I am seeing you one day after the meeting of the Council of the European Central Bank (ECB) in Tallinn, where the developments in the euro area economy were assessed and the latest gross domestic product (GDP) and inflation projections were made public. Many among you know that once a year the ECB Council has an off-site meeting and this year it took place in Estonia, whereas in June of next year we will welcome the European monetary policy makers here in Riga, at Latvijas Banka.

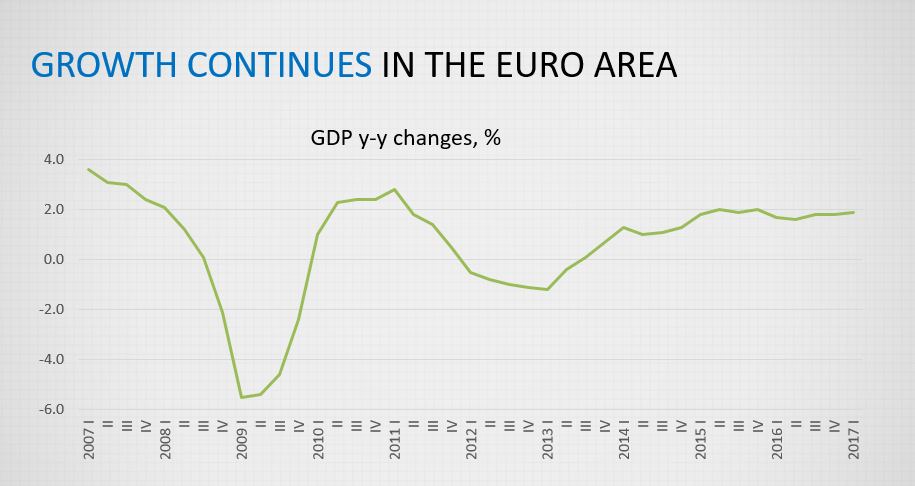

First, let us look at the trend in the euro area economy.

Healthy growth is observed in the euro area economy, with real GDP growing by 0.6% quarter-on-quarter and 1.9% year-on-year in the first quarter.

At the beginning of the year, growth in the euro area was fostered by an increase in domestic demand and improved external environment that was reflected in growing exports. Private consumption was stimulated by rising employment. The confidence level of entrepreneurs and consumers alike continued to improve, which gives rise to hope for further growth. At the same time, improvements in the labour market have not yet been sufficient to result in a more robust increase in wages. Furthermore, the rise in real income at the disposal of households was impeded by a rise in energy prices.

Because of the delay in wage increases and a weaker demand, the pressure of prices and euro area core inflation remained low.

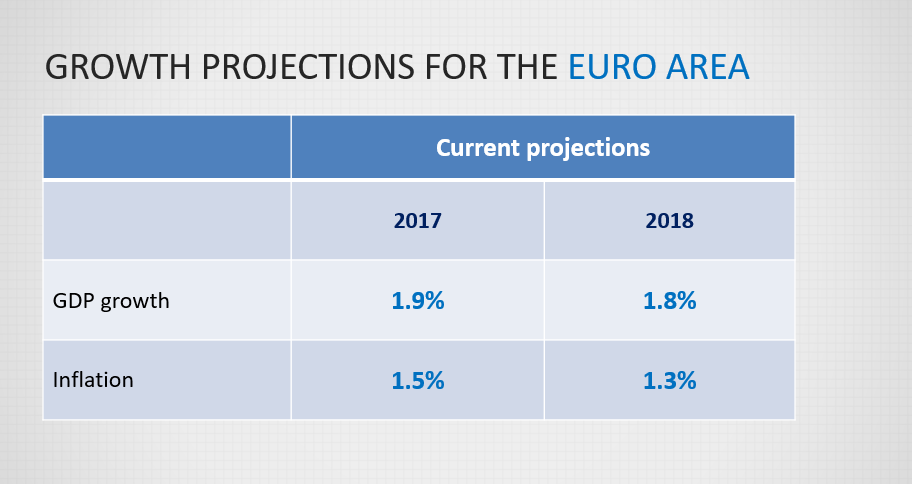

Yesterday, 8 June, the Eurosystem announced the latest euro area economy growth projections. According to ECB experts, the euro area GDP will increase by 1.9% this year and by 1.8% next year.

The euro area GDP growth projections was adjusted upward,on account of the following factors:

- positive trends in the global economy overall,

- an increasing external demand,

- supportive financial conditions,

moreover, economic growth is stabilizing in an ever increasing number of countries.

The global trade flows are recovering notably well, with import demand growing on the part of both developed and developing countries.

According to June forecasts, the average inflation in the euro area will be 1.5% this year and 1.3% in 2018. A faster increase in inflation is expected to be reined in by stabilizing prices of energy resources and a weaker than expected domestic demand.

As far as monetary policy decisions are concerned, the ECB Council decided to leave the euro interest rates unchanged.

The reference to future prospects was changed, no longer including a note on reducing the main euro interest rates.

At the same time, the Eurosystem continues with its especially stimulating monetary policy in order to foster economic growth and achieve inflation close to yet under 2% in the medium term. The main euro interest rates continue to remain at record lows and asset purchases in the monthly amount of 60 billion euro are continuing.

And now to the Latvian economy.

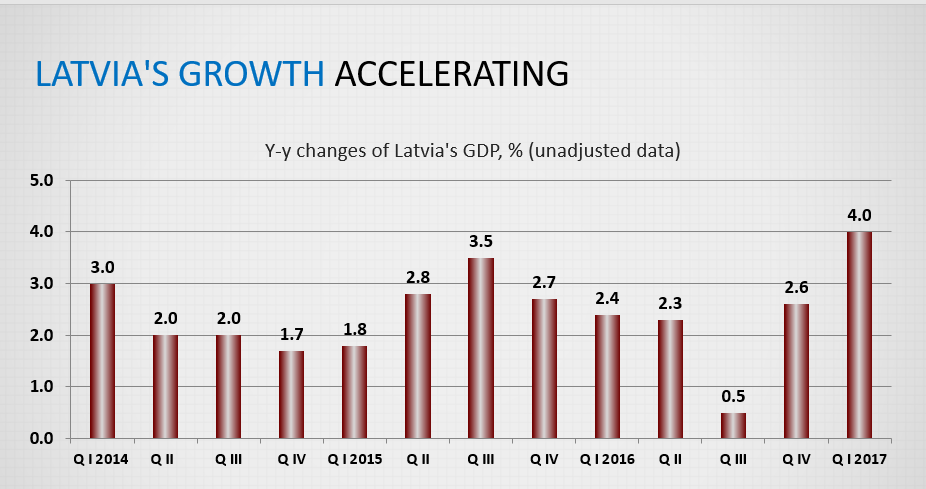

The faster growth in the euro area has also helped our economy and exporters.

At the end of 2016 and beginning of 2017, the growth rate of the Latvian economy accelerated, with GDP increase in the first quarter reaching 4%, which is the fastest growth rate in recent years. The acceleration was due to an improved situation in manufacturing, the energy sector and, as of the beginning of 2017 also construction, trade and transport.

It should be borne in mind, however, that the faster growth rate was also a result of the low base of the previous year and several one-off factors whose impact in the coming quarters will not be as pronounced.

A number of factors allow us to make a projection that growth will be sustained in the future as well. The external economic environment is improving gradually, which is evidenced both by the economic data of foreign trade partners and confidence indicators of economic participants. The data of Latvian manufacturing and foreign trade likewise indicate stabilization of external demand.

In addition, lending is slowly recovering and signs of further improvement can be observed in the labour market – unemployment is down, wage increase is stable and, at the beginning of the year, it even rose somewhat.

The uptake of European structural funds has been slow up to now, but it is expected to become more active within this year, which would have a positive effect on construction and the related branches, as well as overall investment activity.

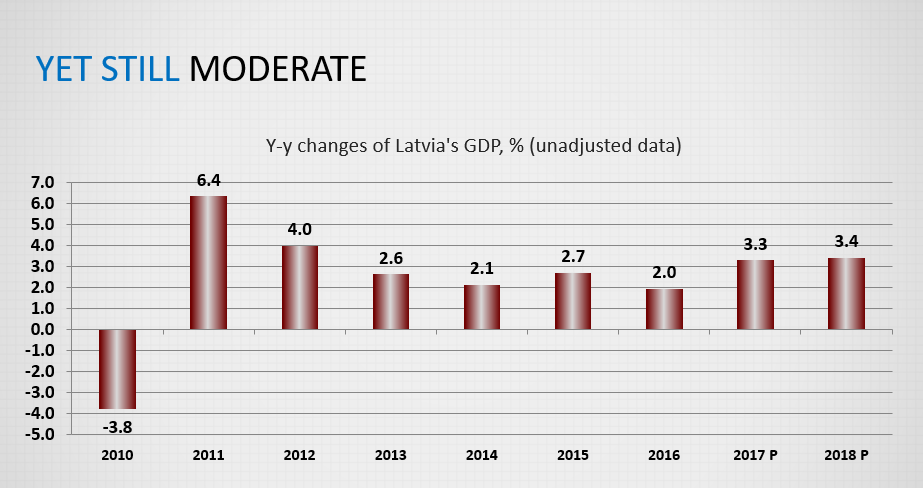

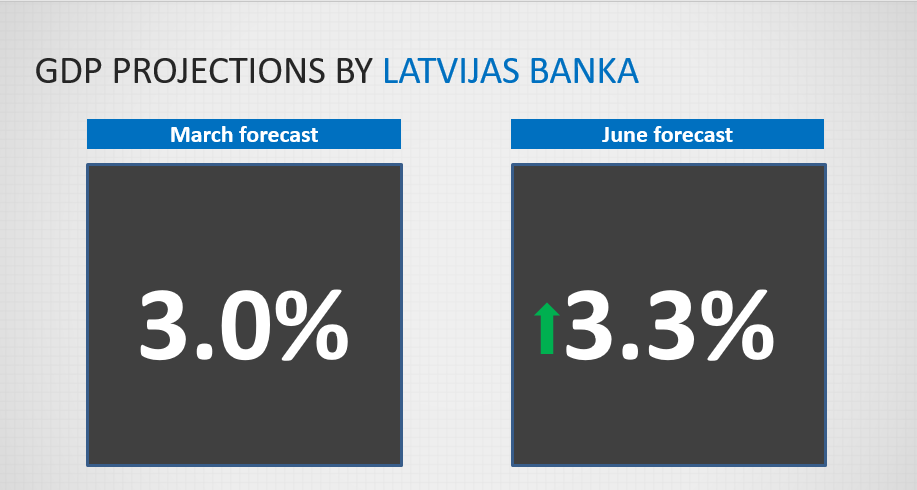

In view of the aforementioned factors, the Council of Latvijas Banka has adjusted upward its GDP forecast for 2017. In accordance with unadjusted data, GDP could grow in 2017 by 3.3% (up from the previous projection of 3%). In 2018, GDP is likely to grow at a similar pace, by 3.4%.

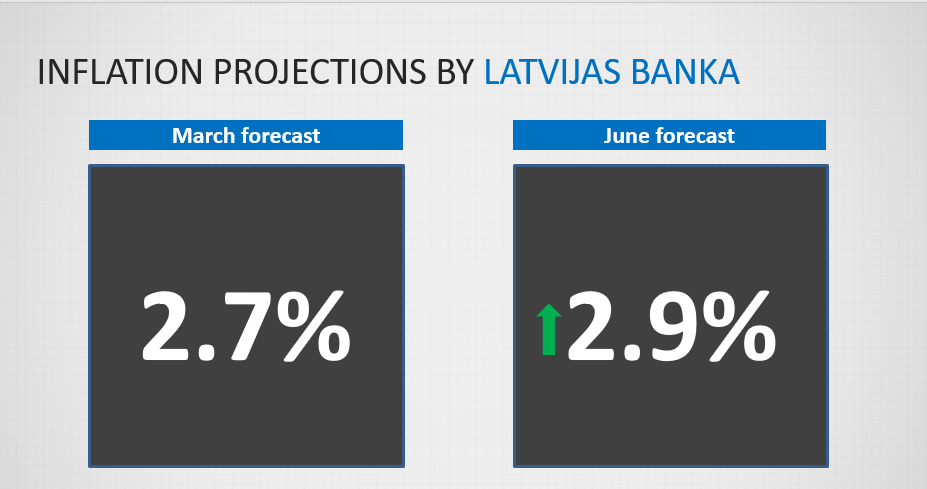

The situation in the global oil and food markets is stabilizing, but the greater economic activity and the accompanying rises in compensation leads us to raise the inflation projection for this year from 2.7% to 2.9%.

Finally, turning to the discussion on the future of the tax system, I would like to remind you why, at the end of February, we published our "Tax Strategy 20/20":

-

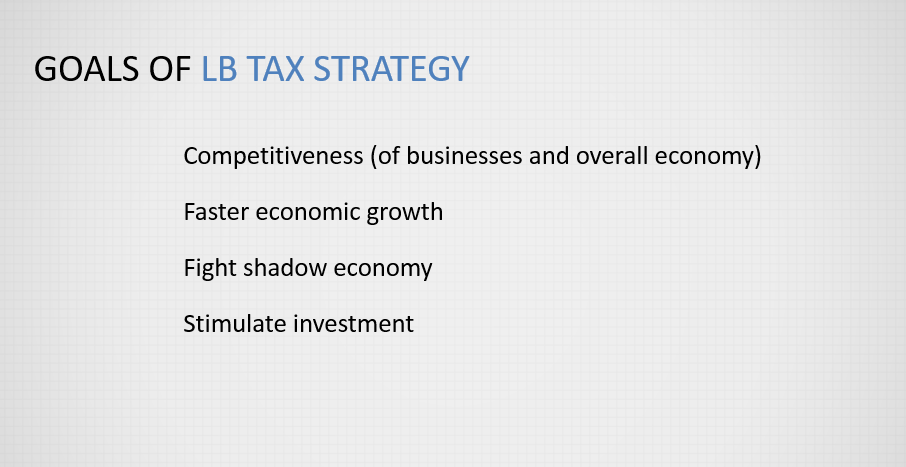

- we set as the main objective fostering the competitiveness of Latvian businesses, economic growth and prosperity of the population while at the same time ensuring a favourable effect on the state budget;

- we suggested diminishing the tax burden on the labour force, setting the population income tax (PIN) rate at 20% instead of the existing 23%;

- we called for equalizing the capital gains tax rates at the 20% level (instead of the existing 10-15%) and

- to reform the existing enterprise income tax (EIN) system, making it simple and transparent, introducing a 0% rate for reinvested profits and 20% for dividends paid.

Thereby tax rates for all kinds of income would be equalized at the 20% level. Our proposal involved a proviso that, by 2020, the tax system and the taxation rates would remain unchanged, hence the title "Tax Strategy 20/20". It would be easy to administer and understand.

The negative effect of the diminished tax rates on budget revenue would be compensated by faster economic growth. As a result, we predicted that next year, the 3.4% growth of GDP I just mentioned, could be accompanied by an additional 0.6% and, as a result, growth in 2017 could be at 4% as a result.

The tax reform was supplemented by proposals from the social bloc, thus planning for additional expenditure and decreasing the potential budget revenue that increases the defic

It is our opinion that the measures to reduce the social inequality gap mentioned in the supplemented basic taxation guidelines should be supported, yet it has been our position that they can only be carried out when the tax strategy has borne the first fruit. Money first has to be earned. When money has been made, it can be used to reduce the increased inequality problem.

It must also not be the case that the taxation reform leads to an increased budget deficit and national debt.

Currently, the tax reform is under a serious threat, however, for many of the things begun so well have been replaced by uncertainty. And new proposals are heard every day.

The tax reform has unfortunately fallen victim to the chaos in the financing of the healthcare system!

It has been proposed to raze to the ground all the elements envisioned to raise competitiveness by raising the social insurance payments (SIP) or the value added tax (VAT)! It would automatically weaken the competitiveness of enterprises and render what was initially a well-conceived plan insignificant.

The ideas proposed up to now would not conceptually solve the problem with financing the health system. Latvijas Banka's prescription is clear and plain to understand – in health financing we should move to constant, long-term financing: the state mandatory insurance model or policy.

The idea of introducing a 20-euro payment does not come from Latvijas Banka. Latvijas Banka proposed a 25-euro monthly payment, but only when the healthcare system has been straightened out.

Only when two things have happened. Only when such a model has ensured:

- an increase in the financing of the healthcare system,

- it would be related to improved efficiency.

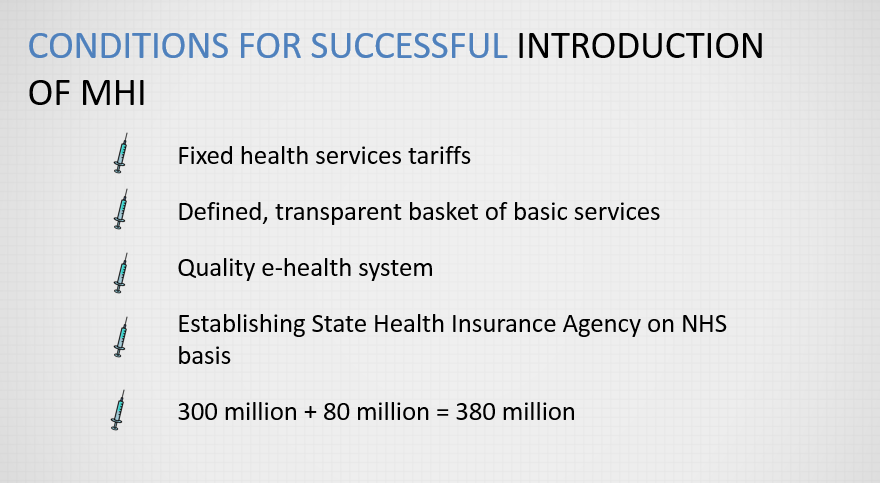

When five pieces of homework have been done:

- clearly defined tariffs in the healthcare system have been set

- a basic basket of services available to the residents of the Republic of Latvia has been clearly defined (currently, Latvia is the only country in Europe where the so-called negative basket has been defined, including that which the residents cannot claim, and it is not clear to what they are entitled. In a system that is not in order it would be totally unacceptable to make residents make an extra payment of 20 euro!)

- a quality e-health system has finally been built

- a state health insurance agency has been formed on the basis of the National Health Service

- only when all this preparatory work has been done, can the monthly payment of 25 euro be required. Furthermore, it is only those employed who would have to pay it and not all, despite what is being rumoured – children, young people, students and pensioners would not have to pay anything. The state would buy the policy for these people, thus ensuring much greater solidarity. Currently, people with more money can get ahead in line. In the future, if economically active residents would pay for this policy and not use all the available services, this extra money would reach children and pensioners. In our opinion, it would be a system with much more social solidarity than now.

What causes uncertainty in this situation where nurses and other medical personnel are leaving Latvia and a number of operating rooms can be closed is the following. The government of Latvia is not even ready to fight for this 380 million euro, which would mean solving a number of problems. (In fact, it is half of the health financing that the government lacks. In our proposal, this financing would be available as early as next year.)Instead, the least successful and competitiveness-distorting proposal is being considered: to raise social payments and value added tax. That would make life more expensive for the less well-to-do and make small business even more difficult by raising the prices of services and goods for entrepreneurs.