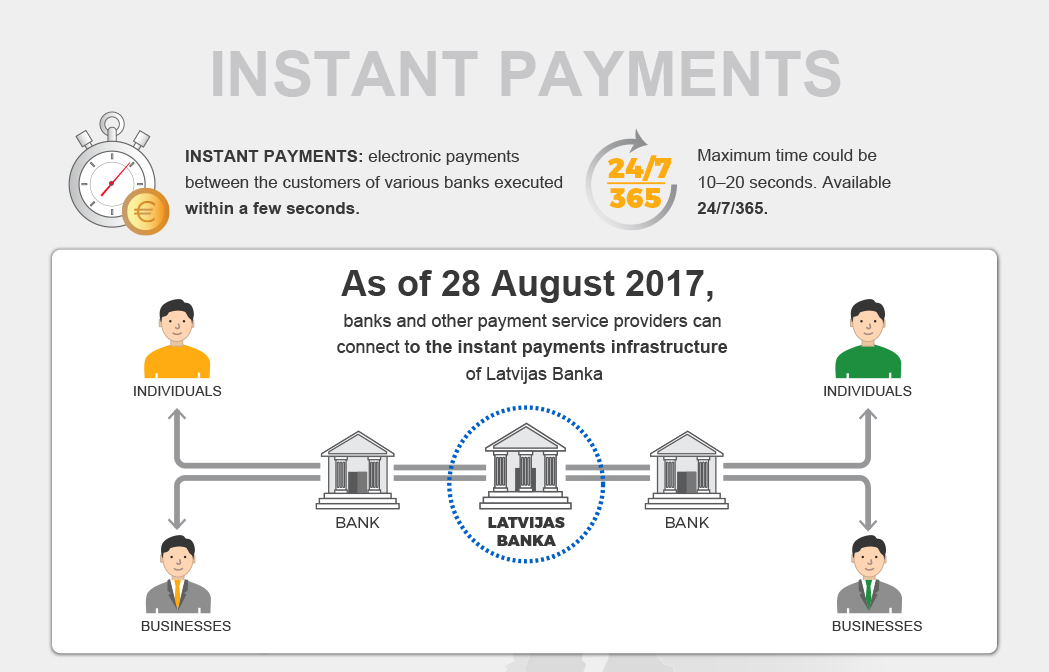

Both individuals and business customers of banks will be able to make instant payments as soon as several Latvian banks have connected to Latvijas Banka's system or any other European instant payments system that has link with Latvijas Banka's system.

Instant payments are non-cash transfers provided 24 hours a day, 7 days a week, 365 days a year, including holidays and weekends. Customer payments are executed within a few seconds and the money received can be reused immediately. This is a very significant change as previously payments between European banks were only available on business days and a transfer took several hours.

"We have completed a very important first stage to enable our banks and their customers to use a really fast and state-of-the-art payment service. The national central bank has developed an infrastructure meeting the demands of the era of latest technologies. Figuratively speaking, it has built the railway, whereas the trains or services for the customers, including smartphone applications, will be provided by banks. With this step, Latvia has become the first euro area country to offer a service compliant with the Single Euro Payments Area (SEPA) instant payments scheme. It has to be noted that major banks have begun timely preparations, so that instant payments can become widely available to Latvia's households and businesses as soon as possible and they become their everyday payment option," says Harijs Ozols, the Project's Manager and Member of the Board of Latvijas Banka.

JSC Citadele banka is the first linked to the instant payments system of Latvijas Banka. "We have developed the technical solution or the infrastructure to enable instant payments. With this, very fast and convenient non-cash transfers will be available to private and corporate customers already this autumn when the instant payment systems become operational across Europe. Transfers between accounts in Latvia as well as elsewhere in Europe in banks linked to the instant payments system will be executed within a matter of seconds, like the card payments we are making today," says Kaspars Cikmačs, Member of the Board of the JSC Citadele banka.

It is expected that a wider use of instant payments in everyday payments across Europe will start in November 2017 when several banks in Latvia and elsewhere in Europe will introduce this service using the instant payments system RT1 operated by EBA Clearing, a capital company established by European banks. Major Latvian banks in terms of the volume of customer payments, JSC Swedbank and JSC SEB banka, also intend to start offering this service as soon as possible, following the completion of infrastructure and functionality tests.