1. The Eurosystem yesterday went public with the latest projections regarding the euro area economic growth.

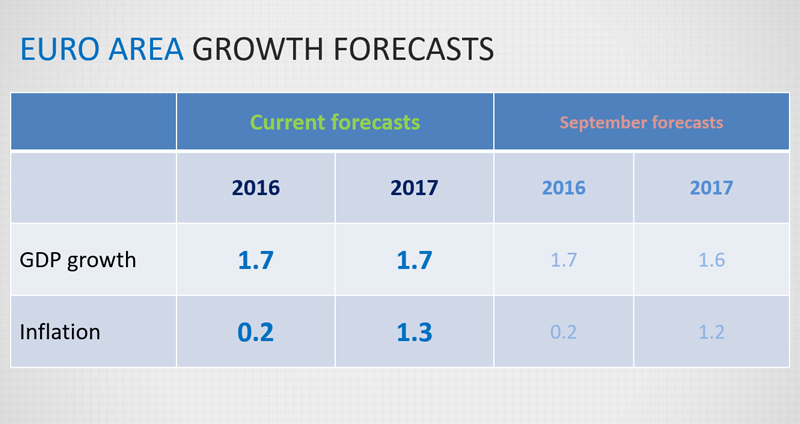

They indicate that this year the euro area GDP growth will reach 1.7%, and in 2017, will grow at the same pace. Slightly slower growth, 1.6%, is expected in 2018 and 2019. The forecasts have not substantially changed over the September ones.

In the coming years, inflation will continue to rise. In 2016, it is expected at 0.2% whereas in 2017 it will rise rapidly to 1.3%, continuing to rise to 1.5% in 2018 and 1.7% in 2019.

Even though the deflation risk has disappeared, uncertainty reigns and this is why the ECB Council made the decision to extend the Expanded Asset Purchase Programme (EAPP) to the end of 2017 or, if necessary, longer – to the moment where sustained stability of the inflation level is observed in accordance to the Eurosystem objective (close to yet under 2%). Until March 2017 the EAPP monthly level will remain at 80 billion euro and, starting with April, the purchase amount will be 60 billion a month.

The experience of using the non-traditional monetary policy instruments confirms again that the Eurosystem, including Latvijas Banka, will not be able to 'print' the euro area out of economic problems of a structural character. [taburetes slaids]

It can be said that the Eurosystem, i.e. all the central banks of the European Monetary Union keep printing money day and night. Since 2015, when the historic monetary policy measures were launched we have secured, within the EAPP framework, about 1.5 trillion euro, including Latvijas Banka contributing an additional 4.4 billion euro to the financial system.

In my opinion, it is of fundamental importance to understand the reasons why this money does not want to flow into economic growth and end up in the real economy.

2. Why does money not end up in the real economy?

Before, until Latvia became part of the euro area, it could be said that there is a lack of money: Latvijas Banka is not printing it, interest rates are high, financial resources are unavailable, the lats is not stable and it should be devalued. By joining the euro area, we have obtained funds – the commercial banks, the economy and entrepreneurs have them at the level we have not known before. Furthermore – in addition to having very large amounts of funds that are available at a very low cost – at low interest rates and for very long periods. And yet these funds are not flowing into the Latvian economy. The reason is not a lack of money but structural problems in the economy – both in Latvia and in the euro area at large.

I think the greatest problems are created by uncertainty – uncertainty about the future, uncertainty about whether taxes will be raised, uncertainty regarding the situation in Europe and the neighbouring countries. Under such conditions, entrepreneurs are afraid to borrow, do not make investments and export and lending stagnate.

The main thing, however – every year as the budget is being discussed, there is talk of changing the taxes. Latvia in fact changes its tax system every year, at the same time living with a budget deficit, increasing the country's foreign debt.

It once again indicates that our call that we have repeatedly issued to politicians, the government, parliament and society at large to come to an agreement on a stable and unchangeable tax system for at least one election cycle, i.e. four years. The effect would be so much larger if entrepreneurs and the population could count on the tax system not to change within the next two years. It would mean not developing new report forms, declarations and other documents, which already are very complicated and take a lot of time compared, say, to Estonia. It takes twice as much time as in Estonia to take care of all the tax reports in Latvia.

We are hopeful as regards the promise by the government to finally do a review of all taxes in the spring of next year, to discuss and agree on reforming the tax system in a way that would clearly and unequivocally suggest the final draft and that the taxes would not change by the next national election, i.e. that they would be at the base of the budgets of next two years.

We also believe that we should stop listening to the advice of foreign experts with an uncritical ear and moreover to buy this unqualified advice for large sums of money. We have enough finance specialists and economists who could draft the necessary decisions, and it is hardly efficient to pay huge amounts of money for expert advice that is like old warmed up soup.

We are gradually approaching the critical point where we will lose in our competition with neighbouring countries and where the Latvian economy could re-enter a period of very low growth, i.e. fall into the trap of moderate income without any chance of improving the state revenue and further development in the future.

3. This is borne out by several problems in the Latvian economy.

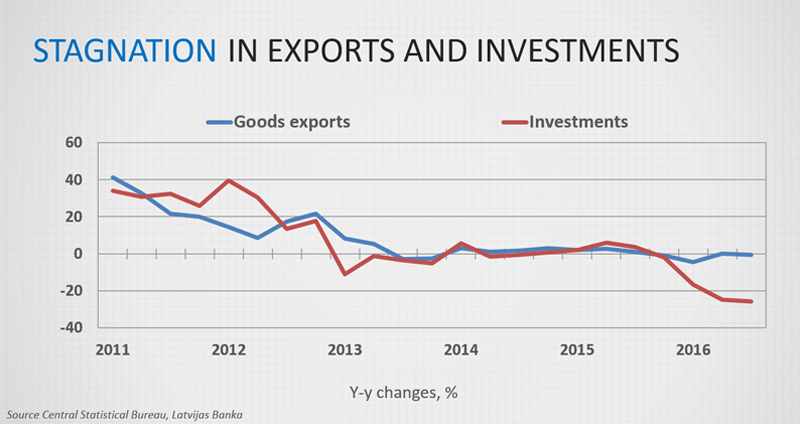

In the last few years we have observed stagnation in many important areas: investments are down, exports are stalling and lending remains at a very low level. Latvia is not successful at the uptake of EU funds, which has meant pulling an emergency brake on the growth of our economy.

Investments in the Latvian economy are at the lowest level (16% of GDP) experienced since joining the EU. Furthermore, it is not happening only because of the uncertainties in the external environment, for these apply to all EU members, but we are at their tail end.

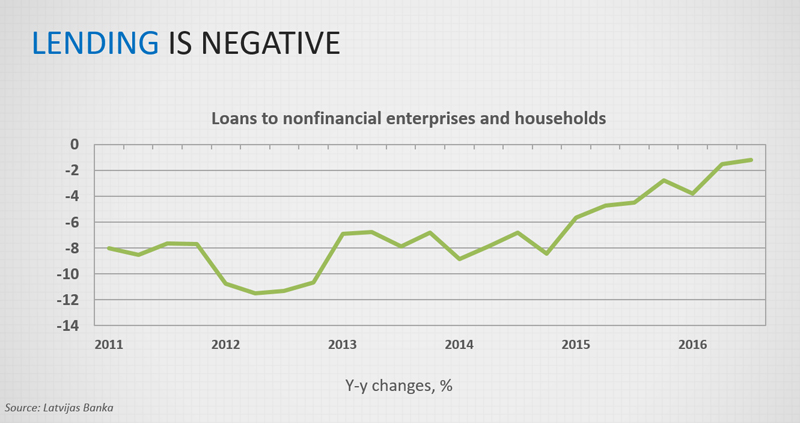

The uncertain developments in Latvia also do not foster inflows of loans into the real economy. Within this year, a fragile recovery of lending to non-financial enterprises has taken place, but in October it did not remain above zero (the year-on-year drop in October was 0.7%). Despite a substantial stimulus from a state guarantee programme, the household loan portfolio also continued to drop (2.3% year-on-year in October).

The cooling of the economy is becoming ever more pronounced and may mean that next year Latvia's GDP will not grow faster than 3.0%.

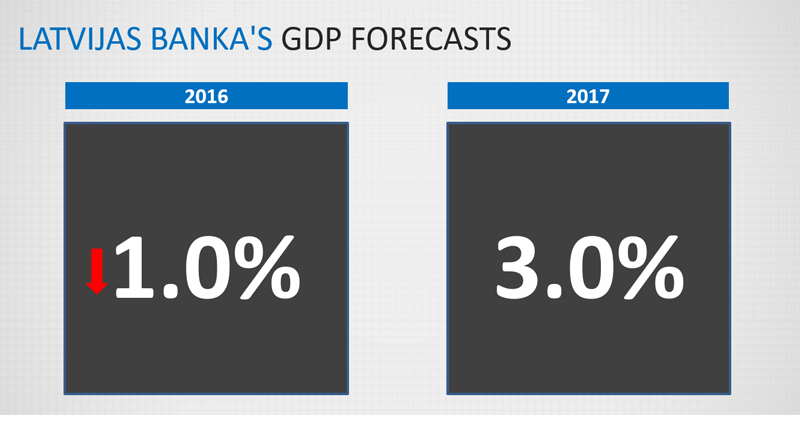

4. The above trends signal caution in forecasting Latvia's economic growth.

In all likelihood, in 2016 the economy will have grown by only about 1%, which is below our previous forecast (1.4%).

For 2017, we maintain the previous projection: the economy will grow by about 3%.

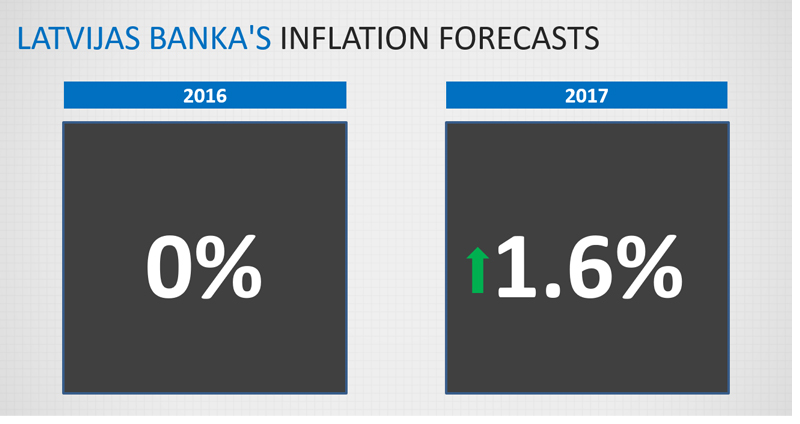

The average inflation this year could be 0%, as we predicted before.

This is an untypically low inflation level, which persists in Latvia for a fourth year, yet we expect that next year inflation could rise rather rapidly. According to our current forecast, the average consumer price level in 2017 will be 1.6%, yet, if oil prices continue growing, household income, wages and the aforementioned inflation projections for next year (1.6%) are under upward risks.

To summarize, – owing to the stimulating monetary policy of the euro area, the Latvian economy is receiving strong stimuli for growth, both direct and indirect. At the same time, the central bank alone, without any help from politicians and their participation in the areas of fiscal policy and modernization of the economy, cannot achieve a change in the economic structures and implementation of painful, yet absolutely indispensable reforms.

Under these circumstances, the efficiency of state administration is of even greater importance. Latvijas Banka urges radical changes in the way we administer and manage our country. Namely, it is necessary to precisely mark measurable growth indicators in areas important to people. With society's help, the system for motivating the decision makers and implementers must be reinforced and for achieving these indicators people may have to be supported and receive bonuses. We cannot afford to continue to stall, an economic leap is necessary and it can only be achieved by radically changing our way of thinking and acting.