Welcome to our regular press conference where I shall speak about the following topics:

- euro area developments;

- significant decisions taken at the external meeting of the ECB's Governing Council in Vilnius;

- Latvia's economic development;

- Latvijas Banka's latest forecasts;

- as well as the strengthening of Latvia's economic competitiveness.

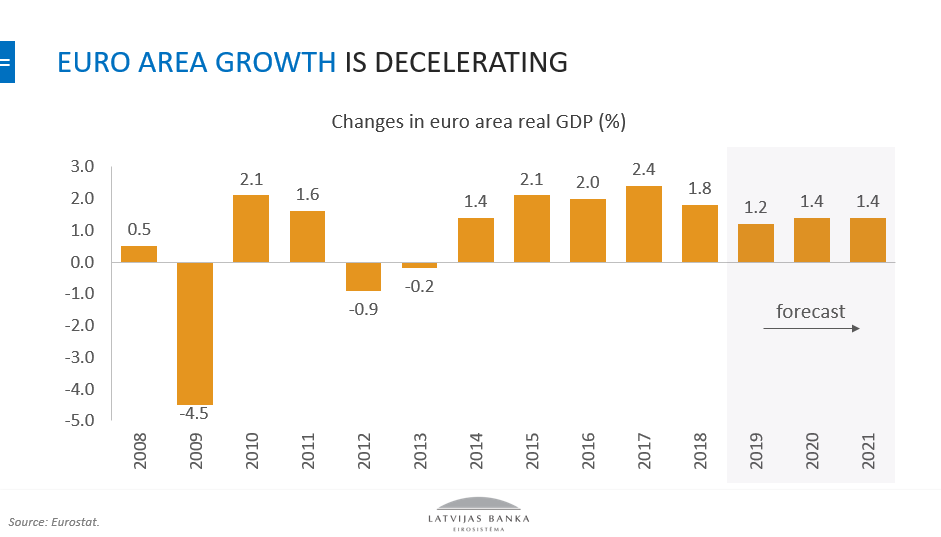

Looking at the euro area growth, we can see that the past years, including 2018, have been overall good for the economy and the growth rate has remained close to 2%. Moreover, the rates have been like that for several consecutive years. To a large extent, this sustainable growth was facilitated by the ECB actively implementing a growth-supporting and accommodative monetary policy.

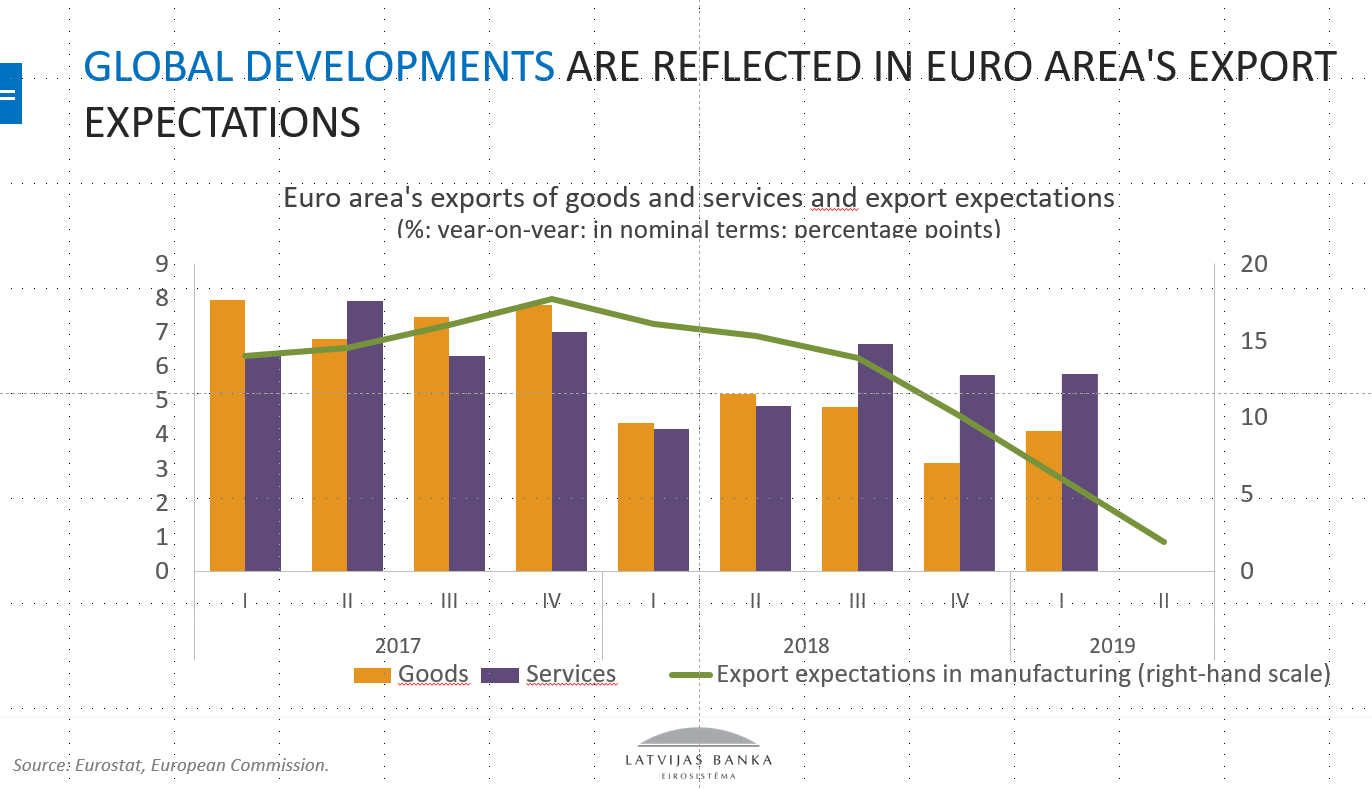

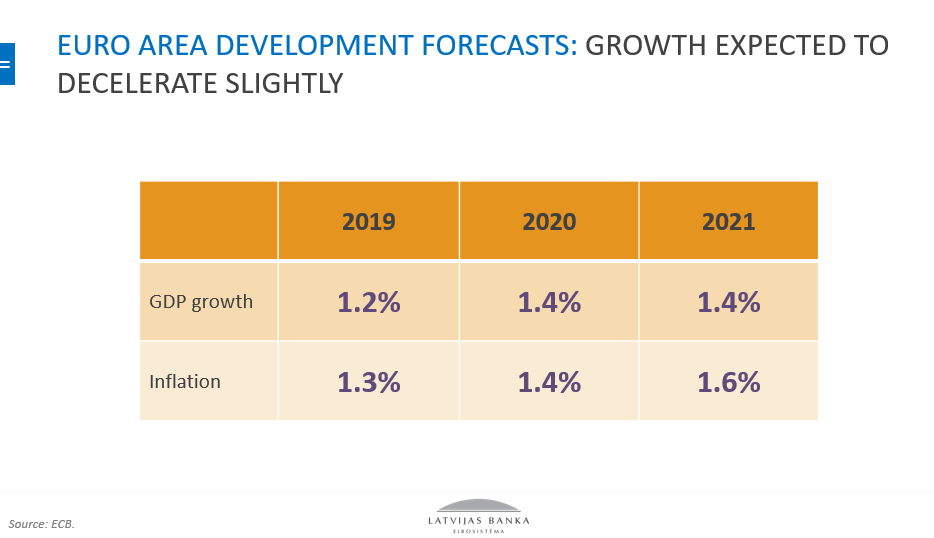

Nevertheless, despite relatively good first quarter data, the global economic developments that have increased the uncertainty clouding the future economic growth scenarios (global economic growth is decelerating on account of deteriorating trade relationships and terms of trade, weaker imports and Brexit developments) warrant caution, as we see that the euro area export growth tends to slow down, gradually dragging down also the overall economic growth. This year, the euro area's GDP growth could decrease to 1.2%, representing the lowest rate of the last five years, followed by 1.4% in 2020 and 2021.

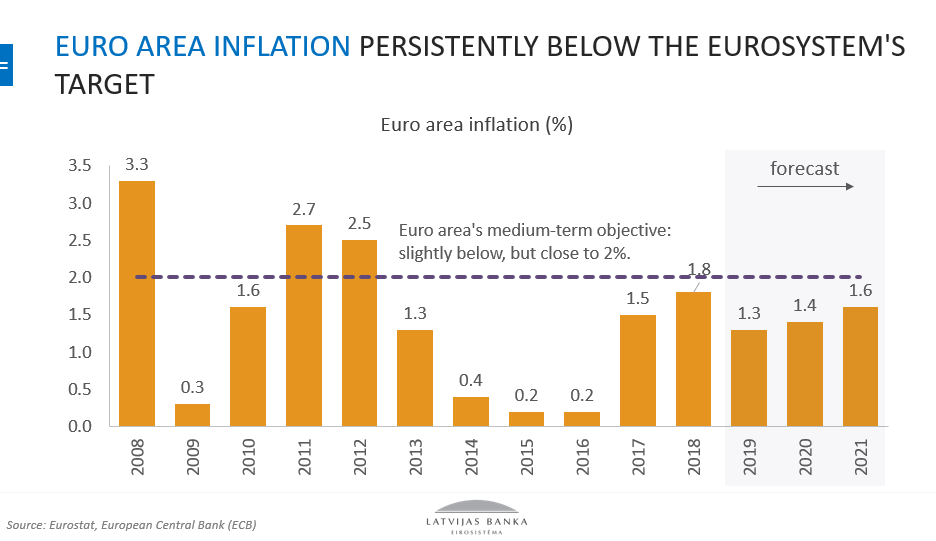

Euro area inflation continued to approach the target of below, but close to, 2% in 2018. Moreover, core inflation or inflation, excluding energy and food prices, has remained persistently low around 1% over the most recent years.

With the economic growth decelerating and the global developments intensifying uncertainties, inflation can be expected to decrease this year.

As I already mentioned, the ECB's Governing Council meeting was held in Vilnius this week and several important decisions concerning the monetary policy going forward were taken. Let's recall that a year ago, at the Riga meeting a decision to end asset purchases within the framework of the APP by the end of 2018 and continue with the reinvestment phase only was taken.

The development of the European economy and the euro area inflation, however, has prompted the ECB's Governing Council to announce a strong and clear commitment to continue with an accommodative monetary policy in order to achieve convergence of inflation towards its target.

Yesterday, the latest euro area growth and inflation projections were published, and according to those, as I already mentioned, growth will be lower than expected over the next two years and this year (1.2% this year and 1.4% over the next two years). And inflation at 1.3% in 2019, 1.4% in 2020 and 1.6% in 2021 which is also not quite "close to 2%".

Now, what were the decisions at this week's meeting of the Governing Council of the ECB?

First, the key ECB interest rates remained unchanged. The Governing Council now expects that the rates will remain at their present levels at least through the first half of 2020 and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term.

Second, the Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Third, and this, I believe, is the most important and biggest news, regarding the modalities of the new series of quarterly targeted longer-term refinancing operations (TLTRO III), the Governing Council decided that the interest rate in each operation will be set 10 basis points above the average rate applied in the Eurosystem’s main refinancing operations over the life of the respective TLTRO. For banks whose eligible net lending exceeds a benchmark, the rate applied in TLTRO III will be lower, and can be as low as the average interest rate on the deposit facility prevailing over the life of the operation plus 10 basis points or minus 0.30%.

I would also like to add, that the ECB also stands ready to act should the situation deteriorate. The monetary policy continues to provide significant support to the euro area's economic development in circumstances when global developments dampen exports and consequently also the euro area growth. At the same time, the monetary policy instruments alone cannot change the situation radically and an active involvement of the euro area national governments in implementation of structural reforms is required.

Turning to Latvia, looking at Latvia's economic growth, one has to take into account the economic developments in the euro area. The year 2018 was undeniably successful for Latvia's economy as well.

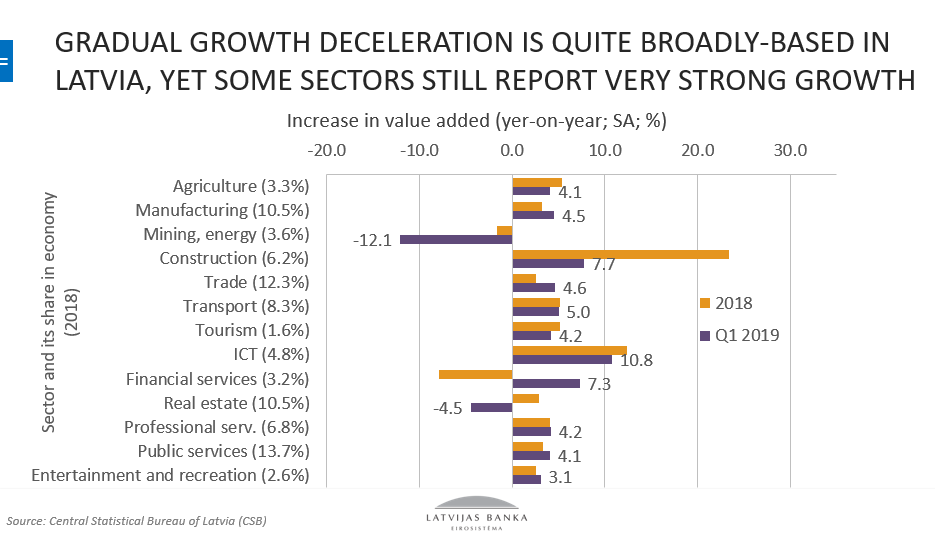

Growth was underpinned by the performance of the construction and ICT sectors as well as the ability of the transport sector to benefit from reconstruction works carried out at Russian ports and increase the volumes of loaded and unloaded cargoes.

At the same time, it is increasingly more obvious that our business cycle is past its peak and the economic growth is starting to decelerate. In the first quarter of 2019, the annual growth of GDP fell to 3.2%, with a 0.1% decline recorded in comparison with the fourth quarter of 2018.

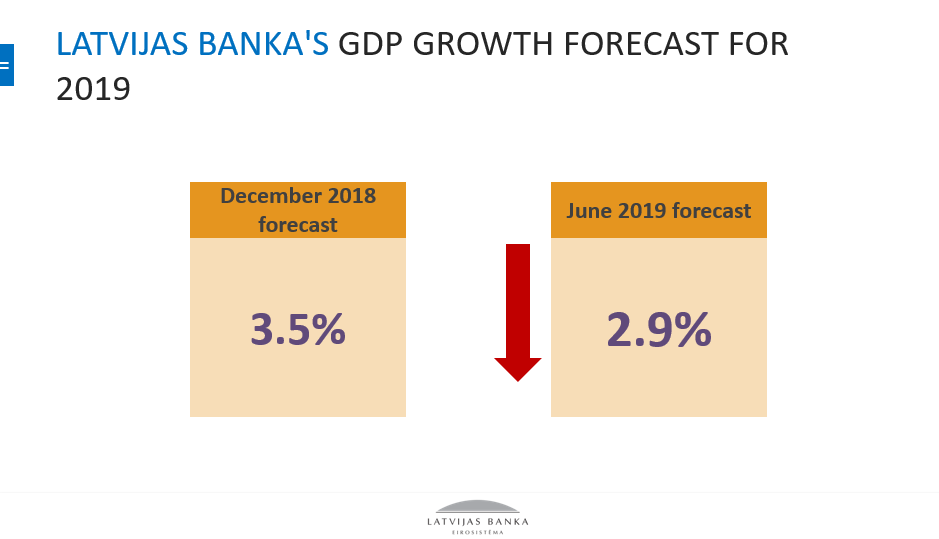

These developments have made us to adjust our economic growth forecast: i.e. the GDP growth forecast for 2019 has been revised downwards to 2.9% (in seasonally-adjusted terms), while the GDP growth forecast for 2020 has remained unchanged at 3.1%.

There are several reasons justifying the downward revision.

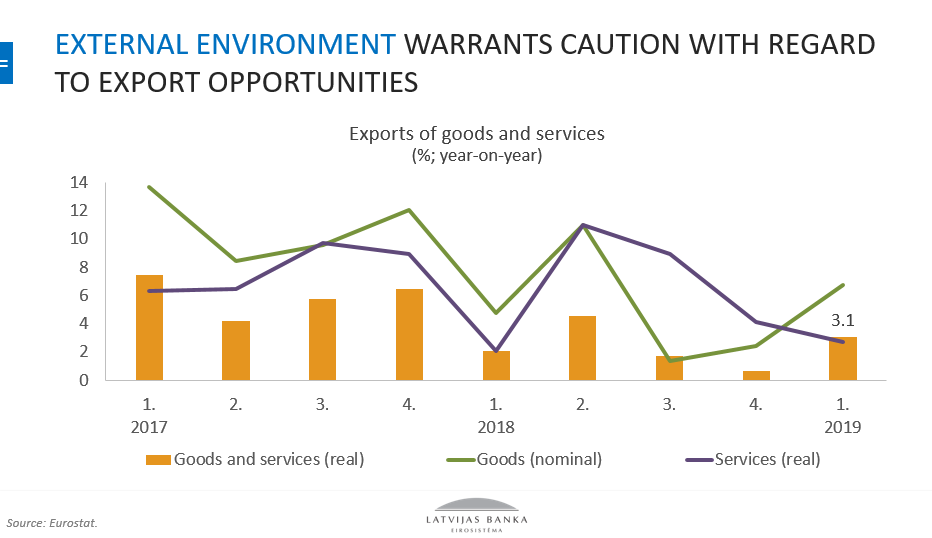

First, the global economic deceleration and the weakening external demand from Latvia's trade partners is reflected in faltering export growth and the role of the main driver is shifting more to domestic demand. At the same time, the high degree of external uncertainties caused by geopolitical and economic developments is gradually reflected also in moderating domestic investment activity and could make consumers more cautious.

Several one-off factors (e.g. the effect of weather conditions on energy) have also had a downward impact.

As I already mentioned, external downside risks to economic growth associated with the Brexit uncertainties, US-China trade wars as well as the probability of an US-European trade war remain high.

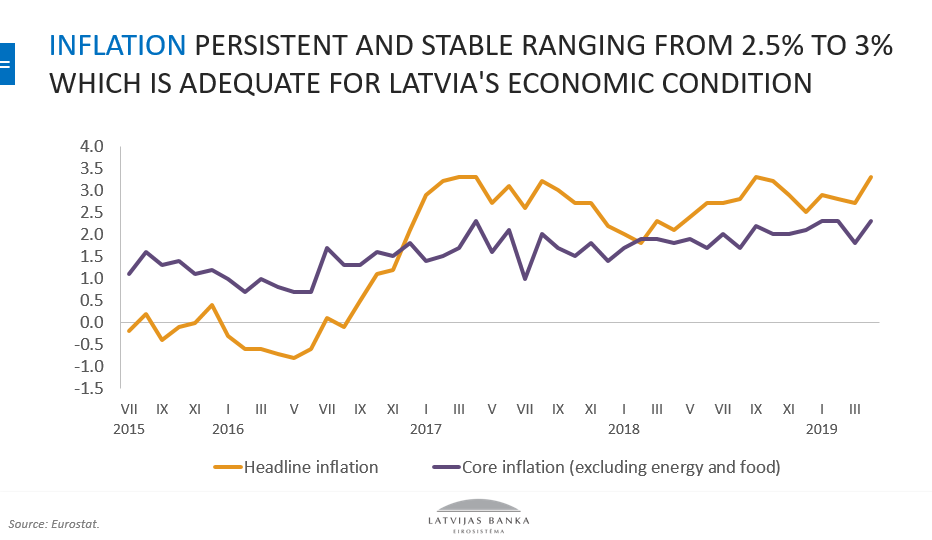

Latvia's inflation remains within the range of 2.5%–3%, which is adequate in the light of the current economic situation and gradual convergence with other euro area countries.

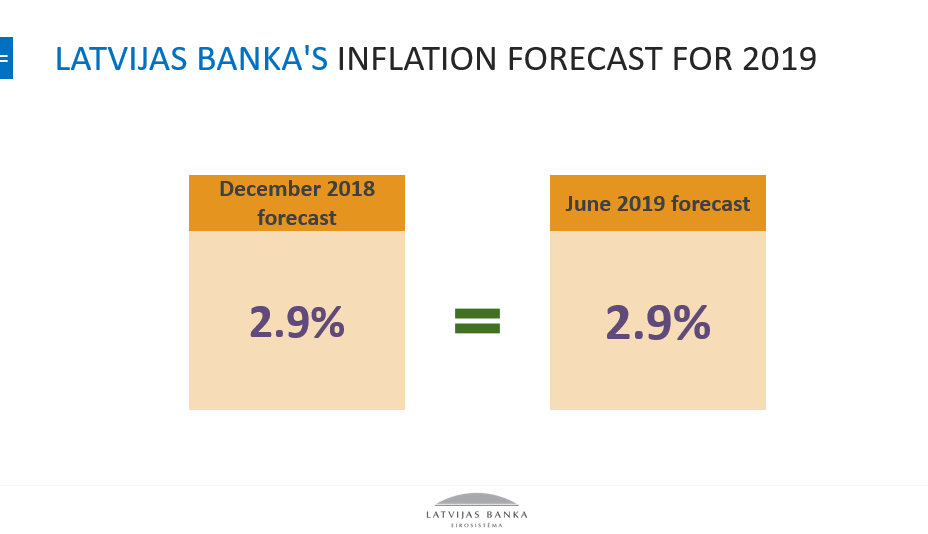

At its regular meeting, the Council of Latvijas Banka reviewed the macroeconomic development forecasts and decided to leave this year's inflation forecast unchanged at the level of 2.9%

Let's turn to the labour market now. Tensions on the labour market remain on account of labour shortages, which I shall discuss a little bit later. Unemployment lingers at 7%. Labour demand is high; therefore, in addition to unemployed persons, previously economically inactive persons are also joining the labour market. Deceleration of economic activity could inter alia decrease labour demand, yet the challenge of addressing geographical and structural imbalances remains.

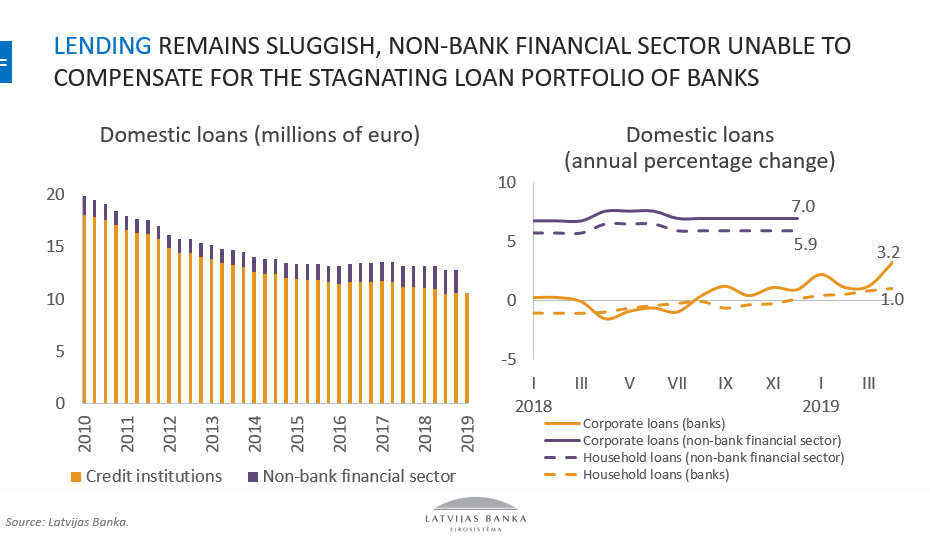

Now about lending. We can see that, following a long period of stagnation, lending growth has picked up slightly, yet it is dampened by the external uncertainties weighing down on both the businesses' propensity to borrow and the credit institutions' risk appetite.

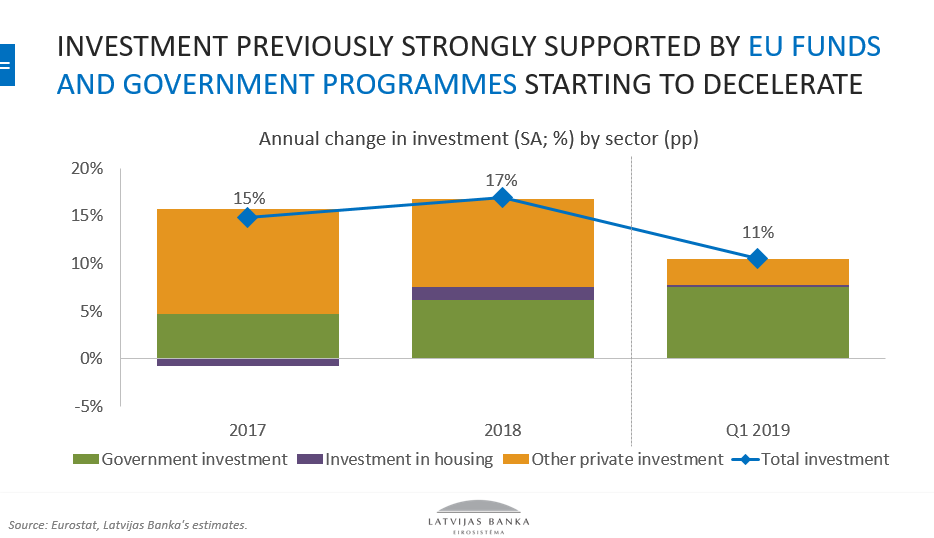

Analysing investment data, we can see that the positive development over the last year was largely underpinned by the absorption of EU funds, but also by significant private sector investment. A challenging external environment may have an effect on private investment decisions, yet the ones that have been already made public continue to paint a positive future outlook. Consequently, investment growth in 2019 will most likely outpace the overall economic growth and accelerate in comparison with the most recent years.

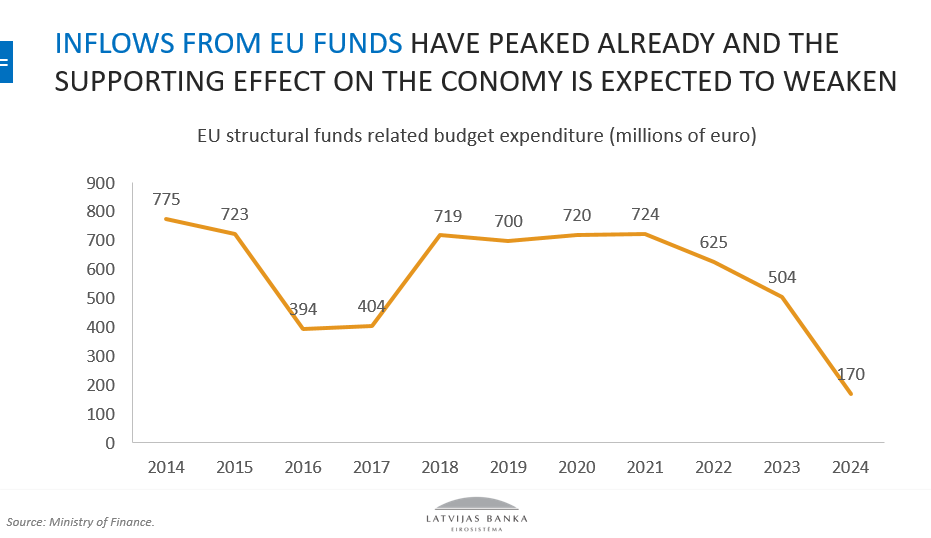

Absorption of EU funds has been a significant source of investment so far, yet one has to take into account that their availability could decrease gradually over the coming years.

A couple of words about the fiscal policy now.

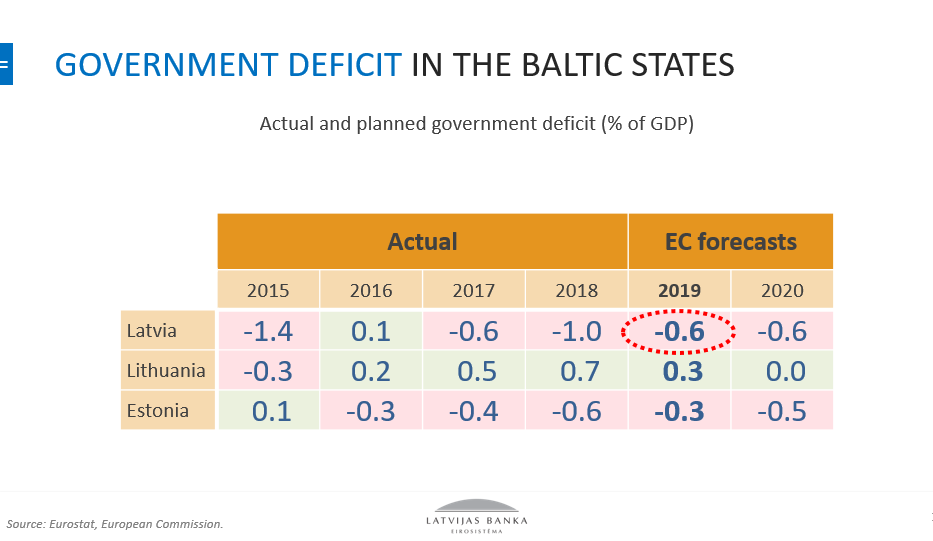

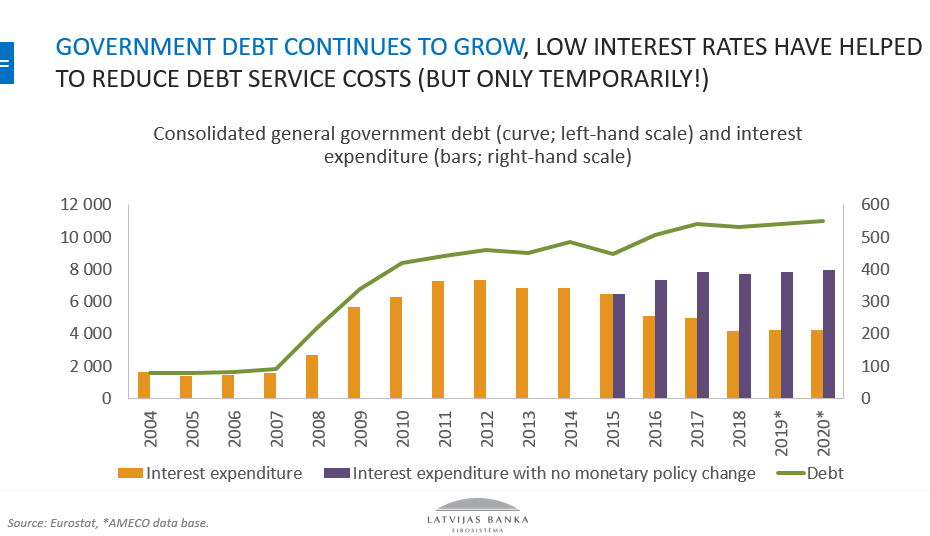

Speaking about the fiscal policy, we can see that, despite the strong economic growth experienced over the most recent years, we've been unable to stick to the principle of saving for a rainy day and have continued living with a government deficit even in good times, while Lithuania has managed to secure a government surplus. A government deficit means growing sovereign debt and impairs the government's ability to address any currently unforeseen future challenges. Like the overall economy, the fiscal area of Latvia has also experienced several years of good times: the expansionary monetary policy of the Eurosystem has enabled the government to roll over its debt at extremely low interest rates, thereby almost halving the government debt service costs. Instead of 400 million euro, we only paid 200 million euro.

This benign interest rate environment has also enabled the government to temporarily "improve" the government budget statistics, making the situation look better than it actually is. The effect of falling government securities yields excluded, the estimate of the projected government deficit this year would not be much different from that of five years ago. There is no obvious intention to reduce the government debt, the situation with public finances is largely dependent on external developments: when the external environment is supportive and Latvia's economic development is sufficiently successful, the sustainability of public finances is also hardly ever doubted. The big question, however, is whether the Latvian economy is sufficiently well prepared for a situation when the external environment becomes unfavourable and where the policy-makers can no longer rely on better-than-expected economic growth. Is the Latvian economy sufficiently well prepared for any potential negative surprises which, looking at the developments outside Latvia, seem to have a comparatively high degree of probability at the current junction.

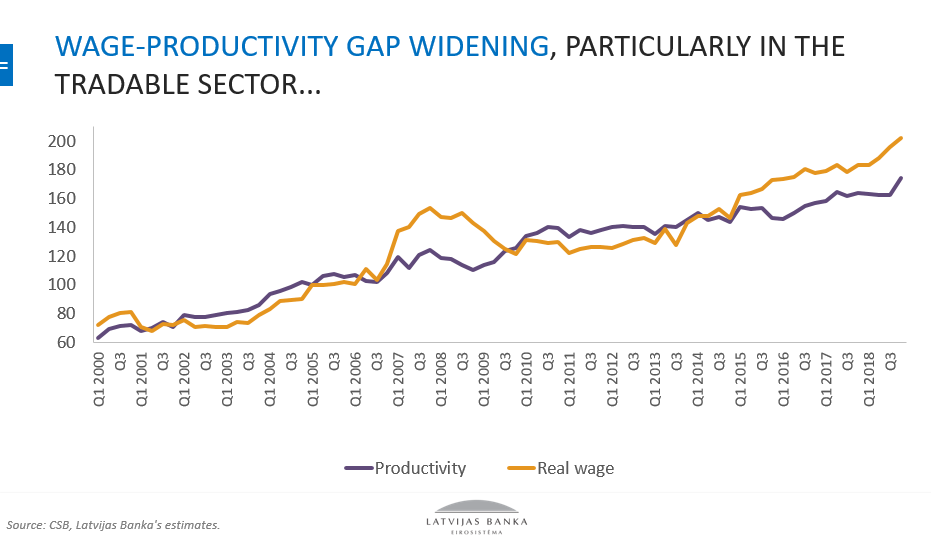

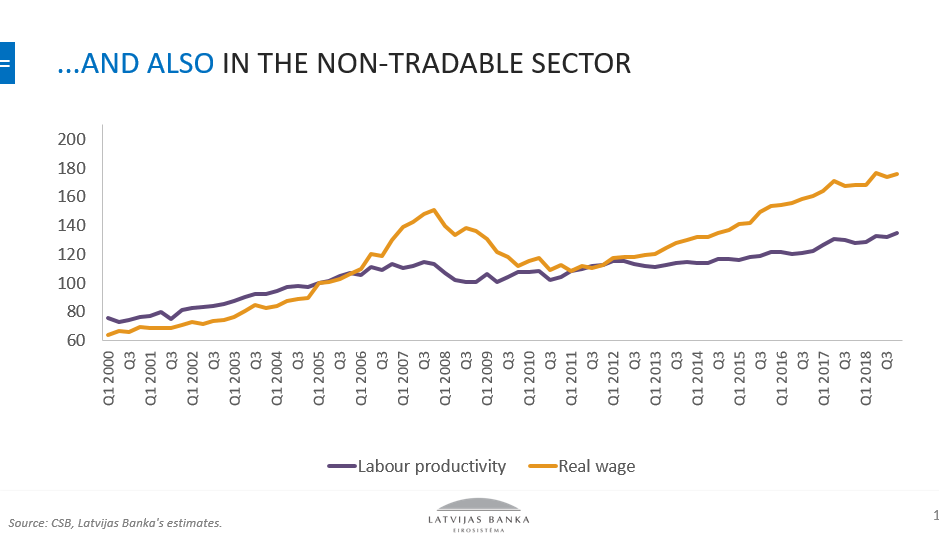

The best guarantee of economic safety and stability for a small and open economy like Latvia is the debt sustainability which, in turn, is closely linked to the ability to generate income from exports. Looking at the short-term or cyclical indicators, we can see some worrisome trends: for example, the growth of wages outpaces that of productivity, resulting in a widening wage-productivity gap. Moreover, this gap is already evident not only in the services sector and the non-tradable goods sector, but also in manufacturing which is affected most by the export competitiveness of the country.

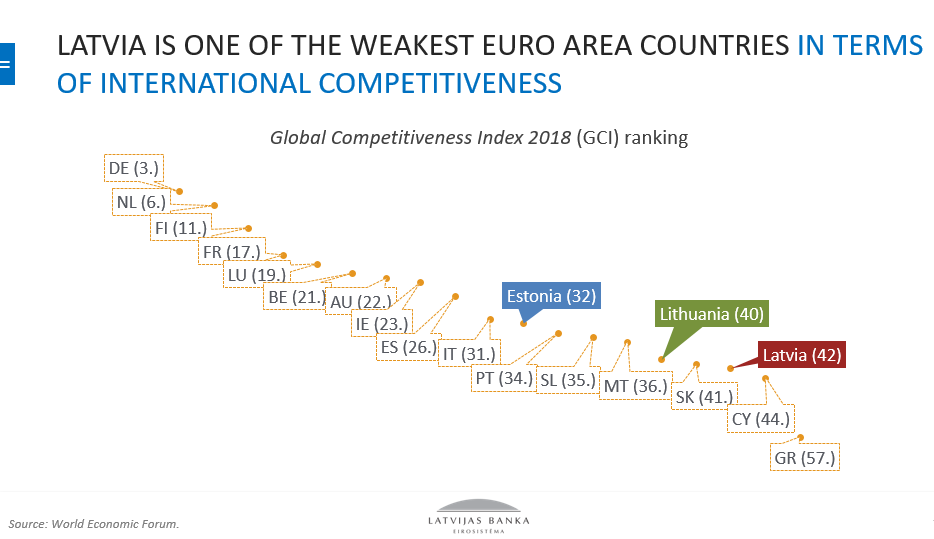

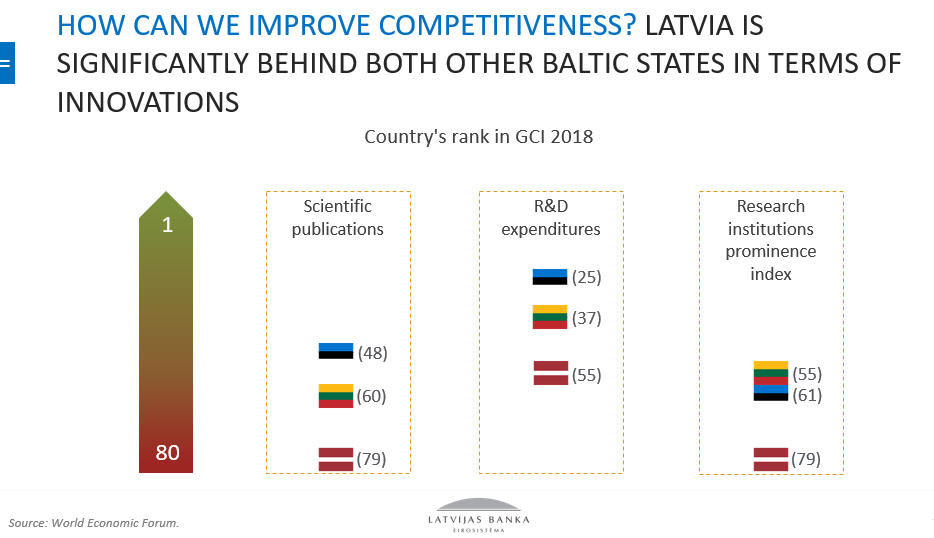

Also looking at Latvia's long-term or structural competitiveness scores, there is no reason for being very optimistic: regretfully, Latvia ranks third from the bottom out of all euro area countries in the latest international competitiveness ranking, followed only by Greece and Cyprus.

Latvia's international competitiveness is and remains the key factor determining both its ability to reach a certain welfare level in the future as well as to withstand unfavourable external turbulences. Therefore, despite comparatively good macroeconomic results, we should not become self-complacent and live with a belief that the main things have already been accomplished. On the contrary, the current period of relative calm is the right moment to focus on long-term competitiveness issues.

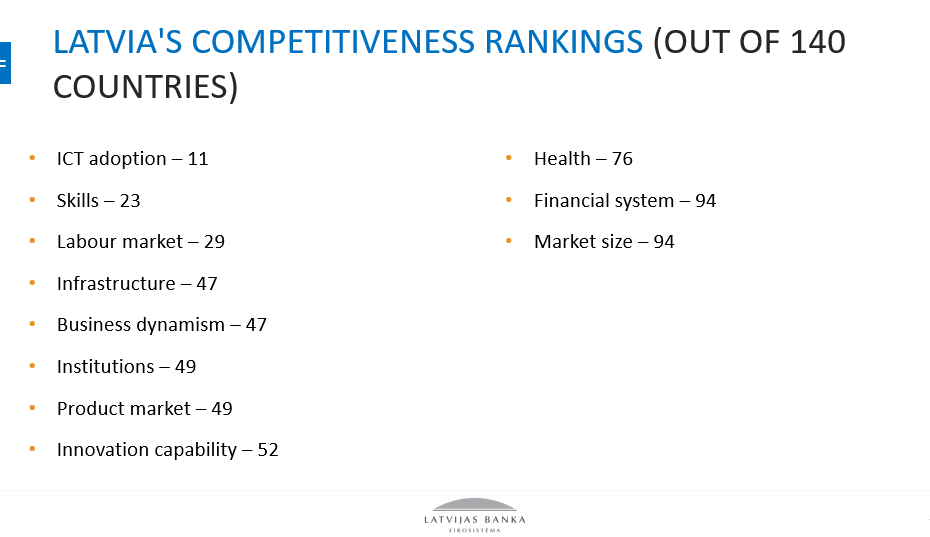

Looking in more detail at the fields where Latvia should continue with significant improvements, several problem areas as compared to the other Baltic states can be seen that, most likely, are not surprising.

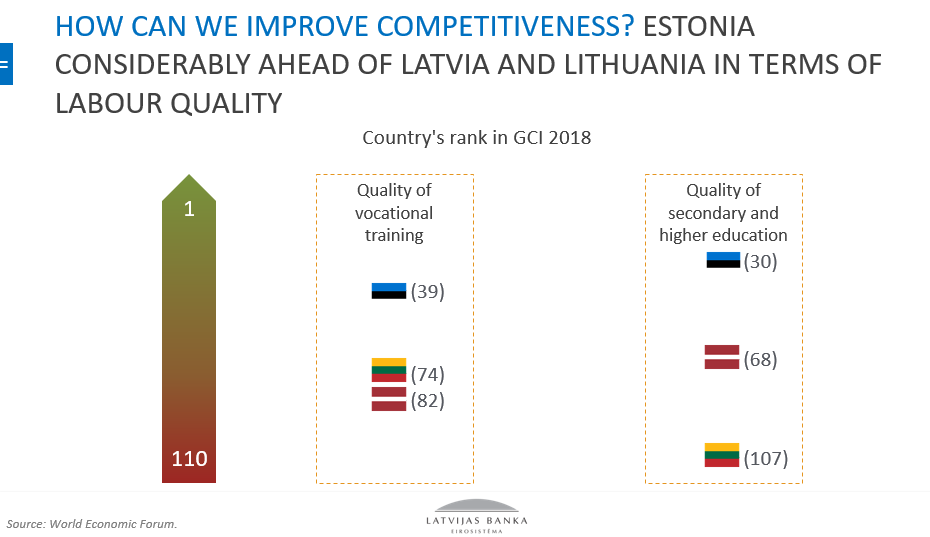

This time, however, I would like to dwell slightly more on the issue of quality of the labour force. We all know that businesses are increasingly voicing their concerns about the tightening of the labour market and the current labour shortages, also confirmed by various surveys. In a longer-term perspective, however, the quality of labour is more important than quantity; moreover, the quality cannot be improved in a short period of time even from a theoretical point of view.

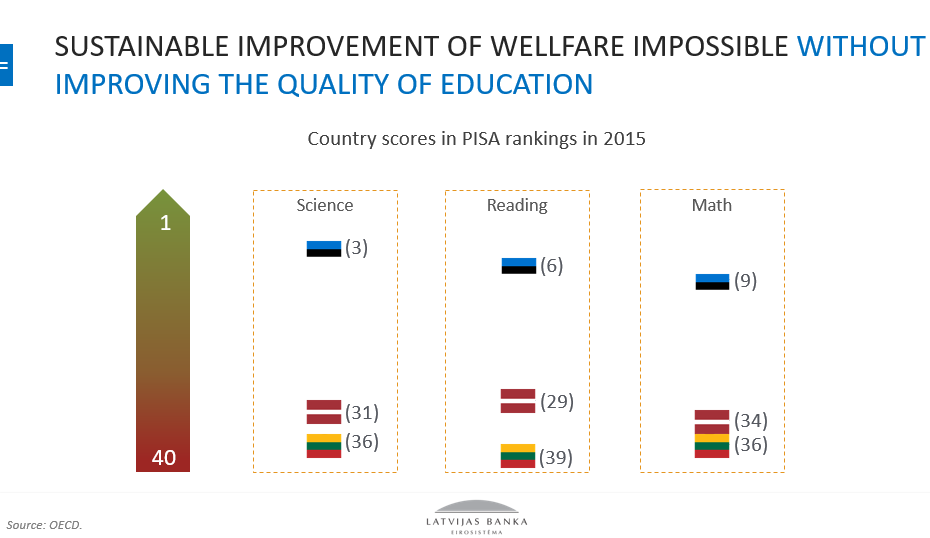

The road towards highly-qualified labour force begins at school, and, according to PISA rankings providing the best quality measure of school systems, the quality of our training is quite poor. Our Northern neighbours will just continue to be smarter also over the next generations and thus, providing that the situation does not change, will be in a more advantageous position in trade and finance.

Also looking at the stage beyond primary education, the quality of education in Latvia is lower than that in Estonia, and this has a significant effect on both the current competitiveness score as well as the future one. It is the well-educated and highly-qualified employees who will come up with the innovations we require in the future and support further productivity gains.

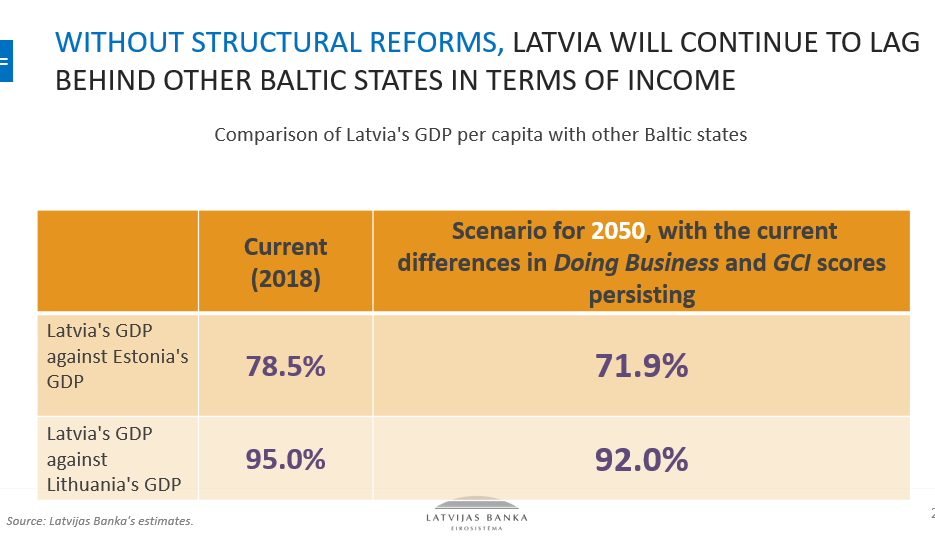

In the absence of a significant progress in this area, we shall never catch up with the euro area core countries in terms of welfare, and, unfortunately, will continue to lag behind other Baltic states as well. This is not just rhetoric, and can be confirmed by economic estimates. If Latvia does not set considerable improvement of international competitiveness scores as its strategic goal, income disparities between Latvia and its Baltic neighbours will remain and increase over the next decades, reaching already a critical level vis-à-vis Estonia.

To sum up, the global business cycle has passed the peak and is currently at a stage of a flat and slow contraction. Similar development can be expected for both the euro area and Latvia and the risks of economic deceleration are intensifying. This is the right moment for several significant reforms to strengthen the human capital and the economic growth potential.

That is basically all I wanted to mention today in my introductory statement.