i.e. minus 0.4%.

Three Latvian commercial banks have shown interest in and will benefit from their participation in the first auction of the second round of TLTRO, which will take place on 22 June. So we are inviting other Latvian credit institutions to consider this opportunity and participate in the coming TLTRO operations, of which the closest one will take place in September.

2. Now let's turn to Latvia's economic development

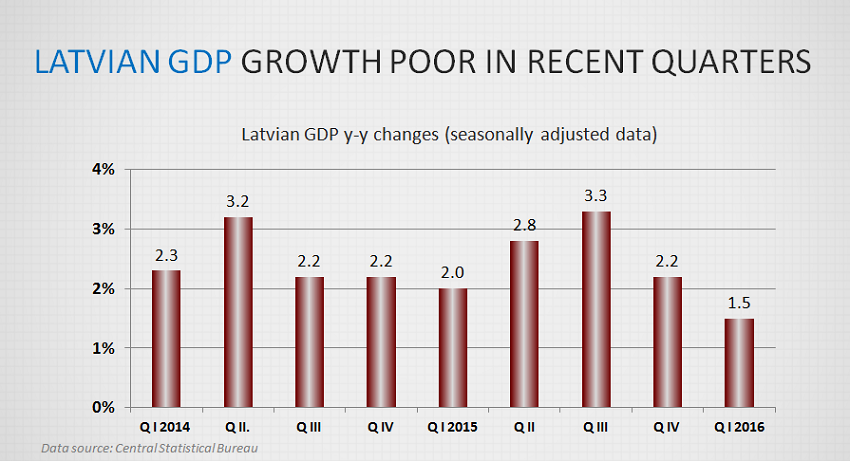

Recent macroeconomic data unfortunately have been poor. After the GDP drop in the fourth quarter of 2015, the data of the first quarter of 2016 likewise have been pronouncedly poor: growth was merely symbolic – one tenth of a percent (0.1%).

This means the scenario about which Latvijas Banka warned: 2016 will be marked by slower growth. The drop in the growth rate is determined by several circumstances – both the continued complicated situation in the external markets, in export, and the interruption in the implementation of investment projects related to financing from European funds and the resulting drop in construction. Activity in retail trade, too, has been lagging behind the rise in compensation to households, which points to their tendency to keep rainy-day savings or to hold back funds for larger purchases in the future.

The poor macroeconomic data in recent quarters and the fact that the launch of a part of EU-funds related projects will be delayed indicate that this year economic growth will be slower than previously. That extends the period of low growth: Latvia's GDP growth has been under 3% since 2014.

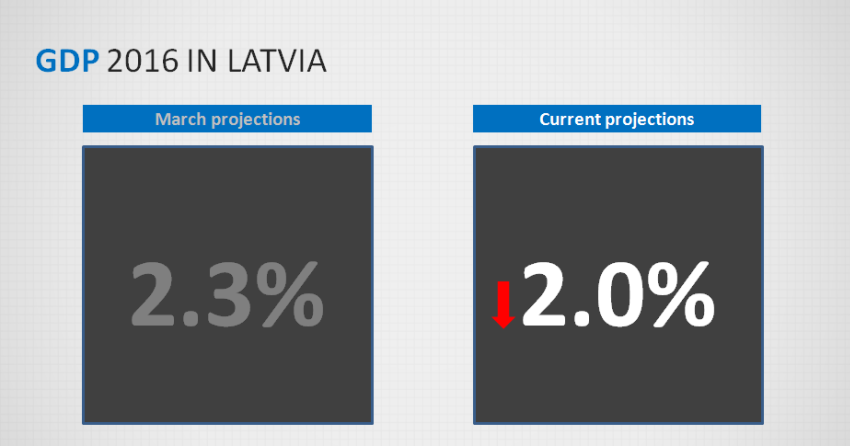

In March of 2016, Latvijas Banka publicized its latest assessment, reducing its GDP projections from 2.7% to 2.3%. The change was determined by the tense geopolitical situation, worsening of the economic growth predictions of partner countries and also the weak investment dynamic. Unfortunately, in June we have to downgrade growth projections even further. According to our specialists, taking into account the latest macroeconomic data, the rate of Latvian economic growth this year will be around 2.0%. Given the expected rise in external demand and higher investment activity domestically, related to a renewed flow of European fund money, our specialists' GDP forecast for 2017 is 3%.

The period when a faster growth rate could result from the differences in labour costs between Latvia and more developed countries is drawing to an end. Improvements in productivity will be necessary for further economic growth. So, on the one hand, we need higher quality investments in capital (more modern equipment etc.); on the other hand, particularly in view of the demographic situation, in the medium and longer term what Latvia does with its most valuable resource, the human capital, will be of utmost importance. For this reason, Latvijas Banka has played an active role in discussions on such areas as healthcare and education.

3. When we analyse inflation trends…

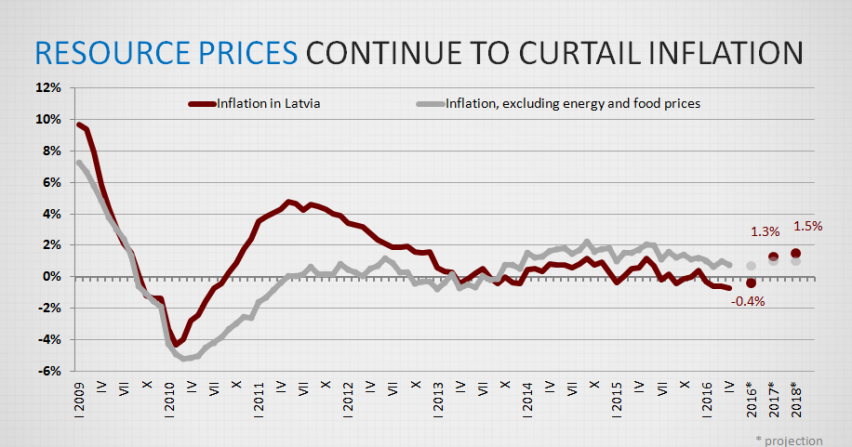

The average consumer price level in the first five months of this year was lower than a year ago, and this trend was on account of world energy prices or mostly their momentum or delayed impact. Heating energy prices, for example, are still continuing to drop, even though the prices of oil products and natural gas have begun to recover in the world market. The prices of agricultural products are also beginning to rise gradually and this, with a small delay, will be reflected in the Latvian price rate.

Income is continuing to rise, but the impact of legislation to the rise in compensation is expected to be less. That could affect retail trade, namely, its growth could be slightly slower than last year. The impact of income on the price rate may remain substantially the same, for the population is saving and the rise in income does not immediately stimulate pressure of demand on prices. Therefore, core inflation in the second half of the year will gradually resume growing along with the change in the prices of resources, whereas the impact of income on prices will in part be determined by the development of lending. Currently, the amount of first-time loans is increasing, but, for instance, in the housing segment, it is taking place from an exceedingly low base. Thus it is not possible to consider the availability of loans as an important inflation driving factor on the demand side.

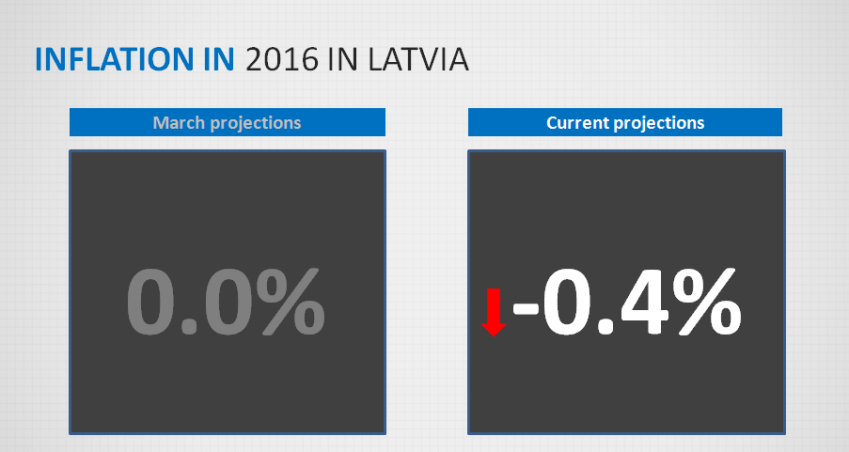

Taking these factors into account, our inflation projection for this year is minus 0.4% (instead of the 0% predicted previously). In 2017, prices are expected to rise at the rate of 1.3%.

To summarize the assessment of Latvijas Banka regarding our economic development: the Latvian economy will grow at a slower pace and we cannot but notice that we are facing structural problems.

The question is – what to do?

4. We have already provided the answer before: the competitiveness of the Latvian economy and the potential for its growth should be raised. Key in carrying out this task is structural reforms and nothing else!

I first showed this picture on 17 October 2014 when we were holding the conference "Have We Learnt Anything from the Crisis?" in Riga with the participation of euro area policy makers and economists of world-renown. We were debating what to do in a situation where the debt level of countries is high and printing of money alone does not help us get out of this stagnation. Even though today I am planning to touch upon fiscal matters less and more about structural reforms, I still have to say a few words about developing a zero budget. [slaids ar bezdeficīta un nulles budžeta definīcijām]

A few words about definitions. It is very important to understand that there is a non-deficit budget and zero budget and these are two different things. It is of utmost importance to observe reasonable budget policies, which means living with a non-deficit budget and, during a period of economic growth, possibly form a surplus. It would me like growing a layer of fat for a rainy day: this budget reserve could be spent when the economic growth rate is in negative territory and it is absolutely necessary to have additional money to stimulate growth.

The zero budget approach is something entirely different: it means that the budgetary items of all levels and all ministries are reviewed from A to Z; beginning with the smallest expenditure item: setting, say, a limit of one of two thousand, they are once again reviewed and reassessed in order for us to be able to make sure that the money that is being spent is spent maximally efficiently and we will have the expected result. I must say that determined and purposeful work has begun to implement the principles of zero budget. Yes, this is a very difficult process, and the budget of 2017 cannot yet be described as a zero budget or quality budget, yet the working group, with the participation of experts from Latvijas Banka, so far managed to identify 64 million euro, which could be spent otherwise, perhaps by financing some of the lined up demands for additional financing.

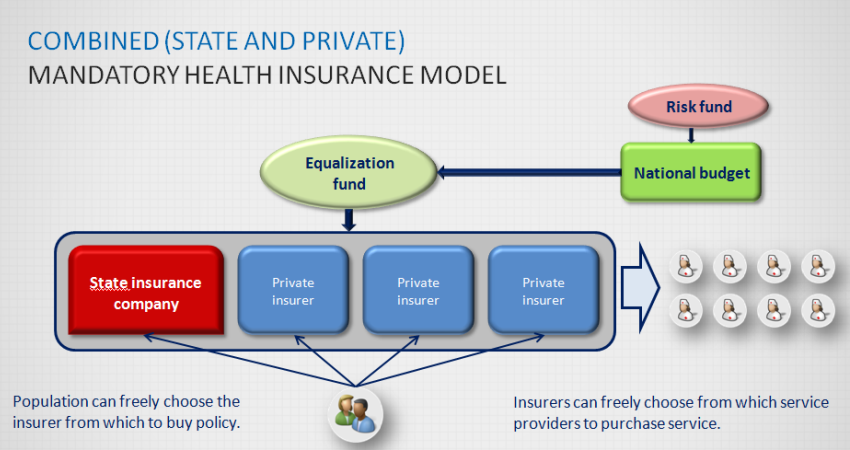

Turning to the recently much discussed topic of structural reforms and what they represent – I must note that we have been talking about them for many years. We proposed the idea of introducing mandatory health insurance 15 years ago. Unfortunately, over this period of time our idea has not received support in Latvia, whereas in several other countries a similar system has been implemented and is working successfully.

Apparently because of a lack of political will, we have not been able to do our homework and make healthcare available to all, fair, efficient, modern and competitive. We are in the same morass where we were about twenty years ago. Our opponents are talking about introducing paid healthcare, but in fact everyone knows that comprehensive healthcare is currently available only to the well-to-do. In fact, we already have healthcare for money: we either have to buy insurance or pay to jump the queue and get to the specialist we need.

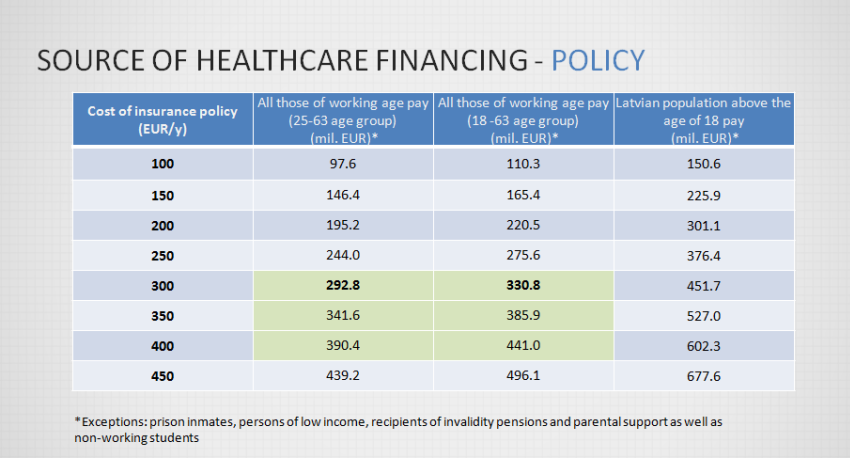

Our proposals for introducing mandatory healthcare system would let the industry attract an additional 300 million but, what's more important – would make this system fair and economically sound. Right now, people are confused as to what services are paid by the state. Moreover, even those services about which there is clarity, are difficult to come by because of queues. You know it yourselves – to get to a specialist, one has to wait, and the wait is very long. The system of quotas is likewise difficult to understand and discriminating; it renders the reception of medical services similar to lottery or phone competition.

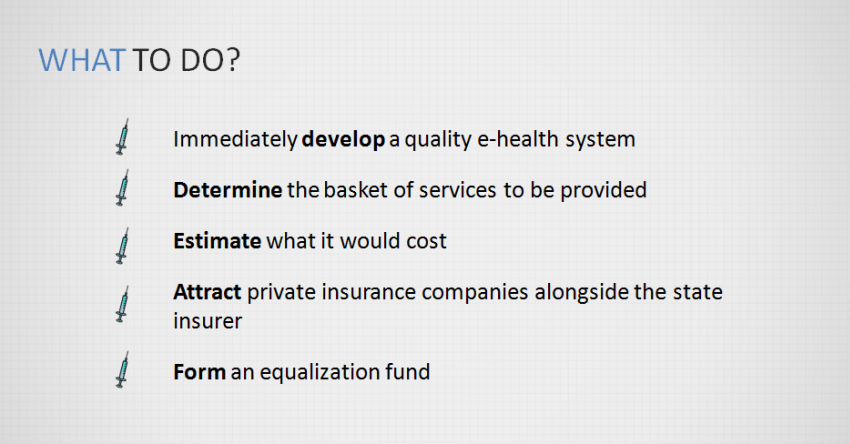

The model we propose would mean three important benefits: firstly, it would ensure the lacking financing to the industry or at least reduce the shortage substantially; secondly, it would increase the efficiency of medical care and transparency of the use of financing, attracting private insurers alongside the government one. And this does not mean privatization of Latvian healthcare system! It would mean providing for healthy competition! This model would indirectly help to put the system as a whole in order, so the patient would be the one who benefits; the patient would feel sure that he or she would receive the needed service, moreover, only by presenting his/her policy and without paying anything extra.

Here we are presenting the main preconditions for the reform, first of all the one that states that the introduction of the so-called 'e-health' should be completed, guaranteeing that any person – a doctor, the head of a hospital – can see how much money has been spent on each client. The government currently has special regulations regarding healthcare services (and, interestingly, they provide for what is not paid for instead of what is). So imagine the situation where a person who has read the lengthy regulation goes somewhere hoping that all the rest is paid for by the state, but is astonished to find out that it is not…

There is a group of people who, from time to time, poses the question: why are you, Latvijas Banka, discussing structural reform?

I will explain: instead of using the existing money more efficiently, one hears the urge to raise taxes and continue to pour money into a bottomless well. Ultimately, it would lead to even greater problems with the budget and macroeconomic instability as well as continue to maintain the uncertainty, which is an obstacle to business, investment and lending. Therefore, our current proposal is to make spending more efficient instead of burdening the people who are able to pay taxes with additional payments and make their lives even more complicated, ultimately leading to the possibility that future economic growth in Latvia could shrink even further.

It is our choice not to stand on the side-lines, quietly observing the problems faced by Latvian economy. Macroeconomic stability and economic growth can be achieved through the interaction of several economic policies. Structural problems, in our opinion, are the reason why Eurosystem's monetary policies fail to reach the goals that we have set for ourselves. For this reason, commercial banks have at their disposal 3-3.5 billion unused money, which is not being invested in the Latvian economy for fear of what might happen tomorrow.

In the economy, we observe problems with the availability of workforce; the quality of workforce is of increasing importance – that involves both adequate healthcare, whose availability, at the moment, is unfortunately limited and raising skills and qualification, for which a modern and competitive system of education is needed.

We are ready not only to theorize about the necessary changes, but to contribute our expertise in working out concrete proposals. With this in view, Latvijas Banka has come up with its proposals for healthcare that have met with such wide publicity. Practically everyone now agrees that we can not continue as before and that changes are absolutely necessary.