Good afternoon, ladies and gentlemen, nice to see so many of you here today.

Welcome to our regular press conference where I will speak about the following topics:

- developments in the euro area economy and the most important monetary policy decisions taken by the Governing Council of the ECB;

- global economic developments;

- economic growth in Latvia, inter alia the revised forecasts by Latvijas Banka.

As you might know, last week the ECB's Governing Council held its meeting where important monetary policy decisions were taken providing additional support to the euro area economy and thereby bringing inflation closer to the target of below, but close to, 2% in the medium term.

First, I would like to emphasize my full support to the above decisions of the ECB's Governing Council: they are timely, reasonable and appropriate for the economic situation in the euro area. The ECB's Governing Council is acting in a consistent and decisive manner within the scope of its mandate and stimulating the euro area economic growth and convergence of inflation to its aim in the foreseeable future. Despite the various comments in the media regarding the decisions adopted by ECB's Governing Council, I can assure you that a broad agreement was reached at the meeting and quite a broad consensus regarding the monetary policy decisions, inter alia on restarting net purchases under the asset purchase programme.

What was the basis for such a decisive action of the ECB's Governing Council?

Data on the real GDP dynamics in the euro area confirm further economic slowdown in the second quarter of 2019. Following the 0.4% growth reached in the first quarter, it slowed down to 0.2%. Moderation of the growth rate mostly reflects the observed weak dynamics of international trade in an environment of persistently high global uncertainty having a particular effect on the euro area manufacturing.

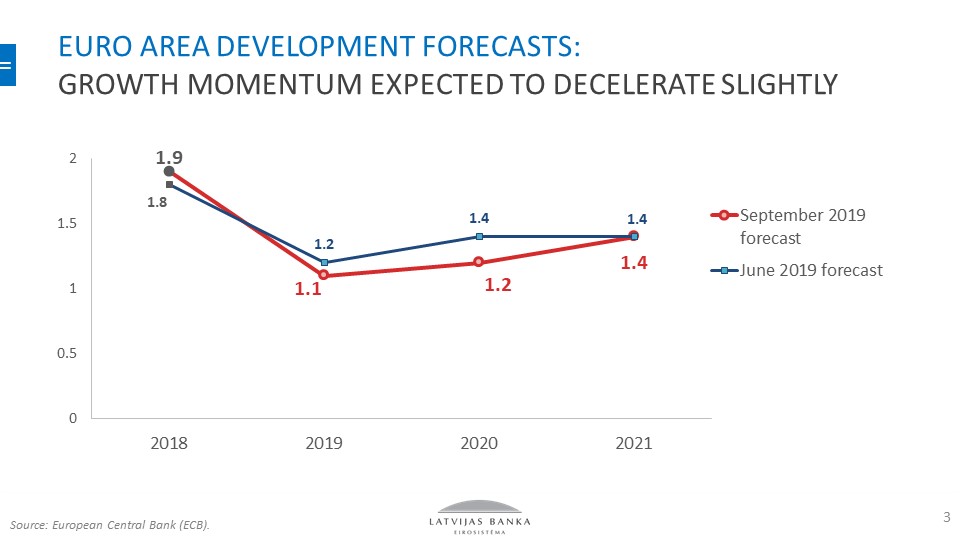

The uncertainty, Brexit, China's development, China-US relations, the economic growth in Germany and the euro area overall have made the ECB revise downwards its projections for GDP dynamics in the near future. The annual growth rate of GDP will be 1.1%, 1.2% and 1.4% in 2019, 2020 and 2021 respectively.

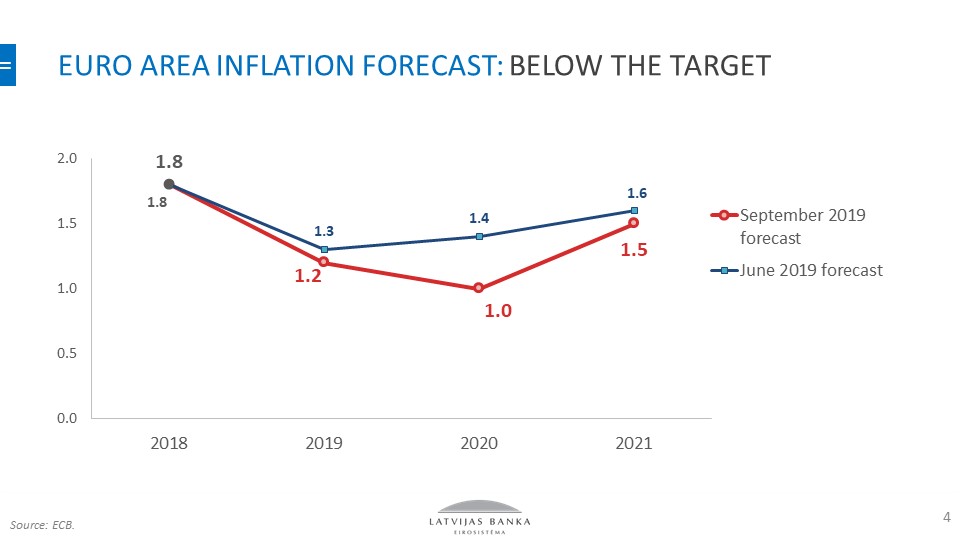

Euro area annual inflation was 1.0% in August, unchanged from July. The drop in energy price inflation was offset by higher food price inflation, while underlying inflation (excluding energy and food prices) remained unchanged at 0.9%. Euro area inflation is expected to decline in the next few months, before increasing again at the end of the year, mostly on account of the energy price dynamics.

Measures of inflation expectations are low in the euro area. Despite the intensification of the labour cost pressure, its impact on inflation is slower than expected before.

Underlying inflation is expected to rise in the medium term. Nevertheless, in view of lower energy prices and growth slowdown, the ECB inflation projections have been revised downwards. According to forecasts, inflation will be 1.2%, 1.0% and 1.5% in 2019, 2020 and 2021 respectively, still quite far from the 2% rate defined in the ECB's Governing Council mandate.

In view of the above and the fact that since the ECB Riga meeting when the decision to discontinue the asset purchase programme was made, the growth and inflation projections have been revised downwards on several occasions, testifying to problems to achieve the euro area monetary policy objective in the medium term, the ECB's Governing Council adopted a number of essential decisions last week, inter alia:

- decrease the interest rate on the deposit facility by 10 basis points to –0.50%. The interest rate on the main refinancing operations and marginal lending facility rate remained unchanged at 0.00% and 0.25% respectively,

- introduce a two-tier system for reserve remuneration, in which part of commercial banks' holdings of excess liquidity will be exempt from the negative deposit facility rate,

- change the modalities of the targeted longer-term refinancing operations (TLTRO) to preserve favourable bank lending conditions, ensure the smooth transmission of monetary policy and further support the accommodative stance of monetary policy,

- restart the asset purchase programme (APP) at a monthly pace of 20 billion euro as from 1 November. Asset purchases are expected to run for as long as necessary to reinforce the accommodative impact of our policy rates, and to end shortly before raising of the key ECB interest rates will start,

- outline the forward guidance: the key ECB interest rates are expected to remain at their present or lower levels until it can be seen that the inflation outlook robustly converges to the target level sufficiently close to, but below, 2%,

- continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when the raising of the key ECB interest rates starts, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

In view of the above, the ECB's Governing Council took a large range of measures to strengthen monetary policy support to the euro area economy. At the same time it was pointed out that the economic challenges of the euro area cannot be resolved merely with the help of monetary policy instruments.

More decisive action is also required with respect to other economic policy areas by strengthening long-term growth prospects and investor and businesses' confidence that the euro area future growth is stable and by way of supporting competitiveness and overall demand in the euro area.

First, with respect to structural reforms to raise productivity and growth potential in the euro area and reduce structural unemployment.

Second, in such a situation governments with sufficient fiscal space, capable of affording to make use of the favourable budgetary and external debt position and stimulate economic growth, should also play a certain role.

Which global developments are the most essential ones directly influencing the euro area economy and hence also Latvia?

There is still no clue as to when and how the UK intends to leave the EU. The materialisation of a no-deal Brexit has become more real; now, however, it seems the Brits themselves cannot really tell what will happen on 31 October, the prospective Brexit date. A no-deal Brexit would imply higher contributions to the EU budget for Latvia in the future, e.g. the Ministry of Finance estimates suggest they could increase by 23 million euro in 2020. Latvia is also likely to receive less funding from EU funds in case of Brexit.

According to Latvijas Banka estimates, a no-deal Brexit would result in a prospective 0.8%–1.7% decline in Latvia's GDP over the medium term vis-à-vis the case where the UK remains a Member State of the EU.

It should be noted though that the Brexit process contains so many unknowns, therefore any assessment of its potential consequences on the economy is an estimate and based on a number of assumptions. Part of this negative scenario can be felt already now: as a result of the uncertainty about the future of the UK, a number of companies have had to review their investment plans downsizing their economic activity and in such a way affecting the economy and exporters as well.

The observed global protectionism trends, such as the expanding US-China trade tariff tensions, have a negative effect on the global sentiment. Moreover, it is obvious that trade is only one of the aspects in the struggle for influence between the two global superpowers. At this stage we can already see them competing in the technology sector, with the potential future competition intensifying in finances and settlements where currently the US is still the dominating one.

Over the last few months, news about the economic slowdown in actually all major economies, particularly in the developing countries, keep coming in; as a result, the overall global economic growth moderated in the first quarter and the first half of 2019 overall. China's economy is slowing down, essential challenges have also emerged in other economies in Asia, Latin America and CIS, inter alia Brazil, Russia, Mexico and Argentina etc.

In view of the above, not only the ECB's Governing Council, but also the US Federal Reserve System has responded announcing its decision to lower the USD federal funds rates.

Over the last few months, decisions on more accommodative monetary policy were taken by other countries as well, e.g. Australia, Brazil, South Korea, Indonesia, India and Turkey; moreover, financial markets are also expecting other economies to follow suit.

When assessing Latvia's economic development, we should take into consideration developments in the global and euro area economy, mostly the prevailing uncertainty.

We can perfectly remember years 2008–2009, with the dynamic pace of developments. We may not assume now that Latvia is a safe haven and the economic slowdown will not affect us. International developments tend to evolve so rapidly.

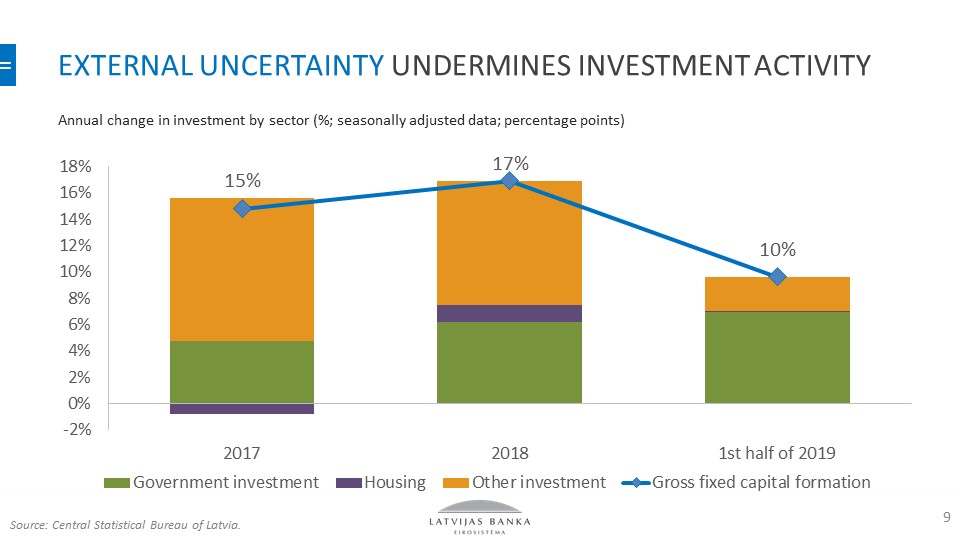

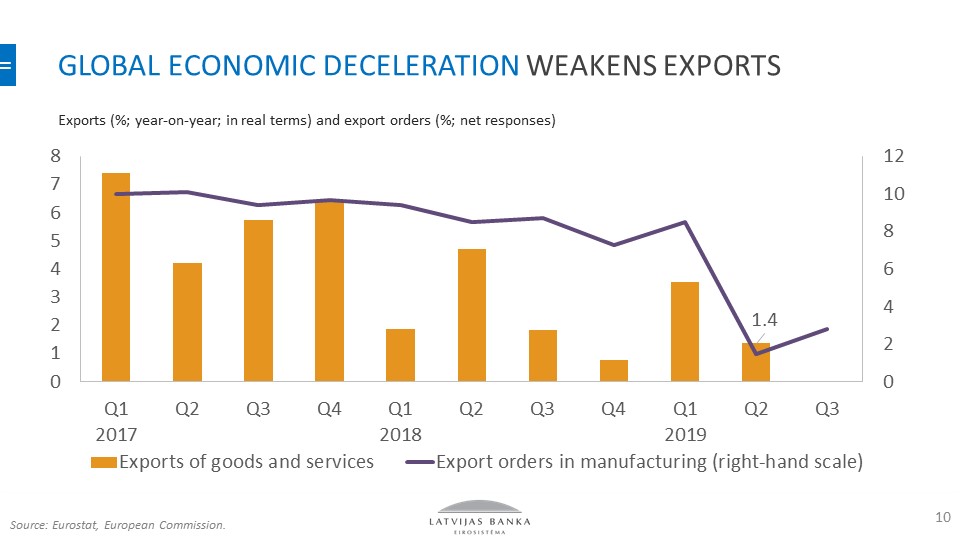

With the global and euro area economies slowing down, Latvia's growth is also gradually decelerating. On account of weaker demand in Latvia's major trade partners, exports are declining, investment is on a downward path, and the main role in maintaining GDP growth is played by the domestic consumption which has slightly decreased in the last few months.

Looking deeper into export trends, one can observe slowdown in the major exporting sector, i.e. manufacturing. The output of the wood processing sector is shrinking on account of several factors; one of the key ones is a drop in external demand, particularly in Scandinavian countries and also in the UK due to Brexit.

The positive trends of the domestic demand are reflected in the services sector, such as professional services, entertainment and recreation services and the hospitality and catering services.

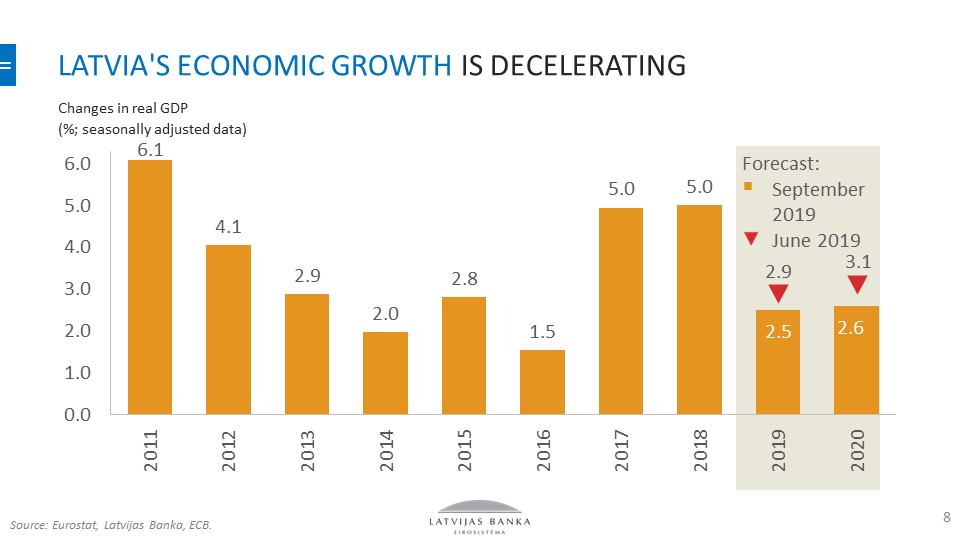

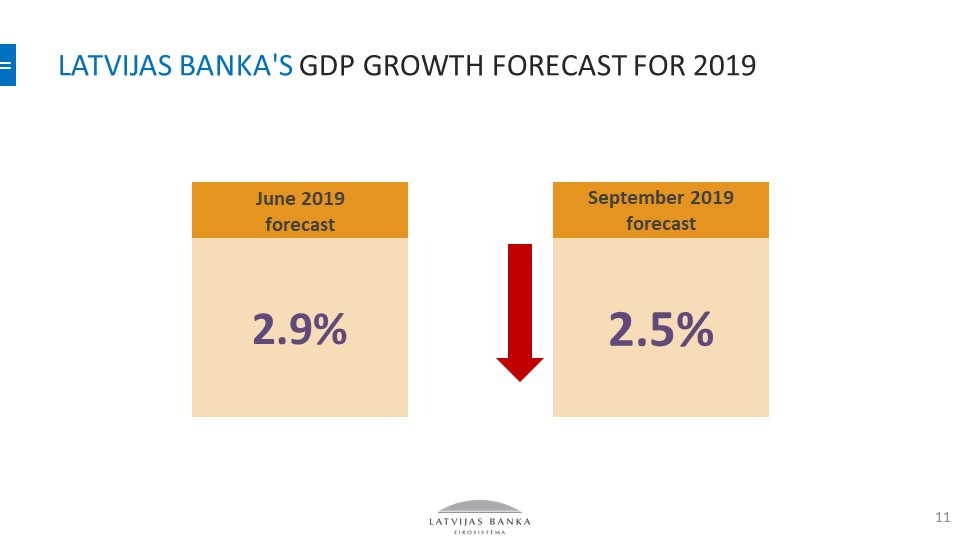

At the same time, it is increasingly obvious that our business cycle is past its peak and the economic growth is gradually starting to decelerate. Moreover, the slowdown is becoming more pronounced: it was just in December when our forecast of Latvia's GDP growth was 3.5% for 2019; in June it was revised downwards to 2.9%, mostly on account of external factors; now our current assessment suggests that the economic growth will be 2.5% (seasonally adjusted data) this year.

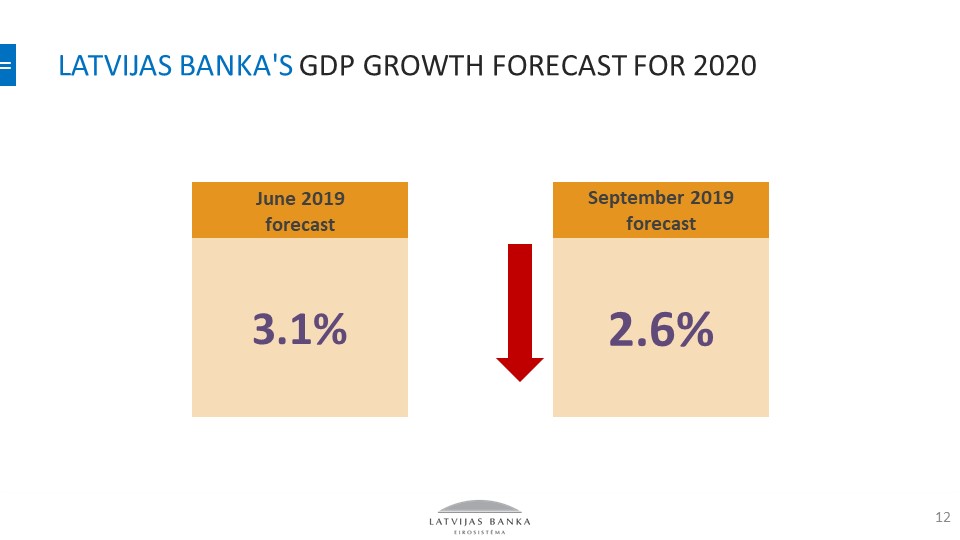

Latvijas Banka has also revised its economic growth forecast for 2020: Latvian economy is expected to grow by 2.6% (seasonally adjusted data; down from the previous forecast of 3.1%). This is the baseline scenario; however, given the prevailing global uncertainty, we should be ready for diverse development scenarios. Although at the current stage it seems that the budget for the next year is formulated on the basis of a planned growth scenario which is conservative enough, the fact that we have had to regularly revise downwards our future economic growth forecasts makes us also cautious with respect to the budget for 2020. With the unfavourable impact of the external environment persisting or even strengthening, we cannot exclude a possibility that the current growth forecasts for 2020 will have to be revised downwards again.

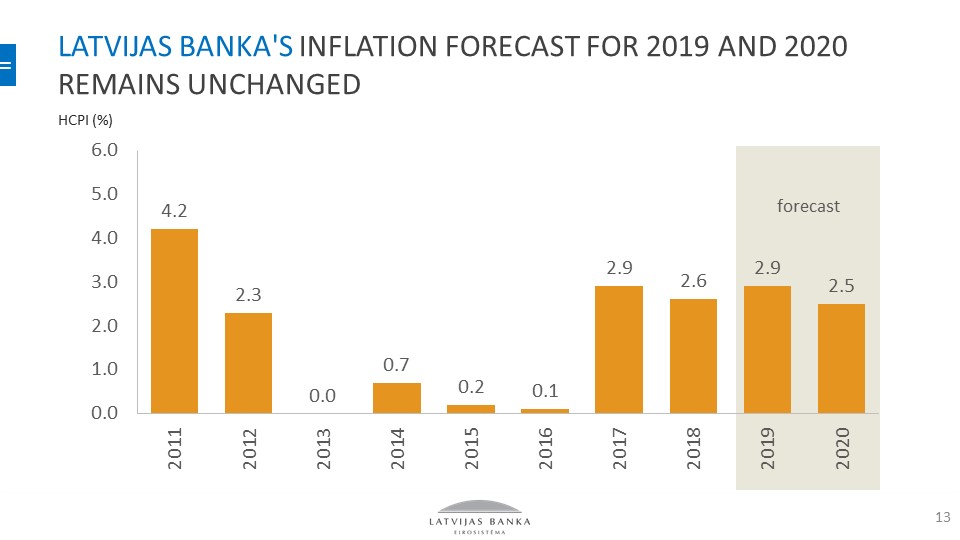

Latvia's inflation is hovering around 3%, which is adequate in the light of the current economic situation and gradual income convergence of households in Latvia with the levels seen in other euro area countries. At this point slower economic growth has not been translated in inflation yet: underlying inflation, lagging behind the business cycle, still continues to show a gradual growth trend. With a high annual rate of increase in remuneration persisting, the services price inflation, being the most responsive to changes in the domestic labour costs, exceeds 3%.

We expect, however, that, with the slowdown of the economic activity, inflation will also gradually decrease. A decline in inflation will also be supported by the price dynamics of global food commodities (wheat, milk) where a downward trend has been observed over the last few months. Oil price dynamics has demonstrated pronounced uncertainty as the effect of the global demand weakening is offset by supply shocks, e.g. the recent attack on Saudi Arabia's oil processing infrastructure.

In view of this set of factors, Latvijas Banka's inflation forecasts for this and next years remain unchanged at 2.9% and 2.5% respectively.

To sum up. Both developments in Latvia's major external markets and Latvia's economic growth dynamics points to a notable risk of growth slowdown in the near future. Therefore, the accommodative monetary policy measures taken by the ECB's Governing Council last week potentially may also have a favourable effect on Latvia's economy.

As regards lending, the decisions of the ECB's Governing Council are largely aimed at stimulating further credit growth. However, an important precondition for that is to have lower central bank and money market interest rates eventually being also reflected in lower lending interest rates for businesses and households. Overall, euro area interest rates for both businesses and households have indeed decreased notably over the last 3–4 years. Meanwhile, if we analyse the situation in Latvia, it is not so positive and as a result, the so called "lending channel" of the overall monetary policy in Latvia is not so strong as in other countries. Let me remind you of a fact: Latvian commercial banks currently have almost five billion euro of unused liquidity; they keep them in the central bank and are even ready to pay for that rather than put them in circulation and provide lending to Latvia's economy. This is the moment when the people in charge should come together with the leading experts of commercial banks and analyse the factors which prevent these funds from being channelled into Latvia's economy and investment.

Under the current circumstances, given the historically low interest rates, discussions on Latvia's long-term development trends and the supporting public investment are highly welcome. Reforms in healthcare, education and public administration: these are key to strengthening Latvia's competitiveness and sustainable growth.

In my previous press conference we have already talked about Latvia's competitiveness, structural reforms, reforms in healthcare and education systems. In our opinion, to support sustainable growth in Latvia, strengthening of the potential of labour force is one of the most essential issues. Businesses are sending a clear signal on labour shortages, but in order to strengthen the potential in the long-term, the role of labour force quality is even more important.

We have planned to discuss this issue which is really essential for Latvia's future, i.e. the availability and quality of labour force, at the annual conference of Latvijas Banka on 2 October. You are also kindly welcome to attend it.